Value over volume

Outcry over a 5,000 per cent rise on the price of a pill rattled pharma stocks and crystallised concerns about rising US drug costs. Even drugmakers acknowledge that their pricing models will have to evolve.

It was probably the most expensive tweet in history. A 21-word missive from Hillary Clinton on Monday wiped more than $40 billion (CHF39.3 billion) off the value of US pharmaceutical and biotech stocks.

The Democratic presidential frontrunner decried as “outrageous” the “price gouging” by some drugmakers and promised action to stamp it out. The next day she announced a package of measures designed to rein in pharmaceuticals “profiteering”.

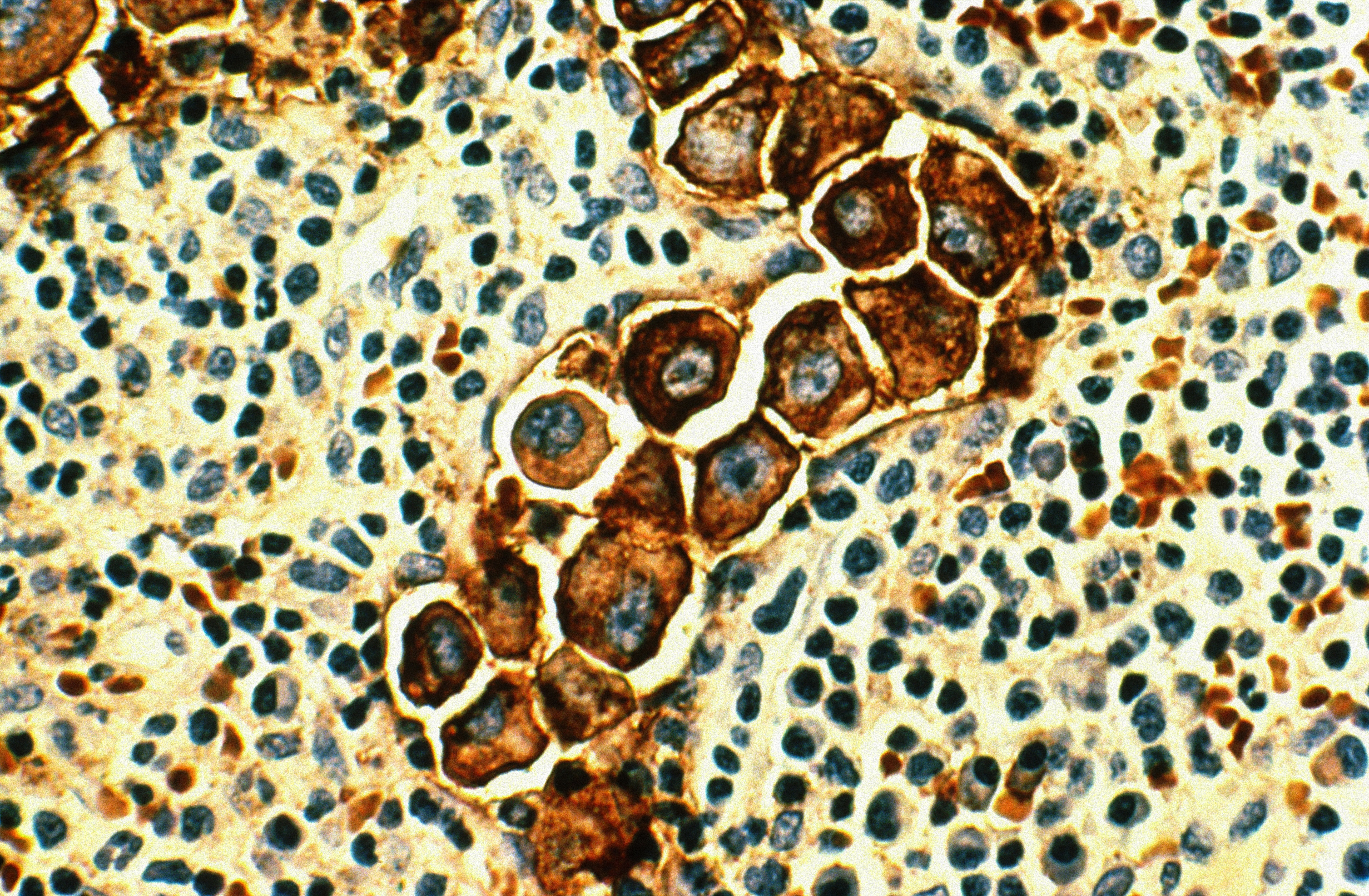

Her intervention coincided with an outcry over a 5,000 per cent price increase levied on an anti-infective drug used by Aids and cancer patients. The company – Turing Pharmaceuticals – is run by a 32-year-old fast-talking former hedge fund manager, Martin Shkreli, who instantly became the unapologetic face of an industry accused of putting profits over public health.

Mr Shkreli responded to the ensuing media storm with a tweet linking to an expletive-filled Eminem song, “The Way I Am”, containing the lyrics: “I’m tired of all you, I don’t mean to be mean. But that’s all I can be is just me.”

This tale of two tweets has thrust drug pricing to the centre of the US presidential campaign and sent investors fleeing in fear of a clampdown on one of the world’s biggest and most profitable industries.

More

Financial Times

External linkWhile the furore reflects the unique excesses of the US drug market, it also feeds into a broader global debate about the cost of medicines. From restrictions on pricey cancer treatments in Britain’s cash-strapped National Health Service to reforms of the way drugs are procured in Chinese hospitals, the industry is under pressure around the world as societies battle to contain the rising cost of healthcare for ageing populations and growing middle classes.

Until recently, the US has seemed immune from such forces. Drug prices have been rising at an annual rate of at least 10 per cent since 2010 even as they stagnated in Europe. The sustainability of this growth is being called into question as the showdown between Mrs Clinton and Mr Shkreli heaps scrutiny on why America’s drugs bill is rising so fast.

Peter Bach, director of the Center for Health Policy and Outcomes at Memorial Sloan Kettering Cancer Center in New York, says Mr Shkreli’s aggressive approach is the natural consequence of a US system that allows drugmakers to charge what the market will bear for products essential to human health. “This guy just happened to get caught in a perfect storm but it had been brewing for some time.”

A market out of control?

The US has long been an outlier from the regulated pricing and controlled market access in other developed countries. This has made America by far the most lucrative place to sell medicines, accounting for about 40 per cent of global sales. Annual US per-capita spending on pharmaceuticals almost doubled between 2000 and 2012 to $1,010, compared with the $498 average among OECD members. Any move to rein in the US market, therefore, would shake the industry to its foundations.

Mrs Clinton’s proposals include opening the market to cheap imports from Canada, mandating pharma companies to spend a minimum proportion of sales on research and development and allowing the government to negotiate prices paid by the public Medicare health insurance programme. The latter measure has for years been resisted by drugmakers and their Republican allies, who fear a slippery slope towards the rationing of care commonplace in socialised European health systems.

Yet the absence of government leverage over drug pricing is one of the main reasons why Americans pay so much more for their medicines than the rest of the world. US prices are typically 20-40 per cent higher than in Europe and sometimes more. Novartis’s Gleevec cancer drug costs $106,322 a year in the US but only $31,867 in the UK, according to researchers at the University of Liverpool.

Is this all about to change? Mrs Clinton’s attack appeared driven in large part by campaign politics as she battles to neutralise the threat posed by Bernie Sanders, her leftwing rival for the Democratic nomination who had already promised action on drug prices.

Andrew Baum, an analyst at Citigroup, describes Mrs Clinton’s plan as “more fiction than future”, noting that even if she were elected to the White House next year the measures would probably founder if Republicans kept control of Congress. Yet, while radical reform seems unlikely in the near term, Mr Baum says this week’s controversy shows that “political pressure on drug pricing in the US is high and will continue to rise”.

Tensions over pricing have been growing for more than a year since Gilead Sciences launched a breakthrough medicine called Sovaldi, which cures most cases of hepatitis C within weeks – at a cost of $84,000. This weighed heavily on insurers and public health providers because of the large number of people – 3.2m in the US – with the disease. Spending by Medicareon hepatitis C increased 15-fold in 2014 from the year before to $4.5bn. The price has since fallen after the introduction of a rival product from AbbVie. But the case demonstrated the unfettered pricing power held by pharma groups in the US when no competition exists.

Mr Shkreli exploited this freedom to raise the price of its Daraprim brand from $13.50 to $750 per pill after buying the product, the only one of its kind, for $55m from another small drugmaker last month. But he backed down on Tuesday with a promise to reduce the increase by an unspecified amount.

Even fellow drugmakers joined the criticism, alarmed at the damage being caused to the industry’s already shaky reputation by one renegade company. The Pharmaceutical Research and Manufacturers of America, the main US industry trade group, briefly broke from condemning Mrs Clinton’s proposals to tweet that Turing “does not represent the values” of its members.

Controversy over drug pricing is hardly new. The industry faced opprobrium in the 1990s when it was accused of keeping HIV drugs out of reach of the poor. Pharma leaders have always defended their right to make a return on heavy investment in research and development. But, in a series of interviews with the Financial Times before this week’s events, executives acknowledged that business models must adapt to an era of constrained health budgets.

“We need to make sure we are taking the choices for long-term acceptability by society,” says Sir Andrew Witty, chief executive of GlaxoSmithKline. “If we don’t, society is going to react through regulation or some other pendulum shift.”

Wider benefits

There is increasing consensus that a clearer connection must be made between the price charged for a medicine and the measurable benefit it delivers to patients and society. Sir Andrew and his peers want to shift the focus from the cost of medicines to the value they create, for example by allowing someone to return to work earlier or keeping them out of hospital.

This may sound like an uncontroversial idea but the concept of “value-based pricing” marks a departure from traditional practices. The big pharma business model was built by dispatching armies of sales reps to push the largest possible quantity of pills at the highest possible price without looking back to see whether the medicine worked. Joe Jimenez, Novartis chief executive, says those days are coming to an end. “The industry has to shift over time from what is today a transactional approach to an outcomes-based approach.”

He cites Novartis’s new Entresto heart drug as an example. The medicine, launched in July, was shown in clinical trials to reduce hospitalisation by over 20 per cent. But the Swiss group faces a challenge to persuade customers to adopt it over older drugs that are less effective but much cheaper. It is trying to do this by offering the medicine at a discount with the potential for bonus payments if it succeeds in cutting rates of costly hospitalisation.

Other companies are experimenting with similar pay-for-performance models, harnessing big data to measure the “real world” impact of medicines rather than relying on the results of clinical trials. “If companies can show that they are producing real value they will be able to sustain reasonable prices,” says Chris Stirling, head of life sciences at KPMG, the consultancy. “But they are going to have to put in more effort than before. Having a big sales force is no longer going to be enough.”

Demonstrating value, however, is only half the problem. Gilead’s Sovaldi might be cost-effective over the long term by curing patients whose hepatitis would otherwise have imposed a prolonged burden on health systems. The cost of a liver transplant – the fate of some hepatitis C patients – is several times higher than the cost of Sovaldi. Yet this potential future saving is of little comfort to the healthcare managers whose budgets have been overwhelmed by the upfront cost of the drug.

Preoccupied with profits

This problem is prompting a radical rethink. James Wilson, a professor at the University of Pennsylvania’s medical school, says annuity-style payments over a number of years would provide a sustainable way to reward investment in one-off curative treatments that produce big long-term benefits.

Others propose a simpler solution: companies should lower their price expectations. The 10 biggest drugmakers had an average net profit margin of 19 per cent in 2013 – similar to banking and double the level of the oil and gas sector. Andrew Hill, an expert on drug pricing at the University of Liverpool, says pharma could afford to charge less while still making ample profit.

This is disputed by Yevgeniy Feyman, fellow at the Manhattan Institute, a conservative US think-tank, who says margins are comparable with other research-intensive sectors such as technology. High-risk drug development must reap high rewards, he says, “otherwise investors would direct their money to the next Snapchat instead of an Alzheimer’s cure”.

Mr Feyman says the fixation on prices is perverse when the almost $300 billion spent annually on prescription medicines in the US is dwarfed by the $1 trillion on hospital care. Similar ratios apply in Europe, where pharma executives lament that it is easier for politicians to squeeze drug budgets than to restructure inefficient health infrastructure.

There are signs that the US may be starting to rein in its bloated healthcare spending. At 18 per cent of GDP, that is by far the highest in the developed world yet outcomes are inferior compared with some countries that spend less. President Barack Obama’s healthcare reforms included incentives to increase efficiency, while consolidation among care providers and insurers is increasing economies of scale.

In the long run these trends could help drugmakers if they create more headroom for spending on medicines and reward products that reduce long-term care costs. The most immediate effect, however, has been a more aggressive approach to price negotiations by the healthcare “payers” who buy drugs. GSK, for example, has been forced to sharply cut the price of its best-selling Advair asthma drug.

“For years in Europe we have had price cuts and restrictions in availability of new products and we’re beginning to see the same in America,” says Sir Andrew. “It’s not going to be exactly the same as Europe but the direction of travel is similar.”

Mr Baum agrees that the most competitive fields such as respiratory and diabetes drugs will face pressure. But he predicts that medicines offering a clear improvement over existing treatments will maintain pricing power – citing the new class of cancer “immunotherapies”.

This pressure to innovate helps explain the record wave of mergers and acquisitions that has swept the sector over the past two years as drugmakers have vied to strengthen their R&D pipelines. Mrs Clinton has fuelled questions over whether the high valuations paid for many of these assets will be justified if pricing comes under attack.

Severin Schwan, chief executive of Roche, admits there will be “tough negotiations” ahead. “It’s a market-driven system. But I think the US will continue to reward innovation – I’m absolutely sure of it.”

Copyright The Financial Times Limited 2015

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.