Ecopop and lump-sum taxation: a cantonal analysis

After the shockwave triggered on February 9 by the acceptance of the rightwing Swiss People’s Party’s “against mass immigration” initiative, the Ecopop initiative “against overpopulation”, which aimed to limit immigration, had been greatly anticipated.

Every political party was set against it, and in the end almost three-quarters of voters and every canton rejected it. The graphic below shows that the cantons that are the most immigration-friendly stayed the same.

The consistency in voting behaviour is illustrated by the position of cantons near a diagonal (the dotted line). Unsurprisingly, the cantons which were most against the February 9 initiative were also least in favour of Ecopop.

Voters in Italian-speaking Ticino (TI) were most in favour of both initiatives (68% and 37% respectively) whereas those in Vaud (VD) remained the least supportive (39% and 17%). The above graphic also shows how French-speaking cantons snubbed the two texts the most.

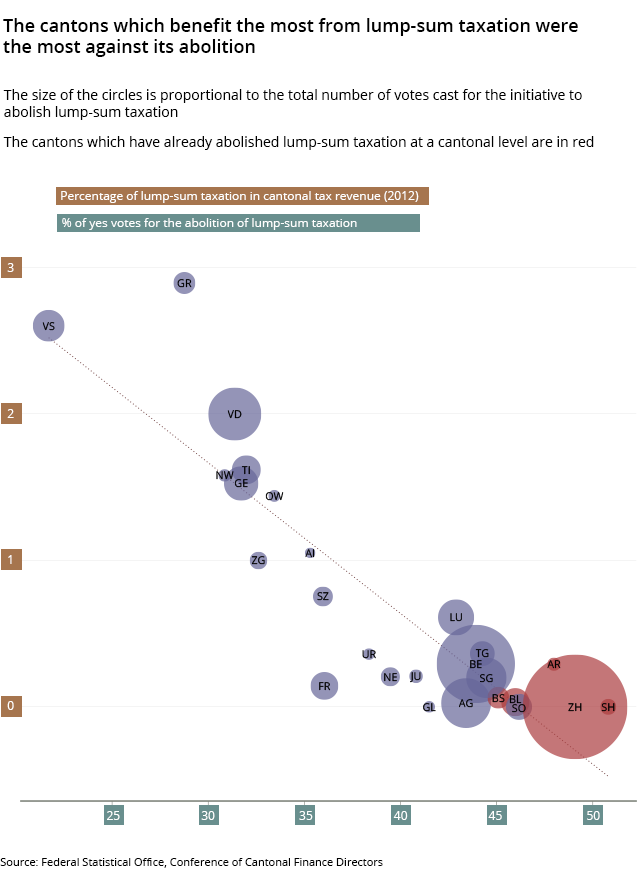

On Sunday, 59% of Swiss voters said no to abolishing lump-sum taxation. Beyond a general rejection by the cantons, it can be seen that it was the cantons which gain the greatest financial benefit from this system of taxation which voted most in favour of keeping the status quo.

The graphic below illustrates this trend by showing the estimated amount of lump-sum taxation in the cantonal tax revenue (for 2012) and the percentage of yes votes to this initiative.

The relationship between the abolition initiative and tax revenue is shown by the position of cantons near a diagonal (the dotted line). The cantons whose coffers are most dependent on lump-sum taxation – Graubünden (GR), Valais (VS), Vaud (VD), Ticino (TI), Nidwalden (NW) and Geneva (GE) – all clearly rejected the initiative.

Schaffhausen (SH), which had already abolished lump-sum taxation at a cantonal level, was the only canton to accept it.

The initiative did best in cantons which had already abolished lump-sum taxation: Zurich (ZH), Basel City (BS), Basel Country (BL) and Appenzell Ausser Rhoden (AR) – shown in red.

Translated by Thomas Stephens

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.