Inheritance tax deal signed with France

Switzerland and neighbouring France have signed a controversial deal on inheritance tax as part of an amended double taxation agreement. Paris hopes to bring in more money from wealthy tax dodgers.

Under the accord signed in the French capital on Thursday, inheritances would be taxed based on where the recipient resides not where the deceased lived, as used to be the case.

France, which taxes inheritance progressively up to 45 per cent, compared with Switzerland’s maximum of seven per cent, hopes the new agreement will make it harder for people living in France to evade taxes.

France is one of a growing number of cash-strapped governments trying to find tax cheats squirreling away cash in Swiss accounts.

The agreement, which still needs approval by the parliaments in both countries, would also allow France to ask Switzerland to investigate suspicious bank activity even if it does not have the suspects’ names.

More

Concern over Franco-Swiss inheritance tax plans

First step

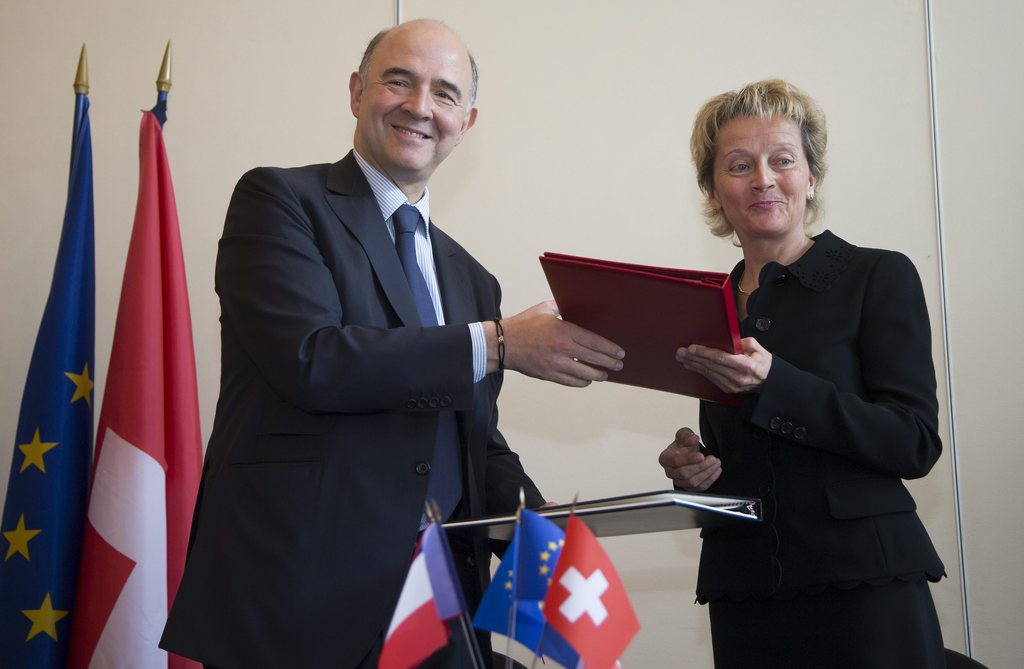

The French finance minister, Pierre Moscovici, praised the new accord as an improvement on tax transparency which helped to close a legal loophole.

His Swiss counterpart, Eveline Widmer-Schlumpf, said Switzerland would have preferred to keep the tax agreement from 1953.

“But the agreement is no longer in line with the will of France,” she told journalists.

Both ministers said the new accord was a first important step in solving a series of tax spats between the two countries, including untaxed assets on Swiss bank accounts and lump sum taxation, as well as a dispute about the Basel-Mulhouse airport shared jointly by France and Switzerland.

Concern

However, the Organisation of the Swiss Abroad (OSA) has criticised the agreement saying it failed to take into account the interests of the nearly 190,000 Swiss expatriates in France.

As many of them have dual French-Swiss nationality they would also be subject to the new tax rules.

The organisation warned the accord could set a precedent for other countries.

The agreement is going against international legal standards on fiscal matters, according to an OSA statement on Thursday. Last May the organisation called on the Swiss government to reconsider the draft accord.

Politicians for the four main parties have also come out against the accord, predicting a defeat for the government in parliament. A date for the debate still has to be set.

The announcement by France in 2011 to review the tax agreement had already caused a public uproar and led to some re-negotiations.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.