Rich foreigner tax perks tipped to stay

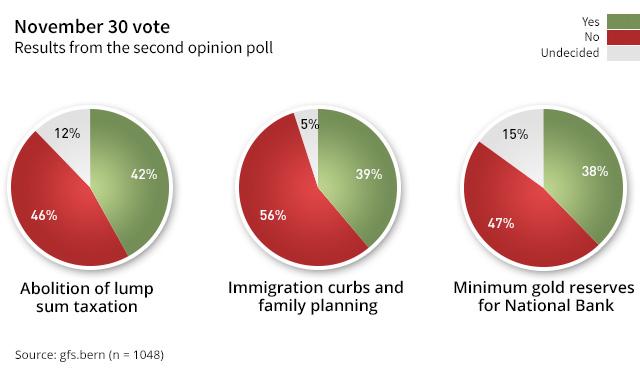

Attempts to scrap preferential tax breaks for wealthy foreigners is expected to fail, according to a poll of voters’ intentions. Some 46% of respondents said they would reject the initiative on November 30 - a significant swing to the “no” camp in recent weeks.

In the final survey before the vote, conducted by the GfS Bern research and polling group, supporters of the initiative fell away by 6% to 42% while those intending to vote “no” rose by 10%. “There is every indication that the initiative will be rejected,” said GfS Bern political scientist Martina Imfeld on Wednesday.

Observers believe that the sea change in voting intentions has been influenced by more vocal arguments from the “no” campaign. Opponents of the initiative have argued that rural cantons would be badly hit by lost revenues and that taxpayers would be lost to other countries that have similar systems.

Some 5,634 wealthy foreigners benefitted from the tax perks in Switzerland at the end of 2012, contributing CHF700 million ($728 million) to federal, cantonal and communal coffers each year.

If Switzerland votes in favour of the initiative, it “would be penalising itself, reducing its attractiveness for good, very mobile taxpayers who are courted by other countries”, canton Vaud politician Pascal Broulis wrote in an opinion piece for swissinfo.ch.

In addition, cantons have argued that they would lose their tax gathering sovereignty should a nationwide ban on the so-called lump sum tax system be imposed on them. Several cantons, including Zurich, have already voted independently to either scrap or tighten up lump sum tax.

The tax system, first introduced by canton Valais in 1862, applies only to foreigners who reside in Switzerland but who generate all their income abroad. It is typically only available to well-heeled individuals.

The levy ignores accumulated wealth and overseas income by imposing a charge based on the individual’s living expenses within Switzerland. Beneficiaries of the system are typically charged between five and seven times the rental value of their property.

The leftwing group that brought the “Stop tax breaks for millionaires” initiative to the vote argues that the lump sum system is socially unjust and violates the constitutional principle that people should be charged tax according their ability to pay.

“The fact that super-rich foreigners benefit from our costly, well-working infrastructure and high level of security without paying an appropriate contribution is simply scandalous,” former Swiss politician and price watchdog Rudolf Strahm wrote in a recent opinion piece for swissinfo.ch.

Most lump sum foreigners are based in cantons Valais, Vaud, Geneva and Ticino. It is therefore unsurprising that opposition to the initiative could be detected more strongly in those cantons, according to the poll.

Age, income and political affiliation appears to have less impact on voting intentions.

Issues at stake

The vote on population control, combined with family planning and immigration curbs in one of three issues to come to vote on November 30.

An separate initiative by a leftwing grouping aims to abolish a preferential fiscal treatment of wealthy foreigners in Switzerland.

A rightwing committee for its part seeks to ban the sale of gold by the National Bank, set a 20% minimum amount of gold reserves and ensure it is stored in Switzerland only.

SBC poll

The pollsters interviewed 1,412 Swiss citizens from across the country for the second of two nationwide surveys ahead of the November 30 vote. Swiss expatriates are not included in the poll. The telephone interviews took place between November 7-15.

The margin of error is 2.7%.

The survey was commissioned by the Swiss Broadcasting Corporation, swissinfo’s parent company, and carried out by the leading GfS Bern research and polling institute.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.