‘Constructive’ talks on US banks tax evasion row

Tensions between Swiss banks and the United States justice authorities should ease up in 2015, Finance Minister Eveline Widmer-Schlumpf has said on the sidelines of the joint International Monetary Fund and World Bank spring meetings in Washington.

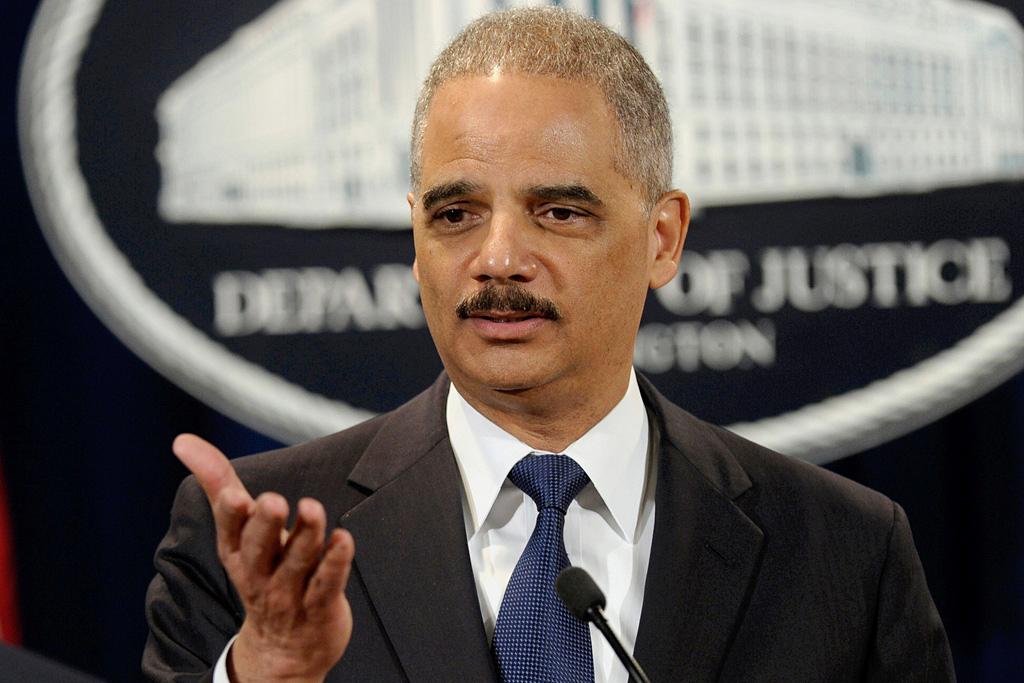

The minister said she had received positive signals that this year would bring solutions to the conflict, a result of the US Department of Justice (DoJ) crackdown on past tax evasion offences by American account holders at Swiss banks.

Talks with DoJ representatives had been “very constructive”, she noted.

She pointed to the recent example of Lugano-based bank BSI, the first Swiss-based bank to complete the non-prosecution programme hashed out between Bern and the US in 2013. “The bank as well as the American authorities were satisfied with it. We see that the programme is working.”

The programme allows banks to escape criminal prosecution, and possible conviction, in return for owning up to non-declared US accounts and paying fines.

BSI bank was fined $211 million (CHF203 million) for aiding and abetting tax cheats. The deal it struck was relative, she said. “Each bank is in its own individual situation and the American authorities’ programme is an open one. Not everything is fixed, it leaves room for manoeuvre.”

Some 106 banks, including BSI, entered the programme under the most onerous category 2 definition at the end of 2013, but several banks have since downgraded their presumed guilt or left the scheme altogether since then. Fewer banks entered the scheme under the categories 3 and 4 which implied innocence of tax dodging offences.

Widmer-Schlumpf was quick to note that the government is not playing an active role in the conflict, as parliament decided that the banks should resolve their differences themselves. However, Bern is still concerned that Swiss banks are treated fairly compared with others.

Bilateral tax talks with Germany, France and Italy are also going in the right direction, the minister added.

Global economy

Meanwhile, at a press conference for the spring meetings, Widmer-Schlumpf said her counterparts from other countries had understood the Swiss National Bank’s decision to abandon the euro peg in January.

The minister said inflation was low everywhere, not just in Switzerland. She noted that economic growth and stable financial markets were only attainable if financial sector reforms were put into place.

World finance officials at the meetings said they see a number of threats on the horizon for a global economy still clawing back from the deepest recession in seven decades, and a potential Greek debt default presents the most immediate risk.

After finance officials wrapped up three days of talks, the IMF’s policy committee set a goal of working toward a “more robust, balanced and job-rich global economy”.

Also in Washington, Switzerland joined a new World Bank programme to strengthen financial markets in developing countries. It will provide a sizable chunk of the funding, around $15.7 million (CHF15 million) of the expected $50 million budget. An accord was signed by Economics Minister Johann Schneider-Ammann.

The goal is to establish stable and competitive financial markets in countries that are important for the future of the global economy. In a statement, the government said it would help the private sector and small and medium-sized businesses in particular.

The non-prosecution programme

The deal signed by Switzerland and the US in 2013 sets out a programme for Swiss banks to avoid landing in the US courts on tax evasion offences. Those banks that believe that they may have illegally accepted the assets of US tax cheats had to register by the end of 2013. Some 106 banks chose this route. These banks had to supply the DoJ with documentation showing their business activities in the US. Penalties will range from 20% of the value of assets held in accounts opened before August 1, 2008 to 50% in accounts opened after February 28, 2009.

Banks that have US clients but believe they complied fully with US tax law were able to enter the programme as category 3. The same entry window was open for category 4 banks that are so small they have no US exposure.

The DoJ did not allow 14 Swiss banks, or Swiss-based branches of foreign institutions, to join the programme because they were already under active criminal investigation in August 2013.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.