Market unrest sparks online brokering upsurge

Switzerland's economy began 2009 with its worst quarterly showing in over 15 years but the founder of the country's largest online brokerage firm still feels bullish.

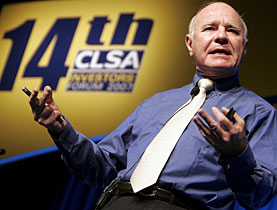

Marc Bürki says the worst of the market turmoil has passed and that Swissquote, which is also an internet-based bank, is booming.

Within the context of a terrible 2008 for Swiss banks – massive losses, bailouts, haemorrhaging customer counts and an assault on banking secrecy – Burke has a reason to be upbeat.

The propensity for many people to want to stash their money under the mattress has yielded an exponential growth in business. In 2007, he had 29,000 customers trading online. By the end of 2008, the figure rose to nearly 120,000.

Burke attributes the success of his business to “a generational choice”.

swissinfo.ch: In recent weeks, the stock market has shown signs of recovery. Is the worst over?

Marc Bürki: Absolutely. From April 1, we recorded a net recovery and in that sense, I doubt we will find the levels recorded in February. The market is anticipating what will happen in the future in the real economy. So we see a light at the end of the tunnel.

swissinfo.ch: The Swiss have apparently not panicked over the past months and have not turned their backs on the markets. Is this the case?

M.B.: There were no panicked reactions, where people sold out. That is a positive aspect that reflects a certain professionalism in the Swiss market.

Of course, the activity was less intense because at some point, it became difficult to make investment decisions. Most people waited to see how the situation developed.

swissinfo.ch: It is often said that the Swiss love to play the market. Is this a cliché or a fact?

M.B.: That’s the reality. Roughly 20 per cent of Swiss have been shareholders in recent years. That is double the proportion recorded in France of Germany. Switzerland is a country that likes to invest.

swissinfo.ch: The economic crisis has ultimately been positive for your company because you gained nearly 29,000 new customers in 2008. Is it fair to say that people have lost confidence in banks?

M.B.: It is true that confidence declined a little. However this is primarily a trend reflective of the choices of this generation.

Many people active professionally do not want to entrust the management of their wealth to others. I met a customer one day who told me: ‘Three things are important in my life: my family, health and money and I not delegate those priorities.’

The crisis may have acted as an accelerating force but the basic trend was already well entrenched.

swissinfo.ch: What is the typical profile of your clients?

M.B.: Most are between the ages of 35 and 45 and are mainly males. In fact, eight out of ten customers are men. It seems that in Switzerland, wealth management is still a man’s business. We also found an increase in people over 65. These are retirees who play the market as a hobby.

For some time, we have noted that the market of people between 45 and 65 has been slow to grow. The average deposit is SFr50,000 [$46.990] and transactions are around SFr10,000.

swissinfo.ch: And the returns?

M.B.: Overall, the returns to our customers are better than those obtained on the market. The results are slightly higher than the Swiss Market Index [SMI] and the Swiss Performance Index.

Naturally, there are big differences from one customer to another, Some earn a lot, others lose more.

swissinfo.ch: Have you noticed a change in the behaviour of your investors since the crisis erupted? Are they looking for more security?

M.B.: We found that some products have become more attractive. For example, during the second half of 2008, we recorded a strong rise in the trading of bonds. The level of confidence was so low that even the best corporate bonds were sold at low prices.

Regarding structured products, there was a fall after the bankruptcy of Lehmann Brothers but now the market is regaining a certain stability.

swissinfo.ch: The strong rise in customers has not resulted in a comparable increase in turnover and profit. How do you explain that?

M.B.: We must distinguish between two factors: long-term and short-term. The long-term is the number of customers. If there are more, turnover and profits should increase.

In the short-term, however, what counts more is the number of transactions per client. During the first half of the year for example, we recorded what would turn out to be 15 transactions over the year whereas normally, it is 15 to 30. This resulted in a decrease in turnover compared with the first three months of 2008.

swissinfo.ch: What are your goals for 2009?

M.B.: We want to add another 25,000 customers and we are on track to receive this. We want to generate around SFr1 billion.

Many customers do not want to monitor their situation day-to-day. In the future, our goal is to develop more effective tools to assist our clients manage their investments.

Daniele Mariani, swissinfo.ch (Adapted by Justin Häne)

By the end of March, Switzerland’s largest online bank had 125,486 customers including 3,335 with only savings accounts. It is an increase of over 28 per cent.

Swissquote customers manage SFr4.6 billion, or 13.3 per cent less than in March 2008.

At the end of 2008, the bank employed 236 people in canton Vaud and in the city of Zurich.

Turnover was SFr111.7 million last year, or 0.7 per cent more than in 2007. Profit was SFr32.8 million, a five per cent decrease.

Swissquote primarily makes money from commissions it collects on each transaction customers make.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.