Bank “supervisors” proposed at G20 summit

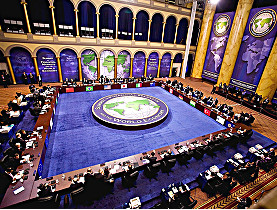

World leaders have laid the foundation for reforms to the international financial system at the G20 summit in the United States.

One reform in particular could change the workings of Switzerland’s biggest banks, UBS and Credit Suisse: the plan for new supervisory bodies to oversee the activities of leading banks.

The summit conclusions adopted on Saturday in the US capital identify around 50 different areas for action. But the outcome was not the “reinvention of the international financial system” envisaged by French President Nicolas Sarkozy and the European Union.

There had been speculation that the gathering would become Bretton Woods II, following on from the 1944 conference that created the International Monetary Fund (IMF) and the World Bank.

The issues it did address ranged from the regulation of speculative investment funds, so-called hedge funds, to the coordination of national tax incentive measures.

Responding to the summit outcome, the Swiss foreign ministry announced it hoped to take part in future talks on the decisions taken and had written to US counterparts informing them of Switzerland’s desire to be involved.

More supervision

The summit’s 12-page final conclusions focus particularly on improving international cooperation, a goal that would include the creation of “supervisory colleges” – bodies comprising representatives of regulatory authorities – in order to “strengthen supervision” for all major cross-border financial institutions.

The idea is that the largest banks would confer regularly with their supervisory colleges about their activities and evaluate the risks they face. No banks were mentioned by name in the summit conclusions but according to the US government, which is behind this measure and the concept of supervisory colleges, it would encompass the world’s 30 biggest banks.

Swiss foreign ministry spokesman Roland Meier said the government had noted the summit conclusions with interest, adding: “We hope that the major financial centres are integrated into this process.”

He dismissed Switzerland’s absence from the summit, despite being one of the world’s major financial centres, as simply “a matter of policy”.

A first step

“It was a productive and successful summit,” said US President George Bush, who welcomed in particular the G20 feeling that capitalism and free trade, together with some regulation, were the best means of ensuring growth, employment and poverty reduction.

Bush and the other G20 leaders stressed however that the Washington summit was just a first step. They instructed their ministers to draw up detailed proposals in the 50 areas for action by March 31, before a possible second summit in April. More specifics about the supervisory colleges are not expected to surface until the spring.

By that time US President-elect Barack Obama will have had three months to become familiar with the intricacies of power and the economic crisis.

On Saturday Bush said he would update his successor on the summit decisions. The outgoing president has also promised to “work tirelessly” for the smooth transition between his government and the incumbent.

President-elect Obama, who was represented at the summit by two emissaries, including former Secretary of State Madeleine Albright, has said the global economic crisis requires an international response.

New era

The only concrete result of the summit came when Japan announced a loan of $100 billion (SFr119 billion) to the IMF to help developing countries that are struggling because of the global crisis.

Welcoming Japan’s “leadership” and “commitment towards multilateralism”, IMF boss Dominique Strauss-Khan said he hoped that other countries would now support the work of the IMF.

It was the first time that the G20, a group formed in 1999, gathered at the level of heads of state and government. The event emphasised not only the seriousness of the current crisis but also the growing importance of emerging economies such as China, India or Brazil.

It also confirms the advent of the European Union as a full partner in the international community. In this regard, German Chancellor Angela Merkel spoke on Saturday of a “beginning of a new era” in international cooperation.

Nevertheless, the president of the World Bank, Robert Zoellick, warned that the integration of emerging countries should not come at the expense of the poorest countries.

“This is a positive step to see the leaders of developed countries meeting those of emerging economic powers, but the poorest developing countries should not be ignored,” he said.

He added that “the current crisis is not resolved and long-term solutions will not be implemented by accepting a world that runs at two speeds”.

swissinfo, Marie-Christine Bonzom in Washington

G20 leaders agreed to take rapid action, including fiscal stimulus measures as needed, to stabilise financial markets and restore growth in the worsening global economy. They also support giving emerging markets more say in the global financial order. G20 finance ministers were instructed to work on specifics by March 31, ahead of the next summit.

The leaders backed:

– Fiscal measures to boost demand rapidly

– Monetary policy steps as appropriate

– More funds for the IMF to support emerging economies

– To strive for a breakthrough this year in the Doha round of trade talks

– Reform of Bretton Woods institutions to give emerging economies more of a voice in line with their changing economic weight

– Colleges of supervisors to review major global banks

– A review of accountancy standards, CEO pay, bankruptcy rules, credit rating agencies and moving credit default swaps to exchange trading.

The G20 includes the seven major industrialised nations, the European Union, and Argentina, Australia, Brazil, China, India, Indonesia, Mexico, Russia, Saudi Arabia, South Africa, South Korea and Turkey.

ECONOMIC ACTION:

“More needs to be done to stabilise financial markets and support economic growth. Economic momentum is slowing substantially in major economies and the global outlook has weakened.”

“Against this background of deteriorating economic conditions we agreed that a broader policy response is needed.”

GLOBAL FINANCIAL INSTITUTIONS:

“We are committed to advancing the reform of the Bretton Woods institutions so that they can more adequately reflect changing weights in the world economy in order to increase their legitimacy and effectiveness. In this respect, emerging and developing economies, including the poorest countries, should have greater voice and representation.”

TRADE TALKS

“We underscore the critical importance of rejecting protectionism and not turning inward in times of financial uncertainty.”

“We shall strive to reach agreement this year on modalities that lead to a successful conclusion to the WTO’s Doha Development Agenda with an ambitious and balanced outcome. We instruct our trade ministers to achieve this outcome.”

REGULATORY RULES:

“We will implement reforms that will strengthen financial markets and regulatory regimes so as to avoid future crises.”

Regulation is firstly a national responsibility but international cooperation will be strengthened, the summit conclusions stated.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.