Women’s retirement age to be voted on again

The nation votes in September on reform of the old age security system, after two previous proposals were rejected in 2004 and 2017. Raising the retirement age for women remains a stumbling block.

What is this about?

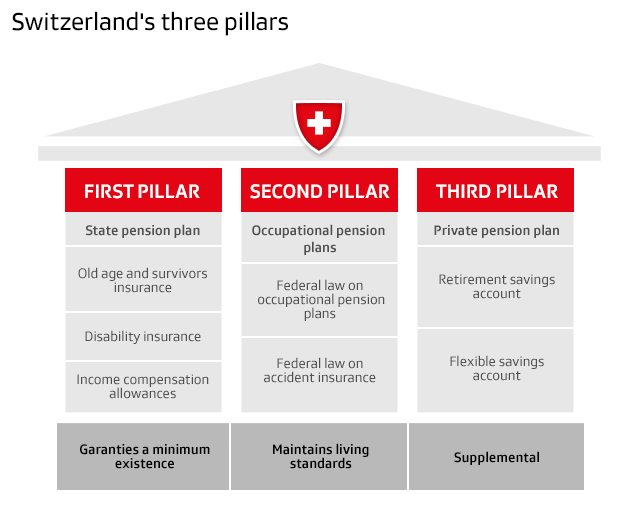

Old-age and survivors’ insurance (known as the AHV/AVS) is the first component of the Swiss pension system. It is funded by obligatory contributions made by workers and their employers. The saving scheme is supposed to provide a minimum income for people to live on later in life. Given the rise in life expectancy, this way of funding the old-age pension is no longer viable in the long term. The government has already proposed two reform packages. Both packages envisioned raising women’s retirement age from 64 to 65, the same as for men. The first proposal was turned down by Swiss voters in 2004, the second in 2017.

Citizens will decide on new amended legislationExternal link on September 25. The governments wants to ensure that the national pension fund can stay afloat until 2030 at least. The referendum vote will be about two points of this new reform package known as “Pensions 21”: an increase in the value-added tax (VAT) on goods and services, and an amendment to the federal legislation on old-age pensions. The people will have to say “yes” to both if the proposed reform is to succeed.

How is this reform proposal different?

The last proposal, “Old Age Security 2020”, was rejected by 52.7% of the voters in September 2017. It was a broader attempt at reform than this year’s effort. It dealt not only with the first component of the old-age security system (the old-age pension) but also the second component (corporate pension funds). After failure in two referendums, the government decided to separate the two issues. “Pensions 21”, the package the people are to vote on this year, concerns only the old-age pension.

The point that stays the same in this proposal is a rise in the retirement age for women from 64 to 65. However, whereas “Old age security 2020” proposed long-term compensation for all pensioners, “Pensions 21” limits any compensatory measures to just one generation of women.

In most of the OECD countries, retirement age is already the same for both sexes. And the retirement age for all is being increased in many countries.

Who is affected by this new legislative amendment?

The increase in sales tax of 0.4 percentage points will affect everyone, since it will mean a slight increase in the cost of goods and services. Since contributions to the old-age pension are compulsory, some aspects of its reform may affect everyone too. It is being proposed that retirement age is to be flexible (between 63 and 70), retirees may opt to take only a partial pension, and contributions made after the age of 65 will count towards the amount of one’s pension. The whole idea is to encourage people to keep working after the official retirement age.

Those most clearly affected by this new pension reform are women, who will have to work a year longer to qualify for their pension. If this latest proposal is accepted by the voters, it would be introduced gradually, beginning 2024. Women born between 1961 and 1963 would see the date of their retirement postponed in increments. The official retirement age would become 65 for all those born in 1964 and after.

The proposal includes compensatory measures for the “transition generation”, that is, women born between 1961 and 1969. There will be an option to take retirement as early as age 62 with a slighter reduction in pension. There will also be a supplement paid to women who retire at the official age or later.

What would it mean financially?

The old-age insurance scheme closed its accounts for the year 2021 with a profit of CHF2.6 billion ($2.7 billion) and assets of CHF49.7 billion. However, according to the projectionsExternal link of the Federal Social Insurance Office, the old-age pension will start to run a deficit from 2029 on. If the new reform is accepted, it will not be in the red before 2031 – and then not so badly.

Raising the retirement age for women would mean savings of CHF1.2 billion per year after 2029. The increase in VAT would bring in an extra CHF1.3 billion in yearly revenue beginning 2024. Yet even the “Pensions 21” reform will not be enough to cover financing of pensions in the longer term, beyond 2030.

What do opponents say?

Any proposed rise in VAT automatically triggers the holding of a referendum, since it requires an amendment to the constitution. So the people would have to vote on this anyway. But a committee made up of unions, parties of the left and women’s groupsExternal link decided to invoke a referendum against the amendment to the old-age pension legislation as well. Their aim is to fight the proposal to raise retirement age.

This coalition does not want to see the reform achieved at the expense of women. They argue that women get a lower pension as it is. According to a study by the Federal Social Insurance Office, the old age pension for women (including all three components of the old age security system) is 37% less than men’s. This gap is mainly due to inequalities in pay and the lesser involvement of women in the workforce, seeing as they still assume the main home-making and care roles. Before making the retirement age the same for women as it is for men, the group wants this pattern of discrimination to end.

The committee also points out that the labour market is currently stacked against hiring of older workers. To increase the retirement age risks increasing the number of unemployed or persons in receipt of social welfare. The referendum movers are calling for old-age pensions not to be weakened but reinforced with a rise in salaries, better pensions, and alternative approaches to financing.

Who supports the reform?

The government and a majority in parliament support “Pensions 21”. They warn that something needs to be done urgently to maintain the level of pensions till 2030 and not to penalise future generations.

Parties of the centre and right as well as business lobbies are campaigning for the reformExternal link. They welcome incentives to work beyond 65 and the idea of making retirement flexible, with the option to defer or advance the payment of one’s pension depending on one’s own personal needs. They believe this approach will lessen the lack of skilled labour in Switzerland. It will let workers as well as their employers look forward to a longer time in the workforce.

Supporters of “Pensions 21” believe the retirement age for women needs to increase. This is because women have a higher life expectancy than men, and therefore need a pension for longer. They are also more highly trained than in the past, and most are now gainfully employed. Supporters of the legislation also say that the women who may be most impacted by this change will benefit by real compensatory measures.

More

Translated from French by Terence MacNamee

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.