Poll: voters edge towards immigration curbs

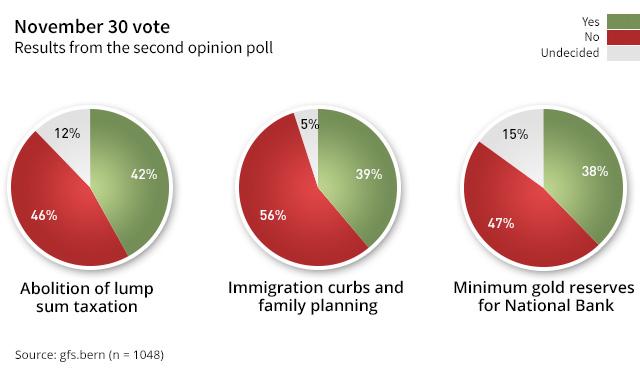

A proposal to reduce Switzerland’s ecological footprint by strict immigration curbs is gaining ground ahead of a nationwide vote on November 30, a poll shows. New rules on gold reserves of the central bank and plans for scrapping lump sum taxation both look likely to fail.

An opinion poll conducted nearly three weeks ahead of voting day found that support for the initiative by a group of ecologists (Ecopop) still lags 17 percentage points behind. But campaigners have succeeded in narrowing the gap in recent weeks.

This is unusual for an initiative, as Claude Longchamp of the leading GfS Bern research and polling institute says.

The political scientist added that a majority of respondents said they would reject the initiative, but there still is a serious possibility there will be protest voters wanting to upset the government and push for stricter immigration regulations.

“There is currently a trend towards a ‘yes’, but it would take a major event for the initiative to garner a majority. The potential must not be underestimated,” Longchamp said on Wednesday.

He pointed out certain similarities with the campaigns ahead of an initiative aimed at re-introducing immigration quotas accepted by a majority of voters on February 9. It resulted in a major political upset and tarnishing relations between Switzerland and the European Union. However, the number of supporters has increased at a lower level compared with the previous vote, says Longchamp.

Lump sum

Voters look likely to reject a separate proposal by a leftwing group to scrap preferential fiscal treatment of wealthy foreigners.

Pollsters found no major indication among the different language or income groups, or the grassroots of the different political parties that the initiative by the Alternative Left would be successful.

“The opponents’ campaign has had an impact,” says political scientist Martina Imfeld. “Their argument that mountain regions would suffer seems to be convincing.”

The government, most political parties and the business community have come out against the initiative.

Most beneficiaries of lump sum taxation live on the shores of Lake Geneva, in Ticino and the Valais region.

Gold speculation

The poll also found that a proposal by members of the rightwing Swiss People’s Party to set rules for the gold reserves of the National Bank – including banning the sale of gold – is likely to be voted down.

Support for the initiative dropped 6% over the past four weeks and stood at 38% in the final poll. Opponents for their part won 8% points, while 15% of respondents were still undecided.

Longchamp says the potential supporters are citizens who prefer a policy of isolation.

The vote has raised considerable interest outside Switzerland, notably among bullion traders.

Voter turnout on November 30 is expected to be around 52% in line with the annual average.

The pollsters interviewed 1,412 Swiss citizens from across the country for the second of two nationwide surveys ahead of the November 30 vote.

Swiss expatriates are not included in the poll.

The telephone interviews took place between November 7-15. The margin of error is 2.7%.

The survey was commissioned by the Swiss Broadcasting Corporation, swissinfo’s parent company, and carried out by the leading GfS Bern research and polling institute.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.