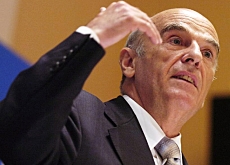

Finance Minister calls for VAT changes

The finance minister, Hans-Rudolf Merz, says he wants to simplify Value Added Tax (VAT) in Switzerland and slash it down to between five and six per cent.

Merz also said he was in favour of withdrawing the country’s request to join the European Union if September’s vote on extending an EU labour accord was accepted.

VAT currently stands at 7.6 per cent, but there are exceptions – for example, the hotel sector only pays 3.6 per cent – and many exemptions.

The minister said that the present VAT system in Switzerland was too complicated and was a heavy administrative burden for small- and medium- sized businesses.

“Nobody can find their way through this muddle where there will soon be 27 exceptions,” said Merz in an interview in the NZZ am Sonntag newspaper on Sunday.

He said that he would present a proposal this winter calling for one single tax rate.

This would mean that the VAT rate would have to be lowered from its present value. “My objective is that Switzerland would soon have the lowest rate in Europe, between five and six per cent,” said Merz.

Boost

Such a move boost Swiss economic growth, he told the newspaper, adding that the changes could be in place by 2008 or 2009.

The minister said he had so far received the support of the hotel sector – which has always strongly lobbied for its preferable rate – which he said made him hope that other sectors would follow suit.

However, Merz admitted that low-income families would likely lose out as household costs could rise slightly but he said this would be compensated.

Previous moves by the government to raise VAT have been rejected at the ballot box.

In a separate development, two political parties have also called for tax changes for companies at their assemblies on Saturday.

The rightwing Swiss People’s Party wants to abolish taxation on companies whereas the centre-right Radical Party, Merz’s party, favours lightening the tax burden.

EU relations

Meanwhile, Merz also commented on Swiss-EU relations ahead of the September 25 vote on extending the free movement of people accord to the ten new and mostly eastern European members of the EU.

Merz said that if the vote was accepted he could envisage Switzerland withdrawing its membership request for the body.

He said that to do this before the vote would have sent out the wrong signal. But Merz didn’t rule out Switzerland reapplying after it withdrew its request.

The minister said that this would have to be accompanied by a “deep political discussion”.

Merz remains convinced that Switzerland should not join the EU and added that he did not consider further bilateral negotiations – which have previously formed the greater part of Swiss policy towards the EU – to be necessary.

swissinfo with agencies

VAT is one of the main sources of income for the government. In 2003 it made up almost one third of the government’s income.

The system is known to be complicated. It is made up of three levels: 2.4% (e.g. medications), 3.6% (hotel industry) and 7.6% (normal rate) and has at the moment at least 25 exceptions.

According to a recent study, companies find it hard to work out the correct VAT level.

The government has around 170 VAT inspectors.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.