Low mortgage rates could pose a trap

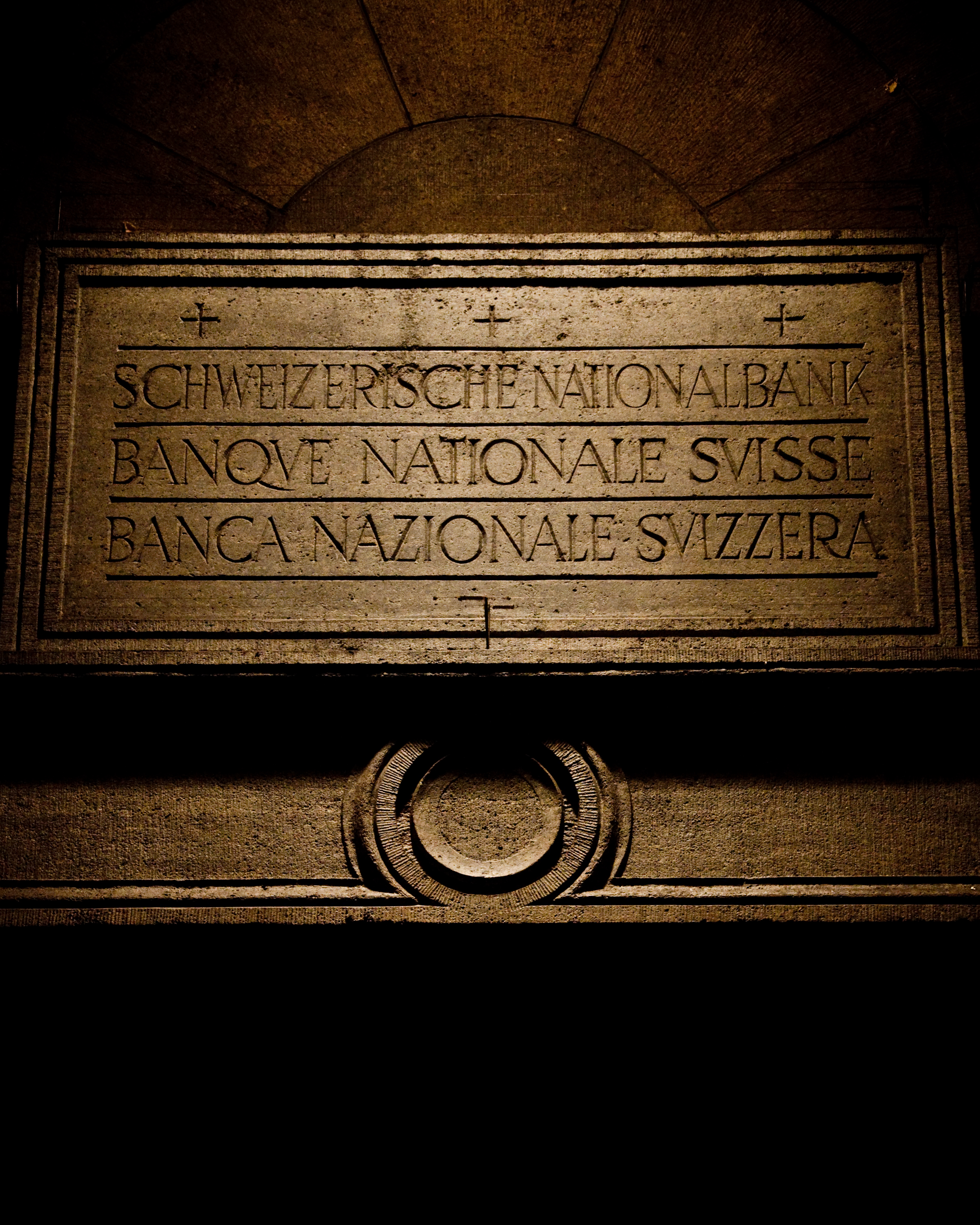

The vice director of the Swiss National Bank (SNB) fears that today’s easy access to mortgages is a trap. In an interview in the Sunday press, Jean-Pierre Danthine said that banks fail to use sufficient caution when granting mortgages.

“For 40 per cent of newly approved mortgages, the rule of prudence is not observed,” Danthine told the SonntagsZeitung and Le Matin Dimanche newspapers – meaning that many of these mortgages wouldn’t be able to handle higher interest rates.

The rule of prudence states that a household must also be in a position to settle a mortgage with an interest rate of around five per cent. No more than a third of the household’s income can be used for this.

In order for banks to cope with the threat of a rise in interest rates through loan defaults, the SNB told them to strengthen their capital bases. For example, last summer they introduced a countercyclical capital buffer. According to Danthine, it is too early to tell whether the braking effect is sufficient to “prevent a hard landing”.

“But we are convinced that it is better to intervene early and gently rather than late and hard,” the SNB vice director said.

Franc ceiling

He also pointed out that the danger went beyond the loss of credit due to households overburdened by higher interest rates. In addition, refinancing of loans by the banks would be more difficult if interest rates rose.

The SNB has projected scenarios to understand the effects of a rapid and steep rise in interest rates on loan refinancing. On average, the negative consequences could be significant, Danthine said – and not just on the banks that rely heavily on loans to finance the capital and interbank market.

He said that even banks that finance mortgages mainly via savings could get into trouble.

“If interest rates rise on the whole, it will be more expensive to maintain the savings than the banks generally believe,” said Danthine, urging the banks not to underestimate the risks of carelessly issued mortgages.

In the same interview, Danthine also said the Swiss National Bank would abolish its franc ceiling once it starts raising interest rates.

“The day the SNB decides to raise rates, there can no longer be a restricting minimum exchange rate. Today the absolute priority is the cap, which we will keep in place as long as necessary.”

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.