Watches enjoy record 2008 but outlook is weak

Swiss watchmaking exports enjoyed another record year in 2008, despite falling figures from September as the global financial crisis took its toll.

Exports totalled SFr17 billion ($15.13 billion), up from SFr16 billion posted in 2007, the Federation of the Swiss Watch Industry reported from its headquarters in Biel on Tuesday.

After a fall of 15.4 per cent in value terms in November, the export situation improved in December, although still declining by 7.6 per cent compared with the same month in 2007 to SFr1.3 billion.

A statement from the Federation said that the signals pointed to a “difficult start” to 2009 for the industry.

“We are in a special situation compared to previous years as we are experiencing a complete trend turnaround with no kind of visibility,” commented Philippe Pegoraro at the Federation.

“Decline…will continue”

“Everything that you can see indicates that the current situation is more difficult and the decline that set in at the end of the year will continue in coming months.”

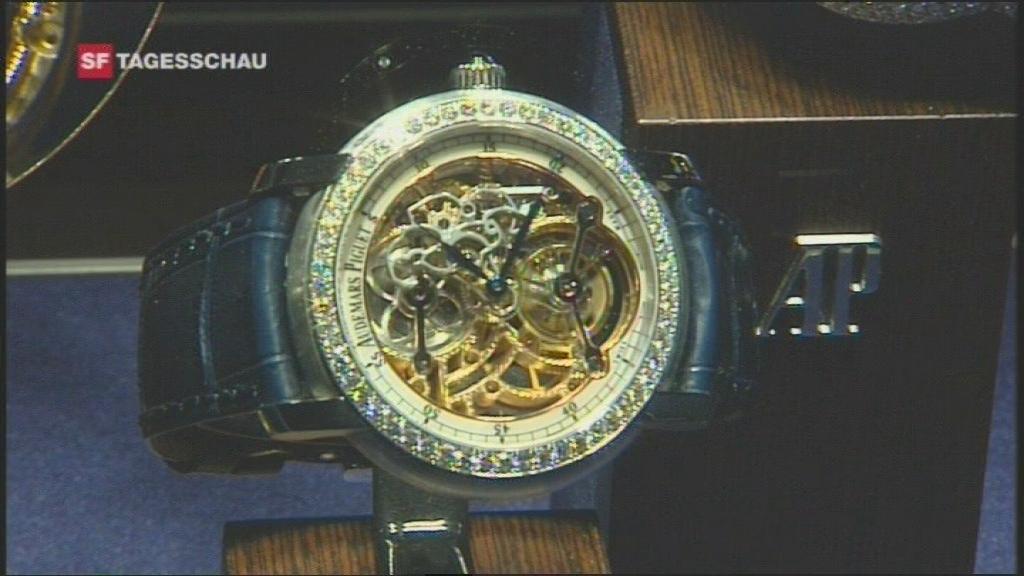

Only wristwatches costing more than SFr3,000 recorded growth in December (3.1 per cent) while the number of pieces in the segment fell by 9.5 per cent.

Volumes in timepieces costing less than SFr200 fell by ten per cent and the downturn in value was 20 per cent in the SFr200-SFr500 price range.

The statement noted that the two main markets of Hong Kong and the United States recorded a “sharp decline” in December but several important markets had held up well and achieved a positive performance.

“We now expect Swiss watch exports to fall by 14 per cent in 2009 from ten per cent previously,” commented analyst Jon Cox at Kepler Capital Markets.

Weaker sales

The Swatch Group, which includes a stable of luxury, mid-segment and lower-end brands (Breguet, Omega, Tissot and Swatch), last week posted weaker than expected sales in 2008 (SFr5.97 billion).

It said the outlook was cautious but not pessimistic for the next few months owing to the financial turmoil. But there was no expectation of a “disastrous development”.

One of its main rivals, Richemont (Cartier, Piaget, Vacheron Constantin)., said it was facing its worst markets in 20 years and saw no sign of recovery after its third-quarter sales missed forecasts.

As a result of the slowdown, the Ebel brand in La Chaux-de-Fonds and Zenith in Le Locle last week announced 50 people would be made redundant. Girard-Perregaux also announced 22 people out of 260 employees would lose their jobs.

swissinfo with agencies

World distribution of Swiss watch exports 2008

1. Hong Kong – Value: SFr2.7 billion (+10.9%)

2. United States – SFr2.4 billion (-3%)

3. Japan – SFr1.2 bililon (-4.5%)

4. France – SFr1.1 billion (+15.1%)

5. Italy – SFr1.05 billion (+2.5%)

6. Germany – SFr913 million (+10.2%)

7. China – SFr826 million (+43.1%)$

8. Singapore – SFr783 (+16.8%)

9. United Arab Emirates – SFr673 million (+27.6%)

10. Britain – SFr641 million (-2.7%)

The figures released by the Federation of the Swiss Watch Industry refer to export figures and not to sales to end-consumers.

The Federation makes the point that differences between these two types of data may therefore exist.

It also notes that the export figures are from all Swiss watch companies.

“They obviously cannot reflect the individual results of one particular company or group of companies, knowing that business activity may greatly vary from one to the other,” the Federation says.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.