Swiss finance heavyweight slams BNP Paribas fine

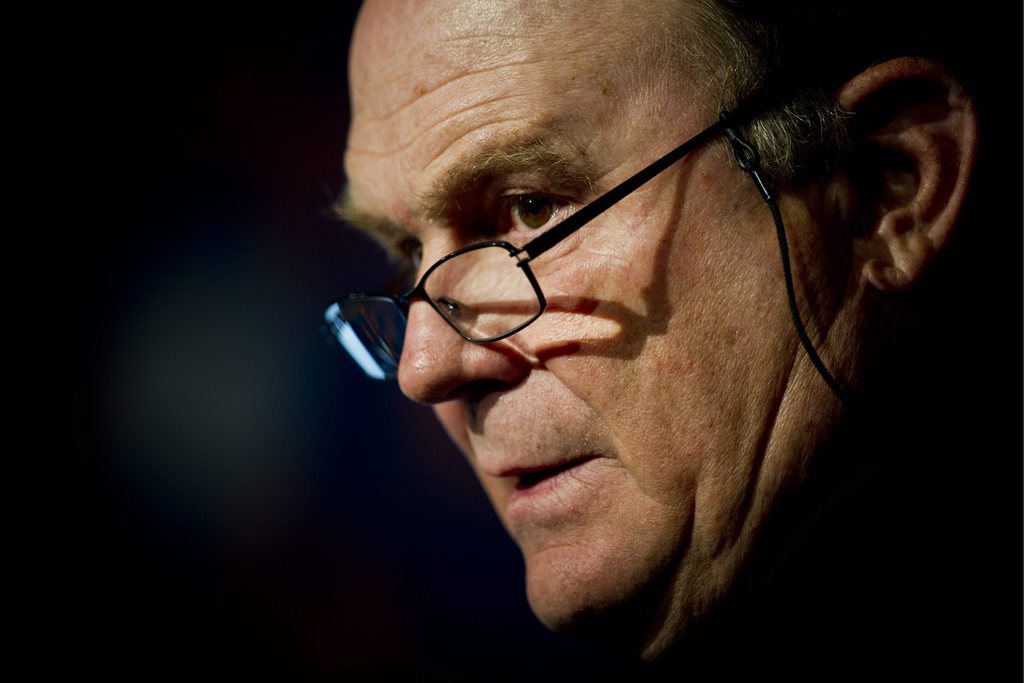

The chairman of the world’s largest reinsurance group, Swiss Re, has condemned the unchecked power of the United States to levy massive fines on international banks and companies.

Walter Kielholz, former chairman of Credit Suisse bank that was recently fined $2.6 billion (CHF2.3 billion) by the US authorities, believes the $9 billion penalty imposed on French bank BNP Paribas underlines a dangerous legal problem.

“In practice, you cannot challenge these fines in a due process,” he told the Financial Times newspaper. “From a rule of law point of view, that is a problem.”

“Is the international legal system working? The feeling that things are not going in the right direction is growing now,” he added in the interview published on Wednesday.

BNP Paribas and Credit Suisse are among a number of banks to have been handed steep fines by the US in recent months for a range of misdemeanors, from tax evasion to sanctions busting and mis-selling financial products.

Kielholz called on shareholders, including large pension funds and hedge funds, to stand up to the seemingly overwhelming power of the US justice system extending its influence over other jurisdictions.

He suggested that these large institutions should challenge the apparent unrestricted authority of the US to help itself to their investments in European banks by issuing such large fines.

“Investors should ask themselves whether they want to recapitalise European banks and see that money appropriated by regulators,” he told the FT.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.