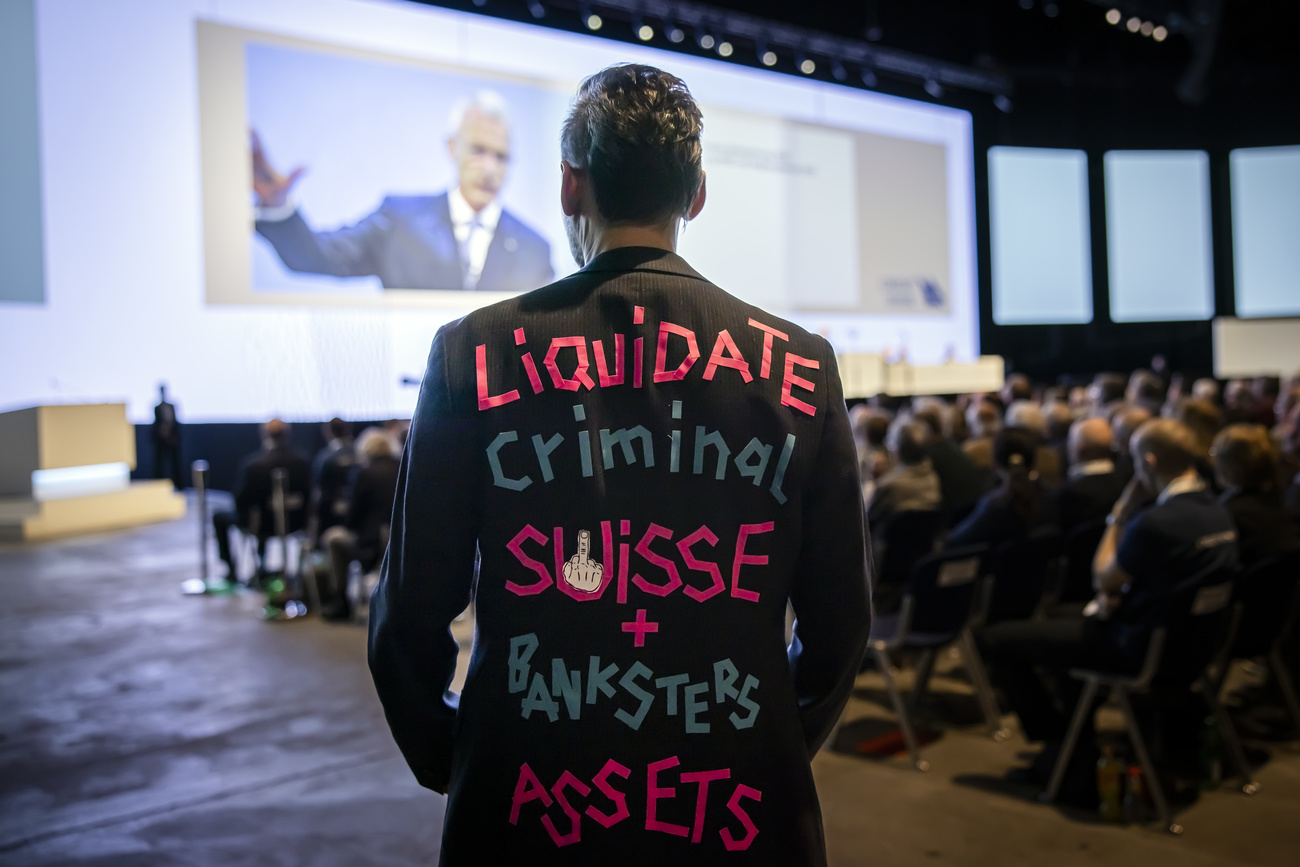

Credit Suisse staff prepare to sue regulator Finma over lost AT1 bonuses

Credit Suisse staff are making preparations to sue the Swiss financial regulator over $400 million (CHF360 million) of bonuses that were cancelled following the bank’s rescue by UBS.

Thousands of senior Credit Suisse bankers have a portion of their bonuses linked to the group’s additional tier 1 bonds, securities that were wiped out in the takeover orchestrated by Swiss authorities in March.

Law firms Quinn Emanuel and Pallas, which are already suing the Swiss regulator Finma on behalf of investors who owned the AT1 bonds, have received multiple requests from senior managers at Credit Suisse to take legal action on their behalf too, according to several people familiar with the matter.

More

Japan creditors set to challenge Credit Suisse AT1 write down

At this point, lawyers are unclear whether claims from Credit Suisse employees could be bolted on to the existing suits filed against Finma or would need to be lodged separately, the people added.

“We have been contacted by Credit Suisse managers from around the world to see how we could help them,” said one person involved in the discussions. “There is a lot of overlap between the two positions, but they are not exactly the same.”

Unconventional awards

The bonuses date back to 2014 when managing director and director-level staff at the bank were offered a contingent capital award as part of their remuneration. The unconventional awards were designed to mimic AT1s, which could be converted into equity or written down to zero if the bank was in distress.

More

Swiss lawmakers agree to ban bonuses at too-big-to-fail banks

CCAs typically made up about 10% to 15% of a manager’s total bonus and vest after three years. They also provided two interest payments a year. In 2021, the last year they were granted, more than 5,000 Credit Suisse staff received them.

AT1s are a type of hybrid debt instrument created after the financial crash of 2008 to give banks greater capital flexibility in the event of crises.

Credit Suisse had initially asked Finma if the CCAs could be treated differently to AT1s, but employees were told three weeks ago that their awards would be wiped out along with the AT1s. UBS said this week that it would book a $400 million gain from the move once it completed the takeover.

Share price plummeted

On Monday, Credit Suisse staff were informed that they would receive the final interest payment on the CCAs before they were erased. Bonuses have been hit in other ways, including equity awards as Credit Suisse’s share price has plunged 93% since the beginning of 2021.

Last month, the Swiss government ordered that bonuses for about 1,000 senior Credit Suisse bankers should be cut. Under the ruling, executive board members had their bonuses cancelled, while staff one level below suffered a 50% cut. Staff a level below that received a 25% reduction.

The treatment of AT1s has proved to be one of the most divisive aspects of UBS’s $3.25 billion purchase of its rival. Quinn Emanuel and Pallas represent investors in separate suits holding more than a third of the $17 billion of AT1 bonds that were rendered worthless.

More

Credit Suisse shareholders reject executive pay request

In an early victory for claimants last week in what is expected to be a long-running case, Finma was forced to divulge the decree that wiped out their investments.

The judge overseeing the case, which was filed in the city of St Gallen in eastern Switzerland, ordered the regulator to hand over the decree, giving the AT1 bondholders a firmer foothold to contest the writedown.

Credit Suisse, Finma, Quinn Emanuel and Pallas all declined to comment.

Copyright The Financial Times Limited 2023

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.