Credit Suisse falls back on Swiss roots to restore order

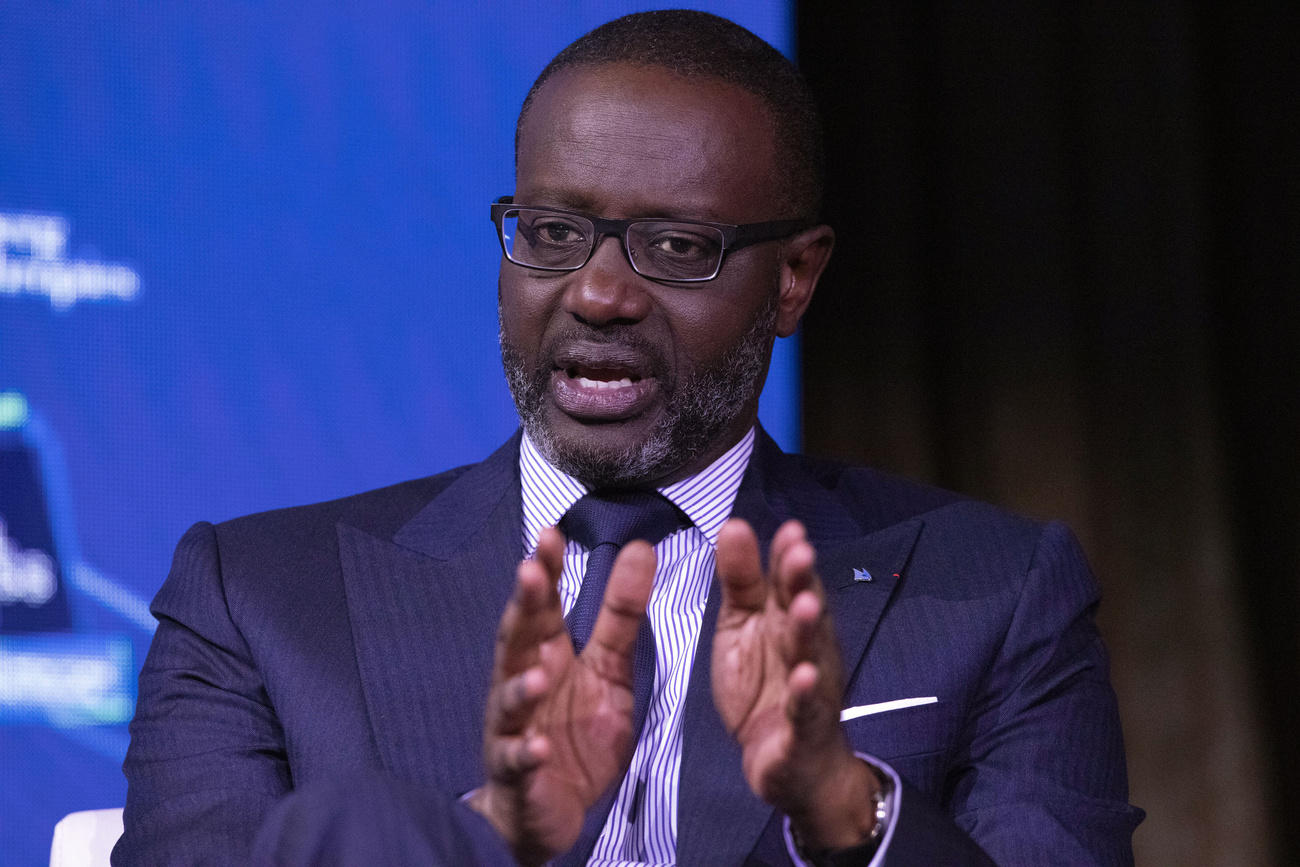

Credit Suisse’s board has defied the wishes of several major shareholders with the surprise axing of chief executive Tidjane Thiam. He has been replaced with Swiss national, and current head of the bank’s domestic operations, Thomas Gottstein.

The bank appears to be going back to its Swiss roots in a bid to re-stabilise its business and reputation following a highly damaging “spygate” scandal. Credit Suisse may be a multinational owned by shareholders around the world, but its core “Swissness” provides the ballast and image that defines the bank.

GottsteinExternal link has been with Credit Suisse since 1999 and was made head of Swiss Universal Bank and Credit Suisse Switzerland in 2015. The 56-year-old had been tipped by the Swiss media to eventually assume overall command of the bank at some stage.

That moment has come sooner than expected, making Gottstein the first Swiss national to become group CEO (on February 14) since 2002.

He will take over from a man who was heralded as the bank’s saviour when he was appointed group CEO in 2015. So what went wrong for Thiam?

Spying scandal

His reputation took a mortal blow with the most recent scandal of Credit Suisse spying on former executives, including the now departed head of personnel Peter Goerke and ex-wealth management chief Iqbal Khan. There are now allegations of espionage directed against Greenpeace.

Switzerland’s financial regulator and Zurich prosecutors are investigating the “spygate” case that has dented the image not only of Credit Suisse, but the whole Swiss banking industry. Credit Suisse pinned the blame on former executive Pierre-Olivier Bouee, who has since departed the bank.

The bank has always maintained that Thiam was unaware of the surveillance, but this has led to concerns that he had lost control of executives working under him. It also led to a major fall-out with chairman Urs Rohner, a stalwart of Swiss banking, which came to a head on Friday.

Power struggle

Thiam had been widely tipped by the media to win the titanic power struggle with Rohner. Key institutional shareholders had praised Thiam’s record in restructuring the troubled bank and setting it on a better course.

Some blamed Rohner – who joined the bank in 2004External link as top legal officer before graduating to chairman in 2011 – for a string of past scandals, including loans made to Mozambique that have blown up into fraud allegations.

But it had also been noted that Thiam had become somewhat isolated having lost key lieutenants Khan, Goerke and Bouee.

While Switzerland wrings it hands in embarrassment over the whole sordid spygate affair, shareholders appear to be more concerned about the bank’s business performance and profits. The markets reacted negatively to the news of Thiam’s imminent departure next week, sending share prices down some 4% immediately after the announcement.

The bank’s annual general meeting on April 30, at which board directors will stand for election, may prove a stormy affair.

Ivory Coast and French national Tidjane Thiam was appointed Credit Suisse CEO in March 2015. He replaced US national Brady Dougan who was seen to have leaned too heavily on investment banking to restore the group’s fortunes.

Thiam embarked on a restructuring plan that re-focused the business towards wealth management, a traditional core pillar of Swiss banking. At the same time, Thiam looked to raise billions in extra capital from the markets.

Thiam’s efforts were initially hit by legacy fines that hit profits. By late 2019, there were some encouraging signs for the bank’s business, but it was still being criticised by analysts for missing some performance targets. Full year results for 2019 are set to be unveiled on February 13.

But the real problems for Thiam took root in early 2019 when head of human resources Peter Goerke was demoted. The bank’s chief operating officer Pierre-Olivier Bouee arranged for secret surveillance on Goerke, a move that was later uncovered by the media.

But the spygate scandal first surfaced in the media in September with the revelation that former wealth management head Iqbal Khan had been tailed by private detectives. An initial review by Credit Suisse found Bouee to be solely responsible.

The Swiss financial regulator intervened when the Goerke spying case became public knowledge, forcing the bank into a second embarrassing admission of guilt. A third allegation of espionage, against Greenpeace, has since surfaced.

Relations between Thiam and chairman Urs Rohner deteriorated over the course of last year, leading to Thiam’s resignation announcement on February 7.

More

Credit Suisse CEO surprises markets with shock resignation

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.