Cantons join the Left in opposing tax cuts

A planned package of tax breaks which goes to a nationwide vote on May 16 is pitting the Left against the Right, and has divided opinion across Switzerland.

While some see economic benefits from an easing of the fiscal burden on families, property owners and shareholders, others consider the move will mainly benefit the rich.

“Over the past 30 years government spending in relation to Gross Domestic Product has more than doubled. The package of tax cuts is a first step towards stopping this,” said Rudolf Stämpfli, president of the Swiss Employers’ Association.

This view is echoed by Caspar Baader, a member of parliament for the rightwing Swiss People’s Party.

“The tax breaks are a unique opportunity to reduce the level of taxes in this country and ensure that people have more money to spend.”

Baader’s party, as well as the centre-right Radicals and Christian Democrats helped push the proposals through parliament.

They argue that a reduction in federal taxes to the tune of SFr2billion ($1.5 billion) could boost consumer spending and spur economic growth.

Stiff opposition

Opposition to the package comes from two corners. Centre-left groups and many cantons have called a nationwide vote challenging the parliamentary decision.

“Families will not be able to benefit from the tax cuts because parliament insisted on reducing the tax burden on property owners at the same time,” said Simonetta Sommaruga, a Social Democrat senator from Bern.

“It serves no purpose for a society in times of economic stagnation if primarily the richest people stand to benefit from massive tax breaks,” she added.

The opposition led by the Green Party and the centre-left Social Democrats has been boosted by support from many of Switzerland’s regional authorities.

In an unprecedented move, 11 of the country’s 26 cantons helped to force a referendum challenging parliament’s decision.

Struggle for cantons

“It is a matter of life and death for many cantons,” said Emanuel von Erlach, a political scientist at Bern University.

“Many of them have faced severe financial problems over the past decade. Large deficits and a mountain of debts have forced the cantons to cut public spending where it hurts most – in education and the health sector,” von Erlach told swissinfo.

Switzerland’s fiscal system is based on federal, cantonal and local taxes. Any change to federal taxation levels could affect cantons and local authorities, reducing revenues by up to SFr4.4 billion.

“Any reduction in federal taxes would force the cantons to cut spending further or find ways of increasing revenue through a tax rise on a cantonal level,” von Erlach added.

He expects a sizeable number of voters who usually support the parties to the Right to side with the opposition camp.

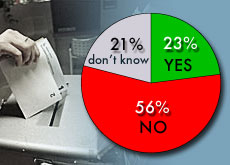

A poll released on Wednesday – the last before the ballot on May 16 – showed 51 per cent of voters set to reject the tax cuts, with only 23 per cent in favour, and 21 per cent undecided.

Von Erlach suggests that the proposed tax breaks would have little impact on most citizens. He also questions whether a lower tax level would necessarily encourage economic growth.

swissinfo, Urs Geiser

The tax breaks are expected to result in a SFr2 billion ($1.5 billion) shortfall in revenue for the federal and cantonal authorities.

The cuts are designed to ease the tax burden on families, property owners and shareholders.

For the first time in Swiss history 11 of the country’s 26 cantons have challenged the proposals in a nationwide vote, alongside centre-left parties.

Opponents argue a possible drop in revenue of SFr4.4 billion could lead to massive cuts in public spending, mainly affecting education and health.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.