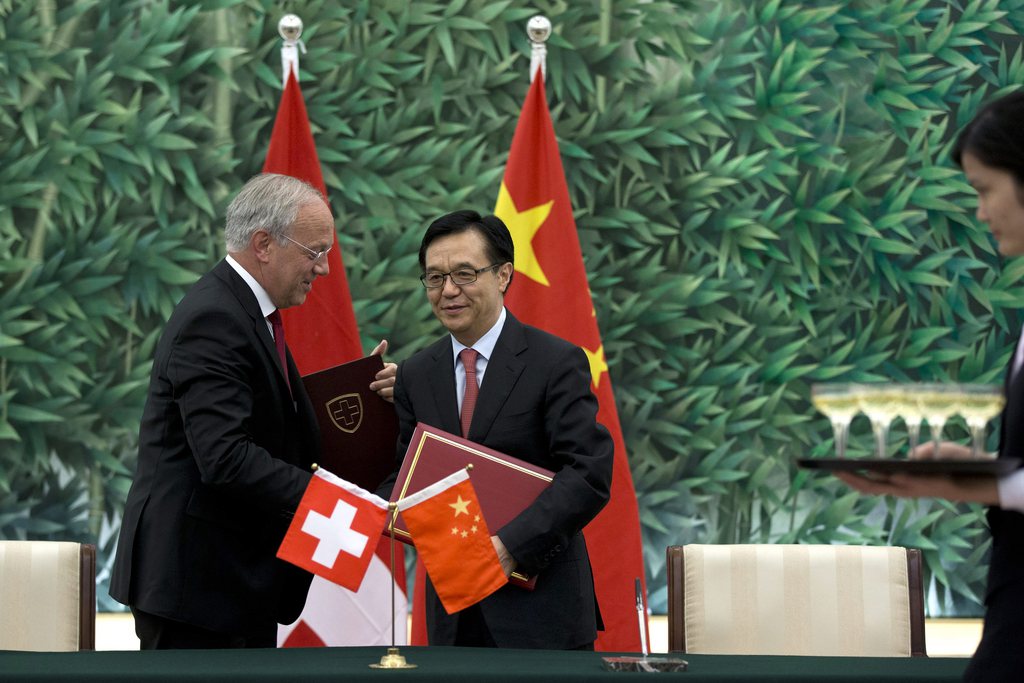

Hurdles to merging ‘Swiss Made’ with ‘Made in China’

With Europe an increasingly attractive target for Chinese investment, some 70 Swiss brands – including the likes of Syngenta, Mercuria and Swissport – have already been subject to Chinese mergers and acquisitions. That has led to anger and doubt among some Swiss, and some Chinese, too, and raised questions on how best to bridge the two cultures.

Mergers and acquisitions are a two-way street. Japan’s wave of acquisitions of Swiss brands in the 1970s and 1980s killed off quite a few of the companies that were acquired. The survival rate was less than 10%, leading the Swiss to become more cautious afterwards, experts said.

Industry insiders see the Syngenta deal as following in the same model as ChemChina’s purchase of a 60% stake in Israel-based Makhteshim Agan, the largest manufacturer of generic pesticides. In 2014, the name of that company was changed to ADAMA Agricultural Solutions Ltd.

In some ways, however, acquiring an overseas company can help the Chinese make an end-run around some of their own bureaucracy.

“For Chinese companies, the development of strategies differ from the implementation of strategies, which is a common problem – especially for state-owned enterprises,” said Guanglian Pang, director of the China Petroleum and Chemical Industry Federation. “Having a merger with an overseas company is relatively easier and faster.”

Guanglian said state-run enterprises can change quickly because they have boards made up of directors that frequently come and go and prefer to launch their own reforms that can build their own reputations, rather than maintain the status quo. Their terms are limited to up to ten years, but most serve only for five years.

“Swiss-made” or “Made in China”?

What to do about labels presents another conundrum.

For many people, the Swiss label indicates high cost and top quality, while the Chinese label implies the opposite: low cost and poor quality.

Significantly, when most Chinese enterprises acquire a Swiss brand, they will consciously avoid contact with local media in Switzerland, and also will reject an interview request from Chinese media. The main reason: To try to maintain the Swissness of a trusted brand – and its connotations of high quality.

Among Chinese consumers, too, the term, “Swiss made” has gained increasing reliability. Therefore, the Chinese parent company will not readily transfer the manufacturing site to China.

But when it comes to research and development, some companies, such as Swiss pharmaceutical giants Novartis and Roche, have established R&D centres in China. Experts ascribe this to not only the lower labour costs but also the ability to learn more about local consumer habits and preferences.

Effect on Swiss culture

Chinese mergers and acquisitions sometimes follow an “iceberg” model, with the Swiss subsidiary becoming the 1% of the company that remains exposed above ground for show purposes.

Beneath the surface, Chinese companies will often operate in ways that conflict with Swiss customs in the business world, which can undermine the loyalty of employees and the trust of customers. Some Chinese companies also hunt for Swiss talent and seek out trade secrets, further tearing at the fabric of the Swiss culture of loyalty and reputation, according to Juan Wu, a researcher on international business at the Zurich University of Applied Sciences.

“Some Chinese companies bring a lot of bad habits to Switzerland,” she said. “This causes great damage and has a big impact on a social culture that Swiss people have spent centuries building up on the basis of reputation and loyalty.”

But, she added, by learning each other’s cultures such differences can be bridged.

Chinese bosses for the Swiss

When things go wrong, both sides, the Chinese and the Swiss, tend to blame it on “cultural differences”. However, Guanglian said such troubles really point to a problem with Chinese management.

After a merger with Swiss companies, US buyers will often implement large-scale layoffs and dismissals and upend the management. It’s a different picture with Chinese owners, who prefer to retain the integrity of the acquired companies, according to Juan.

That alone is not enough to ensure that the Swiss and Chinese get on well together, however. Juan’s research since 2012 found that most Swiss executives complained about the Chinese style of management.

According to the Swiss who she interviewed, Chinese bosses are used to ordering people around and publicly criticising their employees, and place too much emphasis on hierarchy, micro-managing and displays of power – in contrast to the Swiss emphasis on autonomy, discretion and privacy.

One of the Swiss executives, a chief financial officer, told Juan that he “could not get used to the Chinese paternalistic style of management and Chinese staff who insist on speaking in Mandarin, and the Chinese CEO seemed to live 2000 years ago and regard himself as the king”.

On the other hand, Chinese CEOs with state-run companies might have a reason for being a bad mood because they receive fixed government salaries that could be as low as CHF1,200, roughly what an apprentice might earn, though they do receive additional compensation in the form of paid living expenses such as rent and food, Guanglian said.

“These hugely different salaries between the Chinese and the Swiss staff make the Chinese CEOs feel that they are nobody, so they control their staff very strictly just to show that they are somebody,” he said.

Booming Chinese investment

A report published in late January by PricewaterhouseCoopers showed Chinese investment abroad hit a new record of $67.4 billion in 2015, up sharply by 40% from a year earlier. Chinese investment abroad has increasingly favoured Europe over the United States.

This year, for example, German industrial machinery maker KraussMaffei Group is set to be acquired by China National Chemical Corp (ChemChina). Closer to home, Swiss agrochemical company Syngenta is being bought by the same Chinese state-owned chemical company in a deal worth $43 billion (CHF43.8 billion). It stands to be the biggest acquisition ever made by a Chinese company.

Translated by Juan Zhao and adapted by John Heilprin

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.