The world rediscovers its love for accessories

A turning point in the fortunes of the luxury industry came this year when the US notched up 14 consecutive months of growth for jewellery sales.

The April statistic was a sign of the country’s emergence as the driving consumer force in the luxury industry in 2014, according to Sarah Quinlan, head of market insights at MasterCard’s professional services division.

Speaking at the FT’s Business of Luxury conference in Mexico in May, Ms Quinlan explained that as sales to Chinese consumers slowed, jewellery, a vital focus for “discretionary spending”, had become one of the fastest-growing market segments.

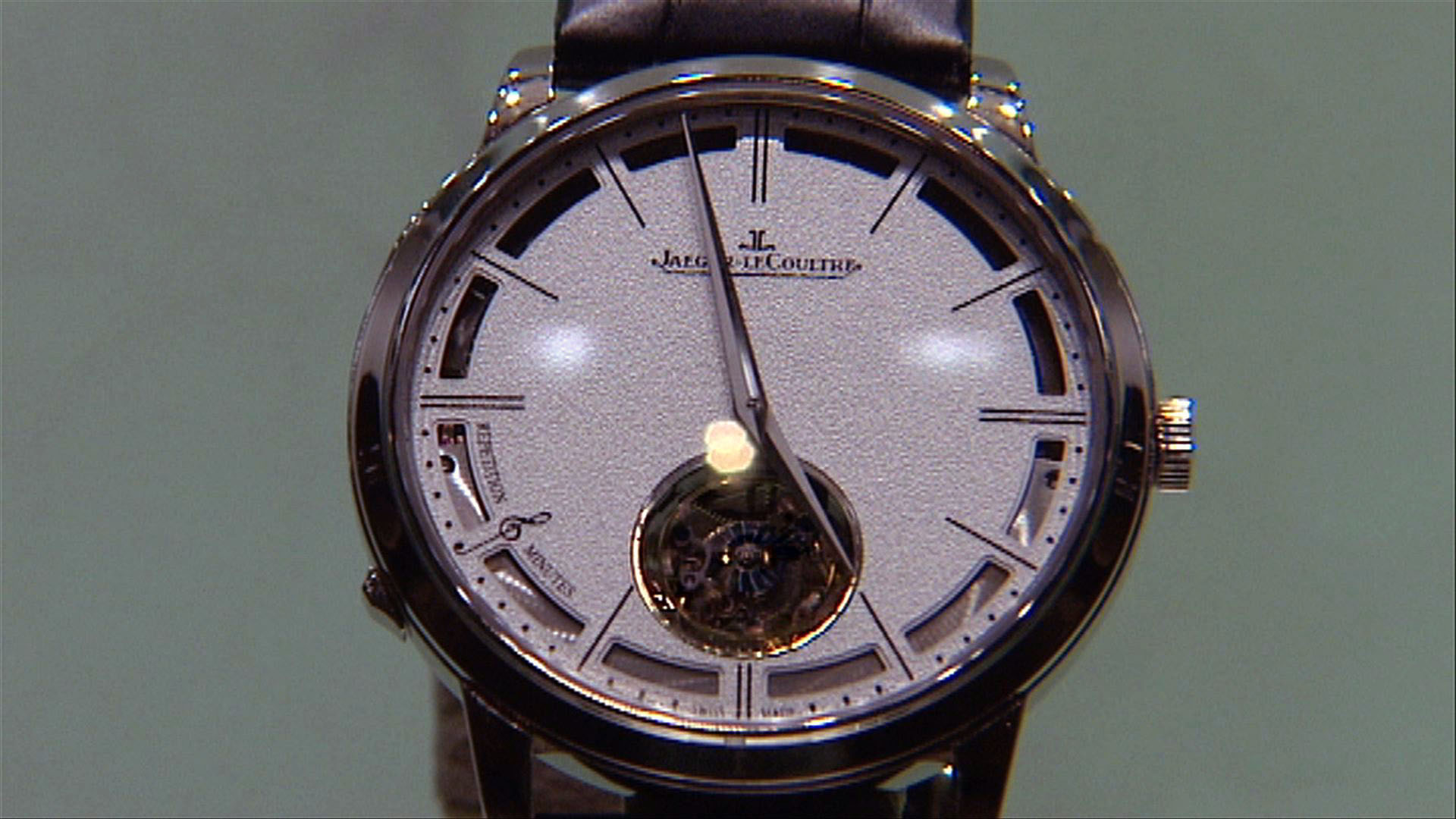

Analysts say jewellery is the best-positioned luxury goods category in the “new normal” for the industry, closely followed by accessories overall, then watches.

Recession-weary shoppers are opting to buy accessories including jewellery and watches, rather than change wardrobes, every season. Jewellery has the added benefit of being regarded as an investment.

Altagamma, the Italian luxury industry body, predicts that accessories, jewellery and watches will be the best-performing categories in 2014.

Strongest growth

Claudia D’Arpizio, head of luxury at Bain & Company, the consultancy, says the affordable luxury market is showing the strongest growth. Meanwhile, global sales of top-of-the-range jewellery and watches are sustained by the international super-rich, despite the slowdown in watch sales in China caused by the government clampdown on gift-giving.

Ms D’Arpizio says the luxury sector is entering a phase where there is an absence of the sort of explosive growth seen in China in the past few years.

More

Financial Times

External linkAt the same time,” she says, “mature markets are showing a greater ability to withstand crises, meaning that the trend will be more stable, with growth of 4 to 6% over the next few years.”

In this way, the US has emerged as the engine of luxury growth, while sales in Europe are sustained largely thanks to tourists from Asia.

Ms D’Arpizio also notes that Africa is showing signs of outperforming expectations. She considers Angola and Nigeria as countries worth watching. In all markets, hard luxury – and especially jewellery – has become a main driver of growth.

John Obayuwana, the head of Polo Luxury, the largest luxury retailer in Nigeria, also speaking at the FT summit, said that Nigerian shoppers were eager to spend their new-found and growing wealth, in particular on Rolexes and other high-profile accessories.

International appeal

The slowdown in China and the emergence of jewellery as a category with international appeal is helping to determine the way the industry is reshaping itself.

LVMH, the world’s largest luxury goods group by sales, moved first, announcing a shake-up of its watches and jewellery division in January.

Antonio Belloni – right-hand man to Bernard Arnault, the French billionaire who controls LVMH – took responsibility for the division with an eye to bolstering the jewellery business, centred on Bulgari, Chaumet and De Beers.

More

The valley at the heart of the watchmaking boom

As part of the restructuring, Jean-Claude Biver, previously chief executive of Hublot, took charge of watches, dominated by TAG Heuer and including Zenith and Hublot.

Meanwhile, Francesco Trapani, who as chief executive of Bulgari orchestrated its sale to LVMH, has stepped down as the group’s head of watches and jewellery, although he remains as an adviser to Mr Arnault.

Mr Trapani has joined Italian private equity group Clessidra, which last year acquired Milanese jeweller Buccellati.

Kering, owner of Gucci and Bottega Veneta, followed in March, announcing it was splitting its luxury division into two.

Couture and leather goods will now be led by Marco Bizzarri, the former Bottega Veneta chief executive, and watches and jewellery by Albert Bensoussan, a former LVMH executive.

Thomas Chauvet, an analyst at Citigroup, considers the move to be positive, allowing Kering to make cost savings in manufacturing and distribution across the various brands, particularly in hard luxury.

Slowdown in China

Richemont – where jewellery makes up nearly a third of sales – is well positioned to take advantage of the upswing in sales, analysts say.

Antoine Belge, an analyst at HSBC, believes that worries about the impact of the slowdown in China on the Swiss group have been overdone. He points out that sales of Cartier watches – a concern in 2013 – are rebounding.

The jewellery division, which is made up of Cartier and Van Cleef & Arpels, outperformed in the first quarter, with sales rising 10%.

“This is a positive, as jewellery and watches – particularly Cartier, the biggest contributor [to the division] – are margin enhancing,” says Mr Belge.

Richemont has conducted a strategic review of its soft luxury businesses, including Lancel and Chloé, while developing its fine jewellery through the creation of the Giampiero Bodino brand, named after Richemont’s long-time creative director.

Management put off a sale of its fashion brands late last year, but in the light of the impact of the China slowdown on the industry, analysts do not rule out an attempt to sell them next year or in 2016.

Richemont is the first of the top luxury groups to try to create a fine jeweller from scratch.

Mr Bodino has launched an “appointment-only” maison, located in a 1930s villa in a quiet, leafy street in central Milan.

Here, he is on hand to help wealthy clients bring their jewellery aspirations to life. He shows visitors his Moleskine notebooks with sketches, and says that, should clients wish, he is ready to work with them to create their own personalised designs.

The launch of Giampiero Bodino taps into a new trend for the wider luxury goods industry: the rise of “experiential luxury” – the pursuit of experiences covering the most expensive cars, holidays and hotels.

Wearable technology

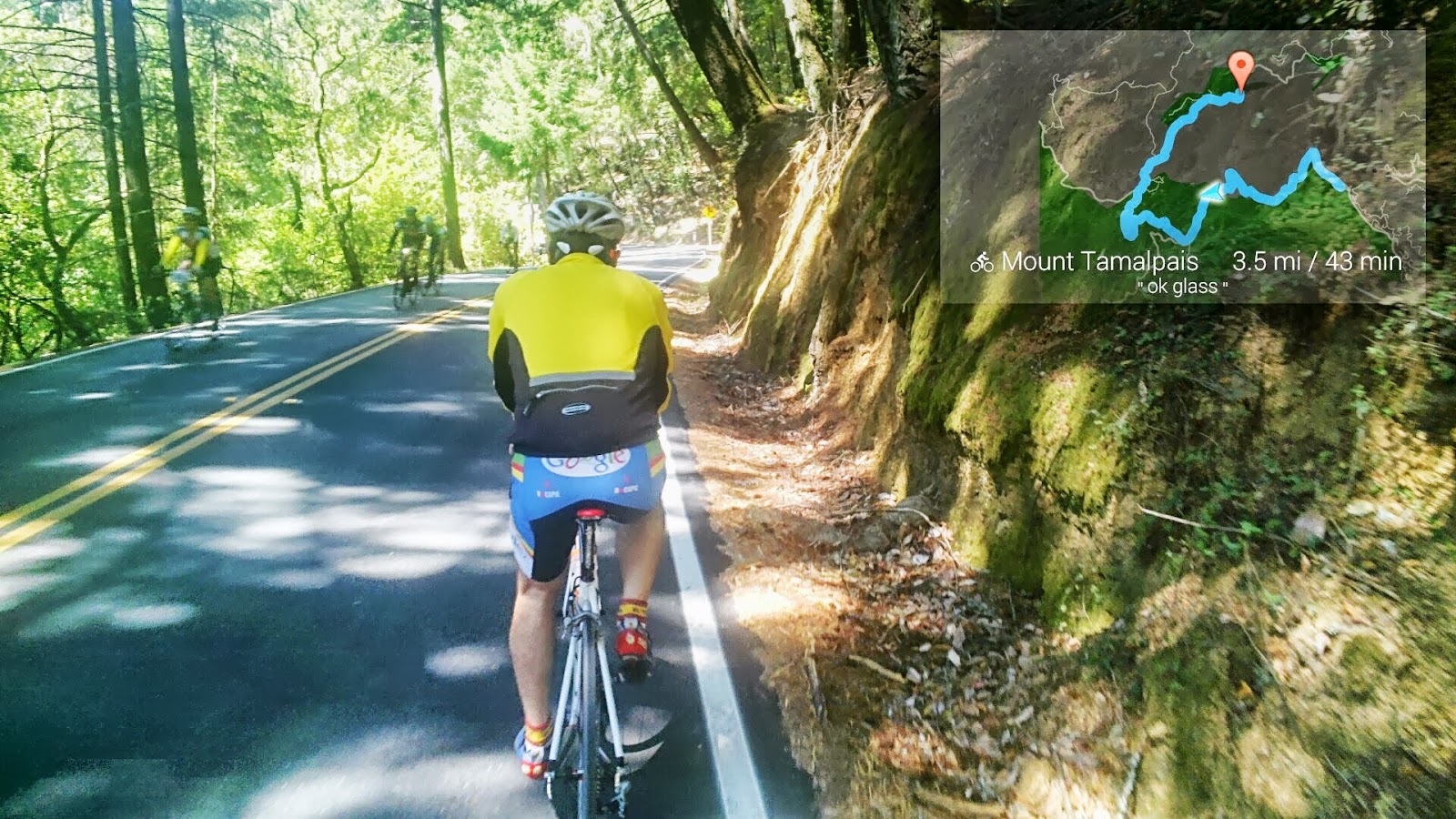

Advances in technology in the digital age are opening other avenues for the accessories industry, especially in the case of watches and eyewear with the advent of “wearable technology”.

More

The future is coming to your face soon

Leading the way, according to analysts, is Luxottica, the eyewear maker behind the Ray-Ban and Oakley brands, which also makes glasses for brands including Prada and Armani. In March, it announced a joint venture with Google to develop Google Glass, the online technology company’s $1,500 headset.

Andrea Guerra, Luxottica chief executive, has signed a deal to design, develop and distribute Google Glass, incorporating designs from Ray-Ban and Oakley.

Luca Solca, head of luxury research at Exane BNP Paribas, considers Luxottica’s move “appropriate” in the face of technology innovation, as it gives the Milan-based brand the opportunity “to continue to dominate the technology frontier”.

He believes wearable technology will be the next big trend for the consumer, technology and luxury industries. Eyewear such as Google Glass together with smart watches are seen as having potential mass-market appeal.

Indeed, the arrival of technology in the hard luxury sector of accessories and watches may yet cause a shake-up in the industry to rival the financial crisis or the China slowdown.

Apple is widely expected to release its “iWatch” this year.

Depending on how they react, companies such as Swatch Group could find themselves in a weaker position if entry-level smart watches challenge their dominance in the market, says Mr Solca.

Copyright The Financial Times Limited 2014

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.