French inheritance tax convention rejected

The House of Representatives has refused to ratify an agreement on inheritance tax between Switzerland and France, with many parliamentarians considering it an attack on Swiss sovereignty.

A clear majority rejected the accord, under which inheritances would be taxed based on where the recipient resides not where the deceased person lived, as used to be the case. While the Senate still has to determine its position, it seems likely that parliament’s other chamber will also give the deal short shrift when its turn to vote comes.

Parliamentarians on the political right, especially those from cantons closest to France, led the charge against the deal, stating that it impinged on Swiss sovereignty.

Christian Lüscher from the centre-right Radical Party called on his colleagues to reject a “diktat from a friendly neighbour”, while the rightwing Swiss People’s Party representative Jean-François Rime said the accord had been cash-strapped France’s sole success in tax matters as it sought to increase revenue.

He added that it was inacceptable for a Swiss living in France to be taxed up to 45% on a Swiss inheritance.

Another Radical, Jean-René Germanier, said the convention had a number of flaws: it did not meet international standards demanding taxation on inheritances be carried out in the country where the deceased person lived; it deprived cantons of some of their prerogatives in tax matters; and it was heavily biased in favour of the French with Switzerland getting nothing substantial in return.

Precedent

The political left, however, said it would be better to have some kind of accord in place, rather than deal with the consequences of no treaty at all, such as being taxed in both countries.

Rather than reject the convention outright, Social Democrats and Greens would have preferred to ask the government to renegotiate with the French to gain some advantages, a proposal that fell on deaf ears.

Paris has been pushing for a revised inheritance convention for the past two years and has considered it a prerequisite before tackling other sensitive issues such as lump-sum taxation, undeclared assets in Swiss banks and the automatic exchange of banking information.

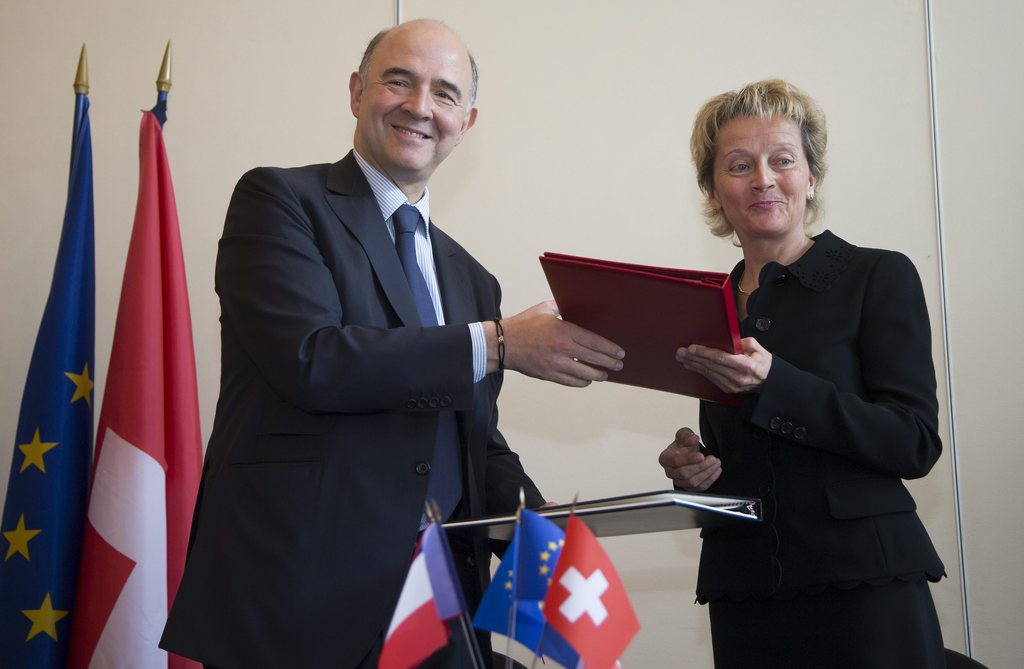

Finance Minister Eveline Widmer-Schlumpf, defending the deal signed in July, said it was not negotiated under French pressure. Switzerland, she added, asked for a new convention after Paris said it was going to dump the previous accord dating back to 1953.

She tried to turn the tide of disapproval by saying that having some kind of deal was better than none at all, adding that it would help improve relations with France, but she failed to convince a majority of parliamentarians.

The Organisation of the Swiss Abroad had criticised the agreement, saying it failed to take into account the interests of the nearly 190,000 Swiss expatriates in France.

The organisation also warned that the accord could set a precedent for other countries.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.