Switzerland key to rehabilitating tarnished crypto exchange

Troubled cryptocurrency exchange BitMEX is charting its revival in Switzerland after the platform and its three co-founders were prosecuted in the United States.

The company has just been given the green light to start operating its new brokerage unit in Switzerland as a self-regulated entity. But BitMEX has grander ambitions in ‘Crypto Nation’ as it strives to distance itself from past controversies.

BitMEX CEO Alexander Höptner wants to build up the Swiss business as a fully licensed securities dealer or crypto exchange. The former Stuttgart stock exchange chief also has plans to reincorporate the group from the Seychelles to Switzerland.

“Achieving self-regulatory status for our brokerage business is just a natural first step,” he told SWI swissinfo.ch. Self-regulatory organisations (SROs) act as a supervisory half-way house for financial firms that do not trade securities or provide banking services. Switzerland’s 11 SROs report to the Financial Market Supervisory Authority (FINMA) and ensure their members comply with anti-money laundering laws.

“Switzerland was an extremely early mover with crypto regulation,” Höptner said. “The country has been very successful at attracting smaller companies but has so far failed to attract any of the globally known big exchanges”

Switzerland currently hosts around 1,000 crypto companies, employing some 6,000 staff. But the financial regulator, anxious to avoid money laundering scandals, has set the bar high for large scale operations. Until recently, crypto exchanges were told to apply for full banking licenses, to set up in the Alpine state.

Rehabilitation plan

Last year, Switzerland updated company and financial laws to embrace cryptocurrencies and other digital assets that run on blockchain – or Distributed Ledger Technology (DLT) – databases. This includes a new license category for DLT exchanges, which is attracting interest from some of the big global crypto companies.

Appointed CEO last year, Höptner is heading BitMEX’s rehabilitation from regulatory bad apple to a compliant financial services company.

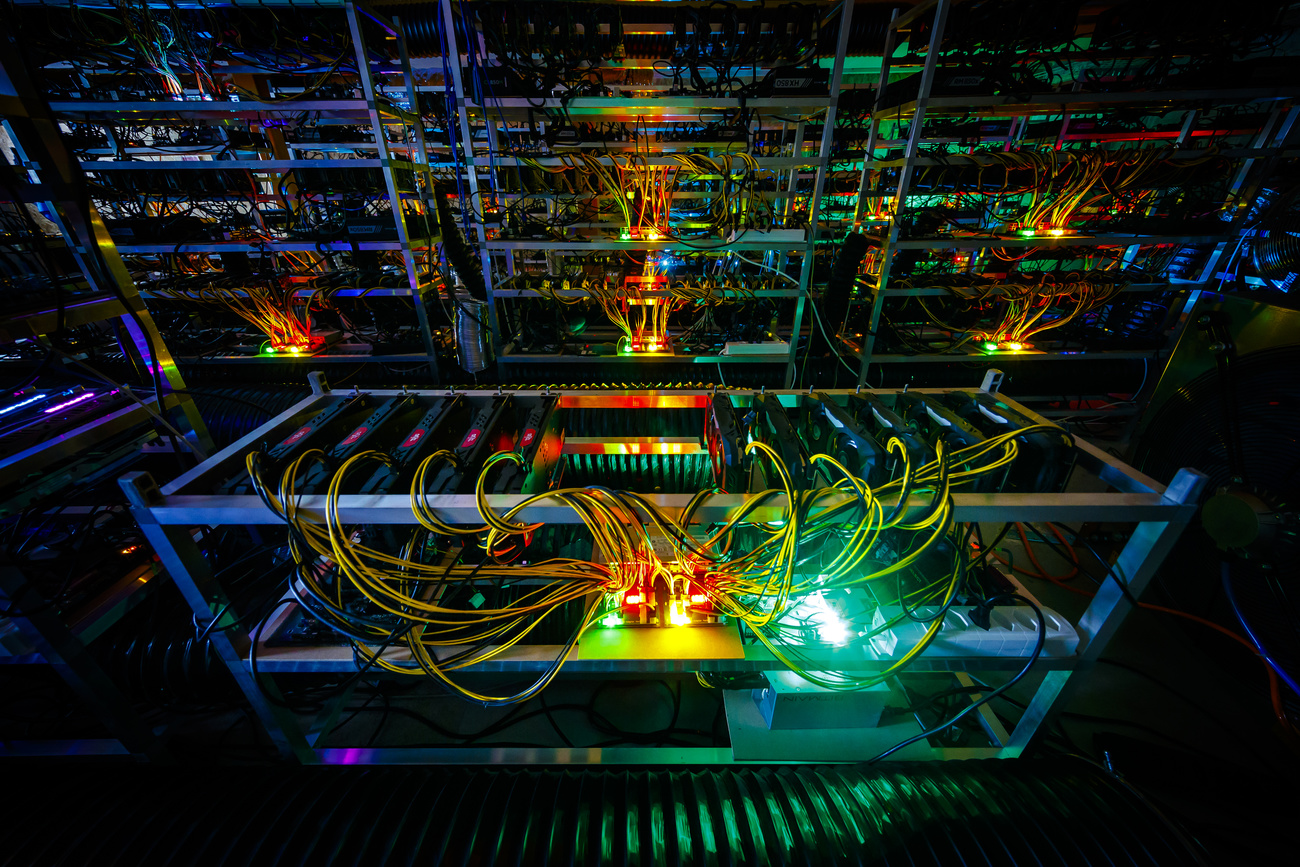

Founded in 2014, the Seychelles-incorporated BitMEX was once a global leader in the cryptocurrency derivatives market – financial contracts that allow investors to bet on the future price of the underlying assets. The exchange was also a darling of the early cryptocurrency industry, which saw itself as an alternative to the traditional financial system, operating out the reach of regulators.

That dream came crashing down when the US authorities fined BitMEX $100 million (CHF97 million) last year for violating anti-money laundering laws. Its three co-founders were more recently hit with $10 million fines. Another former executive pleaded guilty to offences this month and was fined $150,000.

Respectable venues sought

Facing such a regulatory backlash has become a common theme for the rebellious cryptocurrency sector. As investor interest in bitcoin has picked up, other exchanges and financial operators have found themselves in the crosshairs of the authorities – triggering a stampede of companies to respectable venues.

For example, the world’s largest crypto exchange, Binance, is courting several countries for licenses and has found success in Dubai and France.

This has resulted in a game of regulatory arbitrage with several countries, including Switzerland, keen to build up a significant domestic crypto industry without forging a reputation for allowing dubious practices to take place on their soil.

Höptner wants to relocate BitMEX group headquarters away from the Seychelles to a less controversial jurisdiction. This would involve setting up a new corporate holding structure that distances the new BitMEX from its tarnished past. This boils down to a straight choice between Switzerland and Bermuda. “We need to pick a home ground where crypto and DLT are safely regulated but which enables us to operate on a global scale,” said Höptner.

The main advantage that Bermuda has over Switzerland is a specific set of regulations relating to the trade of crypto derivatives.

Höptner is offering to assist FINMA in formulating such a set of regulations in Switzerland. As in the traditional financial markets, the trading volume of crypto derivatives is much larger than the market for buying and selling cryptocurrencies directly.

“Structuring a crypto derivatives trading law is unique opportunity for Switzerland to take a globally leading position. But it’s not an easy decision to take,” said Höptner. “If everything works out then everybody around the world will applaud you, but if something bad happens then you are the big loser. It depends on the appetite of local lawmakers on whether they want to take such a lighthouse position.”

Failed bank buyout

Should Swiss lawmakers and regulators play ball with BitMEX’s suggestions, the company could employ up to 200 people in Switzerland, Höptner says.

BitMEX also has much to gain from finding a stable new home from which to operate. Since its fall from grace, when US criminal charges were laid in 2020, the exchange has been overtaken by the superior trading volume of rivals.

And after launching new crypto trading services and an app, the company’s progress hit a pothole this year as it was forced to abandon plans to buy German bank Bankhaus von der Heydt.

Höptner did not give a specific reason for why the takeover failed. “Linking BitMEX with Bankhaus von der Heydt’s licenses would have been the perfect solution,” he said. “But every so often an idea does not work out.”

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.