Finma warns over interest rate rise

Switzerland’s low interest rates pose a danger for the stability of the financial sector, says the Swiss Financial Market Supervisory Authority Finma.

A sharp rise in rates could destabilise the whole system, the watchdog said on Tuesday at its annual media conference. A gradual return to average interest rate levels would bring considerable relief to the sector, its chief executive said.

Of particular interest at the moment is the issue of interest rate risk for mortgages and life insurance.

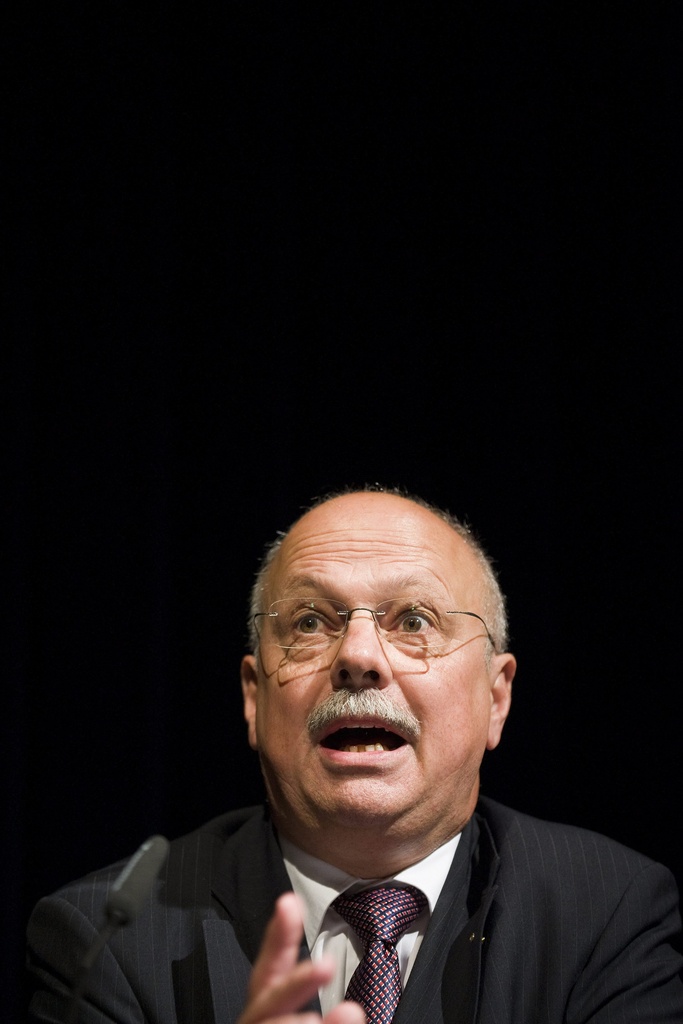

“Finma has taken action on a number of fronts, within its remit and using the apparatus at its disposal, to counteract these risks and minimize them wherever possible. However, prudential supervision can only have a limited impact on some of the risks,” said Finma Chief Executive Patrick Raaflaub.

Observers have warned in recent months of a possible bubble developing in the Swiss real estate market as borrowers take advantage of historically low mortgage rates to fuel a residential building boom.

Finma also called for the “too big to fail” proposals to protect banks from collapse to be implemented swiftly. It supports the draft law on the issue – to compel banks to set aside more reserves to cover risks – which is shortly to go before parliament.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.