Raw materials trade takes off in Switzerland

The well established commodities industry in Switzerland is reaching new heights with rising prices and an influx of new foreign companies, particularly in Geneva.

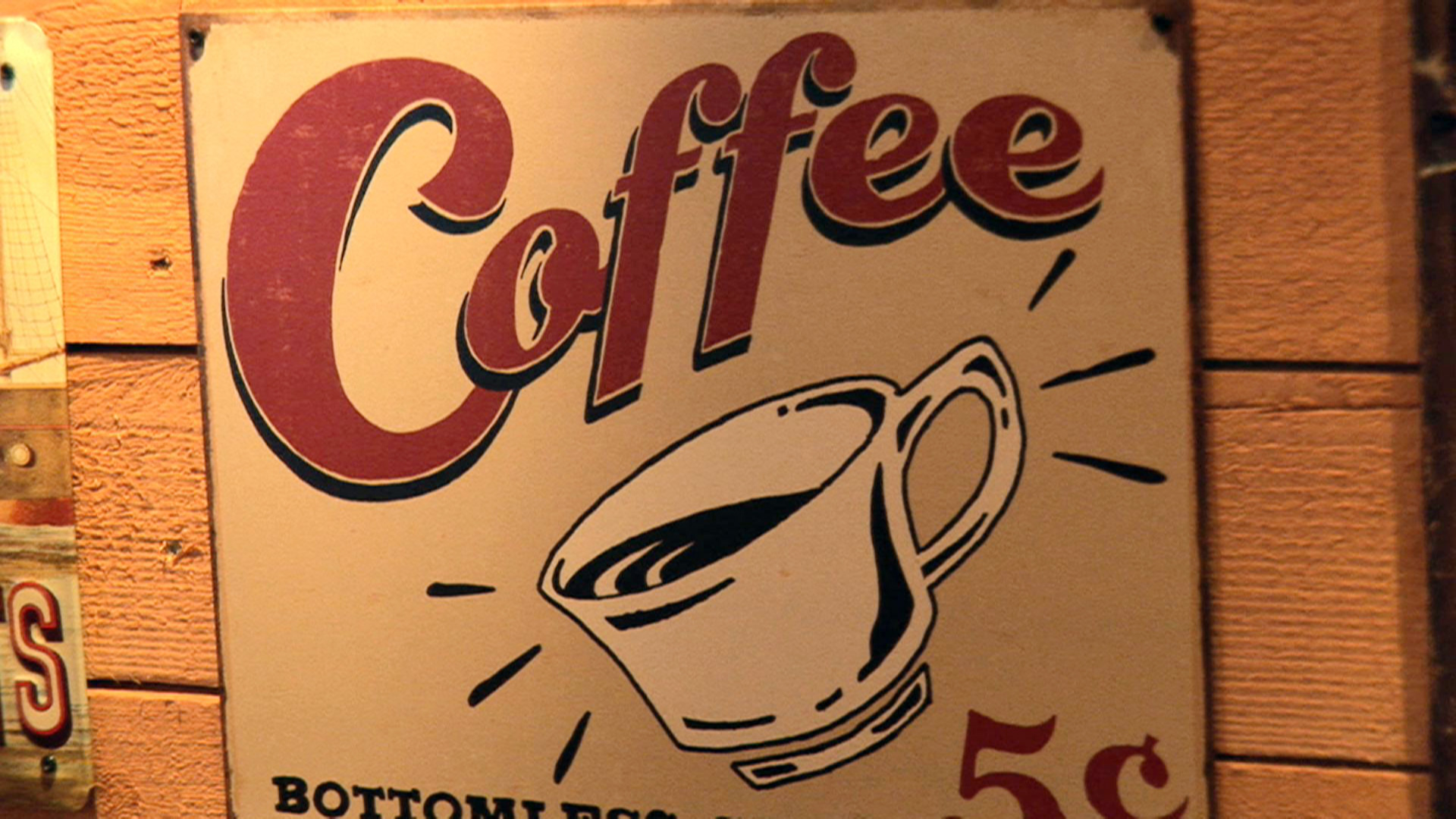

Geneva is fast becoming the raw materials distribution hub in the world, dominating the market in coffee, sugar, cotton and grains and oil seeds and set to overtake London as the number one oil trading centre, according to insiders.

In addition to Geneva, oil, gas and metal traders have a large presence in Zug. Zurich, Ticino and other outlying areas are also represented to a lesser degree.

The success of these areas has recently persuaded Russia’s biggest oil giant Rosneft to set up trading operations in Geneva and compatriot oil producer Bashneft to set up shop in Zurich. The mighty oil concern Trafigura is also rumoured to be moving its traders from London to Geneva.

“Twenty years ago when I started in the commodities industry it was a rather sleepy business that did not operate at the speed it does today,” Credit Suisse head of commodity finance Konrad Wälti told swissinfo.ch.

“The business has developed upwards enormously in the last ten years.”

Profits leaping

Booming raw materials prices have also increased revenues and profits in the last year. The KOF Swiss Economic Institute estimates that turnover in Switzerland reached around SFr17 billion ($18 billion) – or more than three per cent of total gross domestic product – last year compared with SFr12 billion in 2009 and just SFr1.5 billion in 2000.

Company profits are also leaping ahead, with Zug-based oil and metals trader Glencore reporting a 40 per cent increase to $3.8 billion (SFr3.55 billion). Mining conglomerate Xstrata saw operating profit shoot up 75 per cent to $7.65 billion.

The magnet effect of Geneva, in particular, also derives from the vast support structures that have built up around the traders over decades of business.

The city is also awash with legal firms, financiers, consultants, freight specialists and the head office world’s largest goods inspection firm SGS. The 2007 Swiss financial sector masterplan valued these services at SFr4.7 billion (employing 10,000 people and contributing SFr900 million in taxes) – figures that could be valid again following the recovery from the financial crisis.

“If you need a specialised lawyer, an inspection company, or banks or if you want to buy freight, you will find all the professionals you need in Geneva. These clusters drive the industry in Switzerland,” Wälti told swissinfo.ch.

Financial innovation

Switzerland’s well established financial centre, complete with the confidentiality that traders crave, greases the wheels of the commodity trade by providing credit lines for the vast shipments of raw materials from one side of the world to the other.

The system of using the value of shipments to back credit lines was pioneered in Geneva by Paribas bank in the 1970s. The innovation at a stroke allowed smaller traders to ship large volumes of raw materials across the world and remains the standard method of financing shipments to this day.

This wealth of diversified expertise has made Geneva more attractive than ever to foreign commodity trading companies, according to Emmanuel Fragnière who runs commodities degree courses at the HEG School of Business Administration in Geneva.

Disruptions to the balance of commodity supply and demand – caused primarily by population growth, dietary changes and the economic acceleration of emerging economies – have redefined how traders do business, Fragnière argues.

China’s recent surge in consumption of iron ore has pushed up general shipping costs, making it even more important for coal traders to understand freight. The growth of bio-diesel has made it essential for grain traders to become clued up on alternative fuels.

Social crisis?

“Years ago, boutique traders could afford to just specialise in their own sectors,” Fragnière told swissinfo.ch. “But recent volatility has increased the interconnectivity of the commodity trade.”

“It has become even more important for traders to concentrate in places that offer a wide range of expertise,” he added. “That has increased the attractiveness of Geneva as a prime location.”

But the concentration of companies and workers could come at a high cost for Geneva. The city is already buckling under the strain of an influx of foreign firms with property prices soaring and space at a premium.

“The new Eldorado has become even more of a magnet and there is a risk that this could result in a social crisis,” Fragnière told swissinfo.ch.

“Politicians are very happy to collect the new taxes, but they need a coherent policy to promote the location that takes into account structural difficulties.”

The exact impact of Switzerland’s commodities trading industry is hard to judge because of its closed nature. But some observers estimate that Switzerland accounts for 70 per cent of Russia’s oil while Geneva has cornered a third of all crude oil product trading.

Geneva is number one in the trading of coffee, sugar, grains and oil seeds, and is tied with London as the world’s biggest cotton trading centre.

The HEG School of Business Administration estimates that 40% of all commodity trading takes place in Geneva. The industry is thought to generate around 10% of all corporate taxes for the city.

The area between Geneva and Lausanne has around 400 companies operating in the sector, employing just under 10,000 people and handling around $800 billion worth of global commodities between them.

Swiss towns such as Winterthur, Lucerne and Lausanne have a long tradition of trading in commodities such as cotton or coffee, cashing in on Switzerland’s central European location.

The Winterthur based Volkart Brothers company established a highly successful cotton, coffee and spice trading operation in Sri Lanka and India in 1857. The Union Trading Company of Basel was an early traders of cocoa beans.

After the two world wars, commodities traders started looking more closely at neutral Switzerland whose economy and political structure has survived the conflicts unscathed.

The first grain trading houses appeared in Geneva in the 1920s while Switzerland offered a neutral venue for US companies to engage in trade with Eastern bloc countries during the Cold war.

Geneva’s popularity as a destination for Middle Eastern travelers gave the city an edge as the oil industry started booming in the region. Oil traders were joined by cotton merchants escaping from Egypt in the 1960s.

Russian oil concerns followed in the 1990s, establishing a commodities industry in Zug.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.