Watch sector ticks along nicely

Two years ago, Swatch chairman Nicolas Hayek warned there could be another crisis in Swiss watch making unless the industry showed more innovation.

As the industry looks back on a bumper year, swissinfo talks to Jean-Daniel Pasche, president of the Federation of the Swiss Watch Industry, about what Swiss watchmakers are doing right – and what they still need to do better.

Watch exports hit a record high in November and export sales revenue, which accounts for some 95 per cent of the total, passed the SFr10 billion ($8.8 billion) mark earlier than ever before.

Come boom, come gloom, Swiss watches are still held in universal esteem, thanks largely to a reputation for top quality backed by clever marketing.

However, the industry faces several serious challenges, ranging from the sliding US dollar through the threat of counterfeit products to the growing risks posed by more legitimate competition.

swissinfo: It looks like 2004 has been a record year for export sales. How do you see the prospects for 2005?

Jean-Daniel Pasche: We are confident that 2004 will be a record year, although we do not yet know whether we will manage a new all-time high of SFr11 billion.

We are also confident that growth will continue in 2005, and currently predict something in the area of a six to seven per cent increase compared to 2004. We think Asia will continue to grow, the United States will remain an important market, and Europe will continue to improve, though slowly.

swissinfo: Is there a danger when the industry is doing so well of becoming complacent, of not reacting to potential dangers?

J-D.P.: There is always a danger if you do not innovate and pay attention to what is happening in the marketplace. I like to think that we have learned our lessons from the crisis of the 1970s and 1980s, when we failed to anticipate new technological developments. The fact that we have a lot of Swiss brands competing against each other is also a positive factor.

swissinfo: How vulnerable is the industry to general economic factors?

J-D.P.: The US dollar exchange rate is one factor that could obviously disturb our forecasts. We export primarily to the dollar zone (including Asia), and cannot just raise prices because the dollar drops.

As with all luxury goods, we are also very dependent on the general economic situation. People are not inclined to buy watches when the future is uncertain.

swissinfo: If you look at the whole range, from Swatch through to Rolex, what still makes a Swiss watch special?

J-D.P.: One answer is the continuing richness of our brands – internationally, they still “occupy the field”. But an existing brand alone is not sufficient, there must also be long-term quality, including after-sales service. To date, we have been able to offer this.

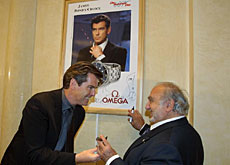

swissinfo: The industry still seems very attached to advertising based on star personalities. Isn’t it time for a new approach?

J-D.P.: There are currently two main approaches to marketing in the industry – the product-focused approach and the focus on “ambassadors”, to create emotional links. While both can be criticised in theory, the market will judge the success of a campaign in practice. Some brands are indeed trying new approaches but, at the end of the day, our market share is continuing to improve.

swissinfo: Another potential major threat is counterfeit watches. How much progress are you making in combating this?

J-D.P.: There will always be fakes on the market, so our first goal is very realistic – to maintain consumer confidence in the real products. We think this has been largely achieved.

Of course, we also try to reduce the phenomenon and to make it less visible. One big issue is China, where counterfeiting is still very open. We are active there and elsewhere in Asia, but it will take time to make significant progress.

swissinfo: At the supply end, the Swatch Group plans to stop providing movement blanks to other companies. Is there a risk of losing a significant part of the industry to competitors abroad?

J-D.P.: The industry has already learned to live with strong competition, particularly from Asia. Also, if brands want to designate their products as Swiss-made, they cannot buy all their components abroad. For instance, in the movement, you need to have at least 50 per cent Swiss components. Some brands have invested a lot in Switzerland to maintain this relationship, and this is positive for us.

swissinfo: What about competition in other fields, particularly the trend to computer-type watches?

J-D.P.: There is still a clear market distinction between traditional mechanical watches and more modern watches. You don’t buy a traditional Swiss watch just to tell the time, so we remain very confident in this sector.

On the other hand, there are new types of watches that can often resemble small computers, but Switzerland is less involved in this trend. Watches are limited in spatial terms – you can make a computer in a watch, but it is far from ideal when it comes to reading the data. I think both areas will develop, but there is not a big risk that they will kill each other.

swissinfo–interview: Chris Lewis

The industry predicts record export sales for 2004, and the forecast for 2005 is even better.

Pasche says watchmakers have learned the lessons of the past and can now build on their unrivalled global brand recognition.

However, they still face serious threats, from the sliding dollar via counterfeit watches to new technological challenges.

Watches are probably Switzerland’s best-known export – and by far the most profitable.

In the 1970s, cheap Asian quartz watches nearly destroyed the industry, which restructured under the leadership of Swatch’s Nicolas Hayek.

Some 90% of watches sold today are quartz, but up-market mechanical watches still account for more than 50% of revenue.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.