Swatch could be heading for hour of reckoning

The world’s number one watchmaker, the Swatch Group - which will present its annual report and results on Thursday – must not rest on its laurels, says an expert.

Grégory Pons, a French Geneva-based journalist specialising in the watch industry, tells swissinfo.ch that despite the Swatch Group’s success – record key figures for 2010 have already been released – challenges lie ahead.

Pons is editor of an international newsletter for watchmaking professionals and jury member of the Grand Prix d’Horlogerie, a competition for high-end watches.

swissinfo.ch: The Swatch Group expects gross sales of more than SFr7 billion ($7.5 billion) for 2011 and to boost its workforce considerably. Are there no clouds at all on the horizon?

Grégory Pons: Things are going very well at the Swatch Group, there’s no denying that. But there are some problems in the background which could become major ones in the future. Most of the Swatch Group’s growth is in China. But this overexposure could become dangerous if the bubble bursts. We’ve seen what’s happened in North Africa and this might happen in China. It can’t be excluded.

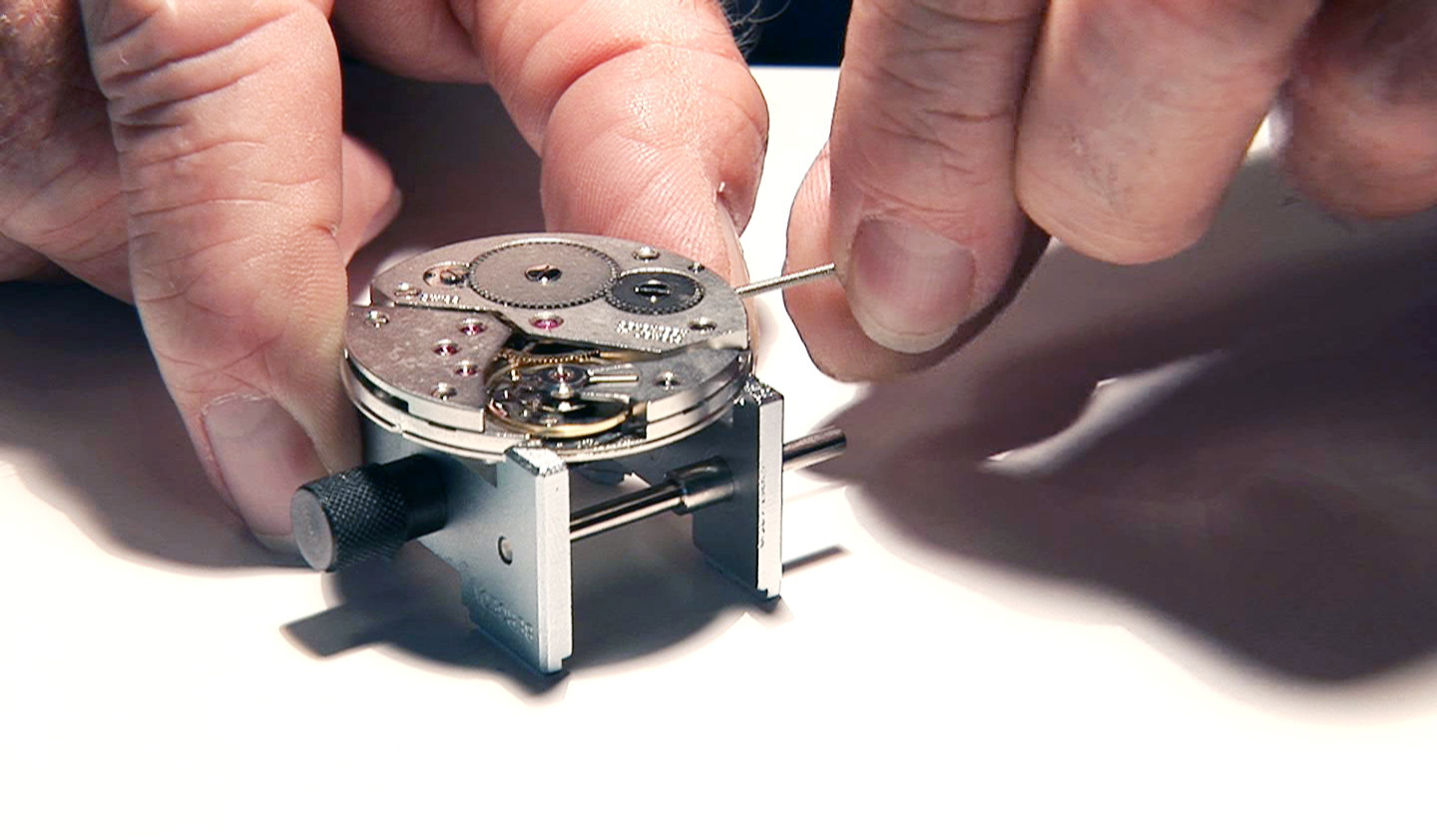

There are also industrial problems. The Swatch Group still maintains a near monopoly on watch movements. But other brands are increasingly developing their own. In the end, the group’s offer will probably become less attractive, even if this is not the most profitable area for the group.

The figures show that the Swatch Group is doing very well. At the same time, there are questions about where it’s going and its strategy. It missed out on Bulgari and almost all the acquisitions in recent years. It’s not such a great market motor any more.

swissinfo.ch: Has the arrival of the second generation of Hayeks, after the death of their father, the founder, had an impact?

G.P.: You can’t really see any changes at the moment. The son and daughter are following in their father’s footsteps. Hayek junior is perhaps a bit gruffer than his father. But there are no fundamental changes in the business.

On the other hand, we can expect more tense relations with other groups. [The world’s largest luxury group] LVMH has become the world number three in watchmaking [after Richemont] after swallowing up Bulgari [announced March 7], making it a major competitor for the Swatch Group. We don’t know how this will develop. This year everyone will be watching everyone else.

swissinfo.ch: The strength of the franc has forced watchmakers to put up their prices. A risky strategy?

G.P.: All the brands have increased their prices by eight to ten per cent, but the watches’ quality hasn’t gone up accordingly. It would have been better to drop prices to adapt them to the weakness of the euro or the dollar. But the brands preferred to reinforce their margins to have a bit of profitability and invest in research and development.

It’s suicidal to raise prices rashly. Consumers are not stupid. They compare prices around the world through the internet and can see if they are being taken for a ride if prices are pushed up automatically by ten per cent. The Swatch Group is average, it hasn’t increased prices by any more – or any less – than the others.

swissinfo.ch: The Swatch Group’s turnover for 2010 rose by more than the watchmaking sector’s average. Why?

G.P.: This is what’s called the market leader’s bonus. The big are becoming even bigger, the small, even smaller. When a market is in crisis, consumers look for reference points and turn to the most important and well-known brands. The Swatch Group rode out the crisis very well, becoming even more dominant.

swissinfo.ch: To almost general surprise, LVMH recently launched an attack on Hermès. Could the Swatch Group also be subject to a hostile takeover?

G.P.: No group is safe. The Hayek family only controls a little over 40 per cent of the shares. There could well be hostile takeover bids, changing alliances among shareholders – those who have about 20 to 25 per cent of the capital, the rest being among the public.

It could well be that Bernard Arnault [LVMH], an unknown Chinese or an investment fund snaps up a large share of the capital and launches a takeover bid on the rest. This would be a real battle. The Oerlikon affair showed that even with a strict family pact, there’s no nut that cannot be cracked.

The best protection for the Hayeks is to keep on going from success to success and to promise SFr10 billion turnover after the SFr7 billion, with profits and dividends. This will help to maintain shareholder solidarity.

Key and sales figures were released ahead of the annual report, including:

Record gross sales of SFr6.44 billion for 2010 – up by 18.8% on the previous year and by 21.8% at constant rates.

Watch and jewellery division sales reached SFr5.53 billion, up by 24.5% on 2009 and higher than the watch industry average of 22.1%.

Net income rose by 41.5% to SFr1.08 billion and the operating profit by 59% to SFr1.44 billion.

The group predicts gross sales of over SFr7 billion for 2011 and intends to invest around SFr300-400 million in production capacities.

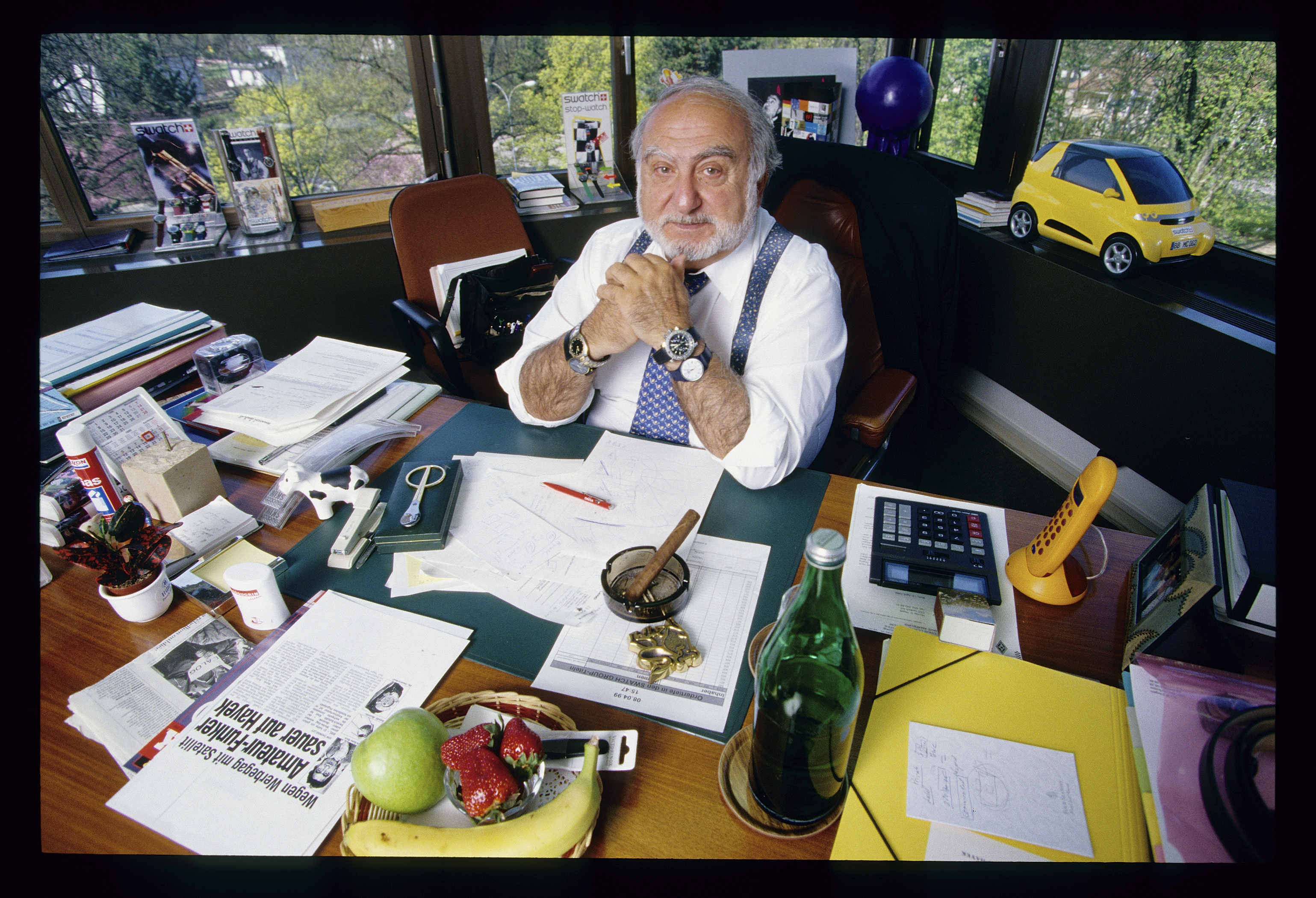

Founded in 1983 by Nicolas Hayek who died in 2010, the swatch Group is the world’s number one watchmaker. Its headquarters are in Biel, in canton Bern. The Hayek family has a stake of around 40 per cent.

The group is made up of 19 watch brands, including Breguet, Omega, Tissot, Longines, Rado, Blancpain and Swatch.

The company says it created 1,600 jobs last year, bringing the number of employees to more than 25,000. It expects to hire a further 1,000-1,500 people this year.

(Translated from French by Isobel Leybold-Johnson)

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.