UBS French tax evasion appeal: what’s at stake

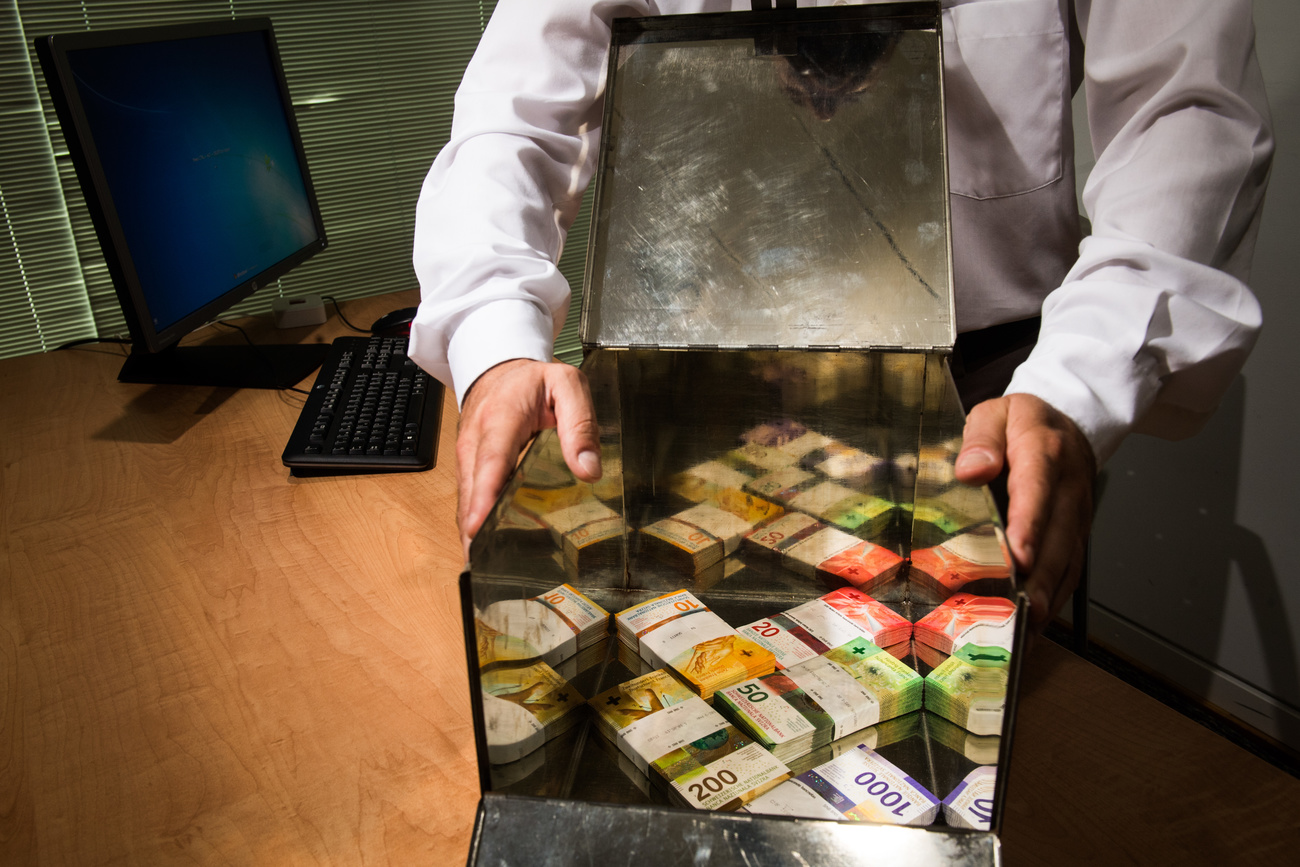

UBS shareholders will be closely watching the bank’s appeal against a €4.5 billion (CHF4.9 billion) tax evasion penalty in France. It is equally of interest to anti-corruption campaigners, who contend that tough sanctions are the only way to clean up the financial system.

In February 2019, a Paris court fined UBS €3.7 billion for aiding and abetting tax evaders and ordered the bank to pay an additional €800,000 in damages. UBS immediately said it would appeal, a case that starts on March 8 and is expected to last more than two weeks.

A main pillar of the bank’s defence is that it was complying with the tax regulations of the day – the European Union Savings Directive, which did not compel banks to hand over client data to other countries. The automatic exchange of tax information between Switzerland and the EU came into force in 2017 – after the offences are said to have taken place.

UBS’s lawyers say the original trial was wrong to state that the bank went out of its way to attract tax cheats and that the verdict was legally flawed.

There are some that think the French prosecution and court verdict were politically motivated. Nicholas Shaxson of the British-based NGO Tax Justice Network agrees, although he sees nothing wrong with this.

“Politicians and voters are getting angrier and angrier about tax evasion and money laundering,” he said. “As a result, I would expect to see more large fines. Sanctions of this magnitude are absolutely essential to stop this type of behaviour. They have not been used often enough.”

The puzzling thing for many people is that dirty money still appears to be rife in the financial system despite the much-hyped death of banking secrecy several years ago. In a recent case, one in eight Swiss banks were suspected to have hidden embezzled Venezuelan funds. Doubts have been raised as to whether Switzerland has either the political will or the legal clout to properly curtail the illicit activities of the financial centre.

“The shortcomings of criminal liability of companies in Switzerland are numerous and considerable,” says Transparency International Switzerland head Martin Hilti. “For the successful fight against corruption and money laundering – and also from a social and constitutional point of view – the current situation in Switzerland is extremely unsatisfactory.”

Other countries have no problems in doling out stringent punishments on Swiss banks. UBS was fined $780 million by the United States in 2009 for tax evasion offences. The US later handed Credit Suisse a CHF2.6 billion penalty, while the storied private bank Wegelin went bust under the weight of a similar prosecution. In the end, Swiss banks were queuing up to admit their guilt and pay damages.

The French fine was limited to just one bank. But it was large enough to anger many UBS shareholders. Months after the fine was imposed, the 2010 annual general meeting refused to discharge the bank’s board of directors and release them from legal liability for their actions.

Shaxson, whose book Treasure Islands charts the history of tax havens, says it is naïve to believe that banks will change their ways of their own accord, even if regulations have become more stringent. “We have seen significant improvements with regards to financial transparency, but banks will continue to look to exploit loopholes,” he said. “The game of cat and mouse will continue with law enforcement agencies. The clampdown on money laundering will not change the essential character of banks but it will affect the nature of how they work.”

UBS continues to insist that there was no legal basis to find the bank guilty of tax evasion offences. It is taking a gamble by persisting with this argument. UBS could afford to ignore the rejoicing of NGOs when the verdict was handed down in Paris two years’ ago. But no company can sustainably prosper with frustrated and angry shareholders.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

Join the conversation!