Swiss business prepare to challenge Apple Pay

A new system for Swiss consumers to make payments through their mobile phones is seen as the competitive answer to US behemoth Apple Inc.’s mobile payment and digital wallet service.

Apple’s entrance into the mobile payments business was a bet that the Silicon Valley-based multinational could alter the retail world by making the physical wallet obsolete.

In Asia and some other regions, however, there already are competitors using more advanced technology than Apple’s offer, which essentially digitises the bank card. It stores and uses credit cards on the iPhone.

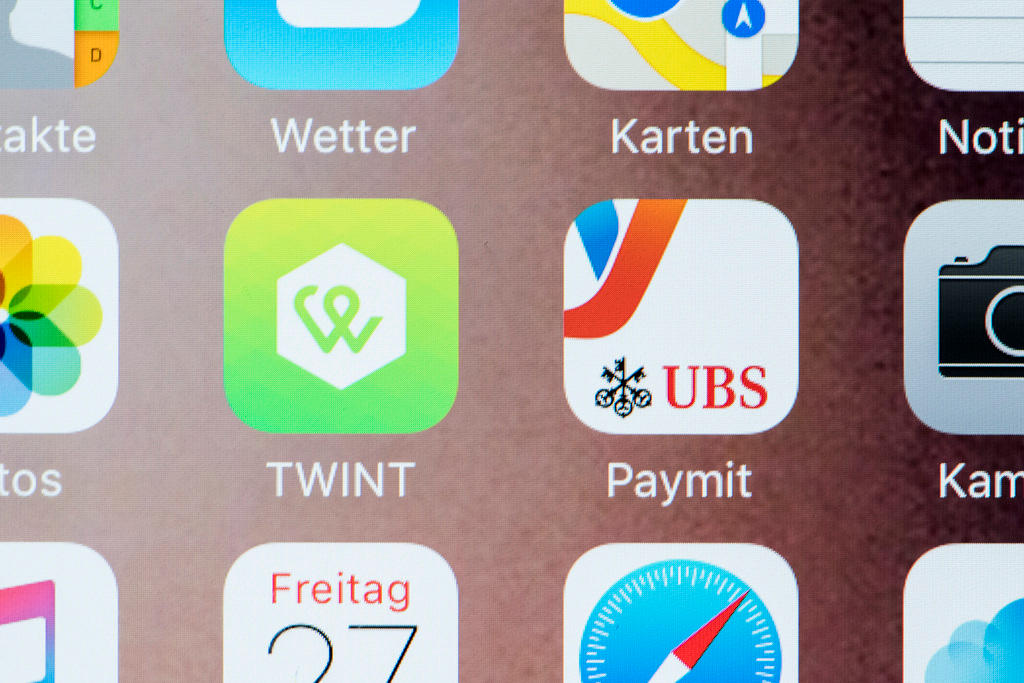

In Switzerland, a new service is being prepared to launch in early 2017 that will be the result of a merger between TWINT Ltd. and Paymit, two leading Swiss companies for enabling mobile payments that are backed by a deep bench of governmental, national and international financial institutions.

TWINT is a fully-owned subsidiary of PostFinance, the financial services arm of the national postal service Swiss Post, while Paymit originated with SIX Group Ltd., which is owned by about 130 banks and operates Switzerland’s financial market infrastructure.

Within Swiss borders

Urs Rüegsegger, the CEO of SIX, said mobile payment services are attractive to businesses because handling cash requires a lot of time and energy – store owners must keep track of it, put it in a safe or bring it to a bank; customers have to keep it on hand, which is not always convenient, for instance, when parking a car.

The merger of TWINT and Paymit was agreed to in May by the major Swiss telecommunications provider Swisscom and the two largest Swiss banks, UBS and Credit Suisse, along with Raiffeisen and some of the cantonal banks. It still awaits regulatory approval.

Their new Swiss payment service, which aims to replace the use of cash, probably would be confined to Switzerland – unlike global systems like Apple Pay – and require pricey security measures, Rüegsegger said.

“While this may seem paradoxical, because we think that the digital world is international by nature, phone applications that work best are those that have strong local roots,” he told the Tribune de Genève newspaper for an article published on Monday.

“The digital payments industry has high security standards. And to ensure such standards, payment terminals must be technically very advanced, this is why they are expensive,” said Rüegsegger. “With the new digital offerings, merchants can add other services such as accounting, loyalty programs for customers, etc., which should increase their attractiveness.”

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.