Electricity concerns spark lively debate

The term “supply gap” often pops up in Switzerland’s energy debate, but to what extent is this scaremongering and to what extent is there a genuine threat?

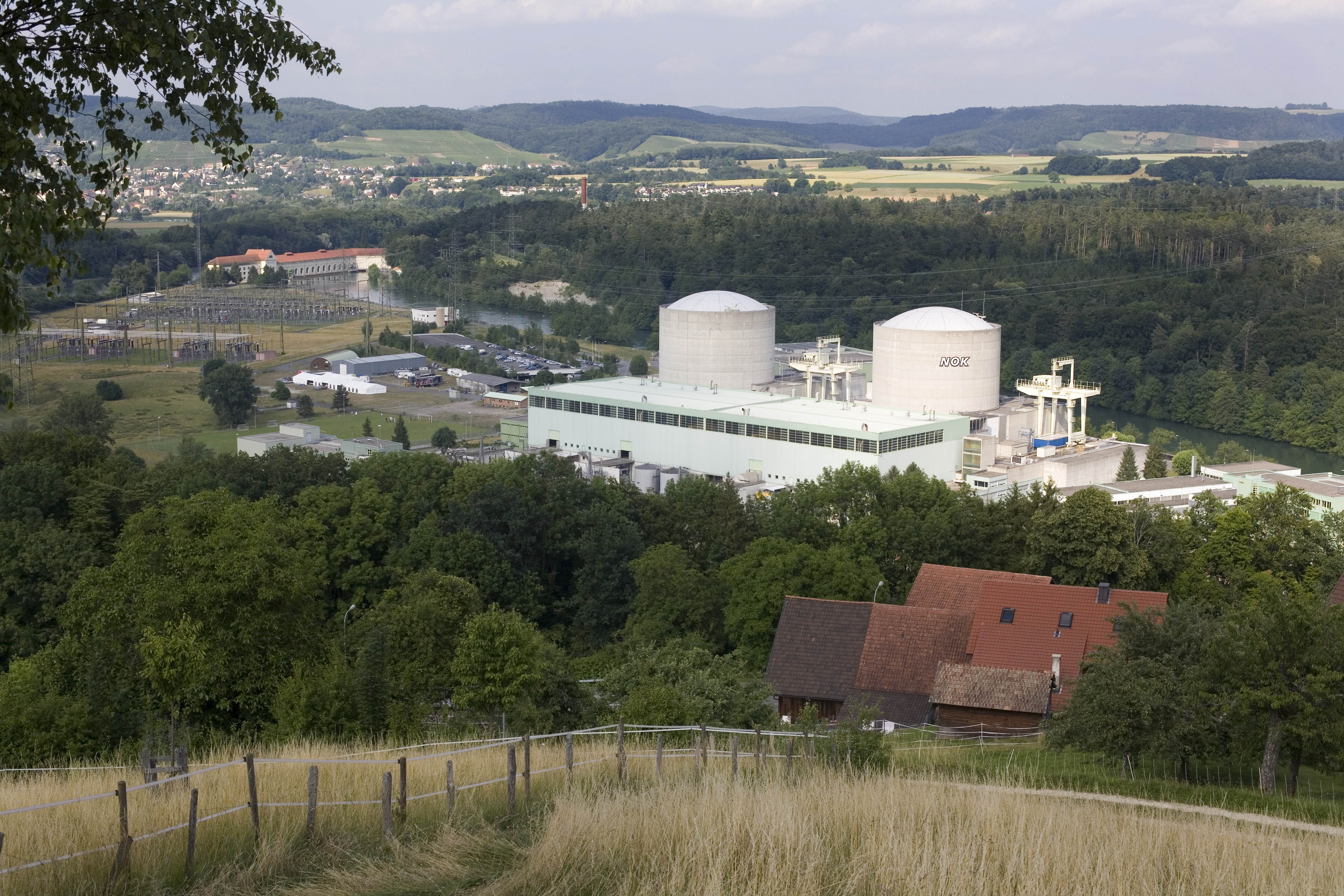

Many people have been asking themselves – particularly since the cabinet’s call on May 25 for the gradual phasing out of all of the country’s nuclear power plants by 2034 – whether liberalising the market will result in the price of electricity going up.

Urs Näf, an energy expert at the Swiss business federation, economiesuisse, points to recent history: three years ago talk about increasing the price of electricity led to a flood of political bills.

“[Electricity prices] went up by ten per cent,” he told swissinfo.ch. “Faced with the gap today, you’ve got to expect them to double or treble.”

Rudolf Strahm, an economist and former national price regulator, also reckons opening up the market would see prices increase.

“Prices have already gone up – in Graubünden and western Switzerland,” the former Social Democrat parliamentarian told swissinfo.ch.

He added that in any case the price of hydroelectric or fossil energy would increase across Europe and around the world – independent of a country’s energy policy –because of the integration of markets and the shortage of energy sources.

Falling behind

Observers are therefore wondering why, despite this market integration in Switzerland, the energy debate is national in focus.

“Because people can begin the internal debate about the national energy sector in the assumption that they can have some effect there. On the electricity industry which is dominated by the cantons and also the public sector,” Strahm said.

Näf explains that the rules for a significant part of the Swiss electricity market are completely different from those in Europe.

Economiesuisse favours all measures for the liberalisation of this market, he says, because when it comes to the opening up of the electricity market, Switzerland has fallen some way behind the European Union.

According to EU regulations, each country is primarily responsible for its energy supply, Näf explains. The new Lisbon Treaty, which entered into force on December 1, 2009, contains an additional law that enables mutual supply in the case of bottlenecks.

However, it does not apply to third countries such as Switzerland.

“Perverse”

Strahm says it is “bordering on the perverse” for an energy debate in Europe to be held at a national level – as is the case in Switzerland.

This mentality had resulted in terms such as supply gap – a term he considers “threatening” since Switzerland has exchanged electricity with foreign countries for many years.

“Depending on the day, we import [electricity] for five minutes when the entire country is watching the evening news and the hydroelectric turbines aren’t yet running up in the Grimsel Pass,” he said.

“Or maybe we need an uninterrupted net import for the three coldest winter months. ‘Supply gap’ is an elastic concept that depends on the measuring methods.”

That said, Strahm doesn’t deny that a gap exists. “Even the term ‘supply’ is technically very difficult to verify. The result is a lot of politics.”

Imported energy

Economiesuisse, on the other hand, has seen concrete evidence of the gap.

“For 40 years power consumption has been constantly growing in relation to demand – despite changing to the latest energy-saving technologies,” Näf said.

But on the supply side no power station has been built for 15 years.

Näf said that as a result, for six months every winter around 15 per cent of supply can no longer be covered internally and must be imported.

This situation is set to continue, he says, since no new power stations look like being built in the near future. “For us, that is the widening power supply gap.”

Industry vs households

Strahm explains that energy prices don’t fluctuate as much as petrol prices “for political and technical reasons”.

“The prevailing feeling is that energy can be controlled a lot better. The producers are here in Switzerland and belong mostly to the public sector. Oil companies on the other hand are global players. In this case the feeling is that any state intervention is hopeless.”

Näf adds that political resistance means raising prices is not easy – consumers would only feel it if prices doubled or trebled, and from economiesuisse’s point of view that was delicate.

“Industry uses 60 per cent of energy in Switzerland. And depending on the power intensity of production, the electricity price becomes a significant factor,” he said.

He points out that abroad industry pays on average considerably less for electricity than private households. Research funds for new energies – in Germany included in the electricity tariff – are reimbursed to industry.

Interim solution

Strahm urges caution. Switzerland is in any case a high-cost and high-wage country, he says, so comparisons with the majority of exporters don’t carry much weight.

“But there remain energy-intensive sectors, where more than ten per cent of the costs go towards energy, for example in the production of paper, cement or steel. Here there is indeed a problem. But how many of these industries have actually stayed in Switzerland? They’ve been outsourced – and not because of the cost of energy.”

When it comes to these sectors, Strahm calls for an interim solution.

“It wouldn’t be absurd for these industries to budget for certain relief, as long as it was only for a limited period of time.”

Switzerland’s electricity supply is secured by approximately 850 companies.

Many of the electricity works in towns and cities are also responsible for supplying water and gas. In some cantons and towns, a single vertically integrated company is responsible for the entire supply chain, while in other cantons a variety of companies share this responsibility.

Roughly 83 per cent of the electricity supply company capital, totalling around SFr5.2 billion, is held by the public sector, while the remaining 17 per cent is held by private companies (in Switzerland and abroad).

In 2009, end-user electricity consumption totalled 57.5 billion kWh, and domestic producers generated a total of 66.5 billion kWh.

Cross-border electricity trading is of major significance for Switzerland, both economically and in terms of supply security. In 2009, 52.0 billion kWh were imported and 54.2 billion kWh were exported. The electricity trading balance for 2009 was around SFr1.5 billion.

Private households, industry and the services sector each account for one-third of Switzerland’s electricity consumption. The proportion of electricity to overall energy demand is approximately 23 per cent.

Hydropower plants account for around 55 per cent of domestic production, followed by nuclear power plants (40 per cent) and conventional thermal energy / renewable energy plants (approximately five per cent).

(Source: Federal Energy Office)

(Translated from German by Thomas Stephens)

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.