Pacifist group slams Swiss investment in global arms industry

Promoters of an investment ban on arms manufacturers say their initiative would help Switzerland boost its international credibility.

A left-wing party and a pacifist group have joined forces to try and restrict the financing of weapons producing companies. The issue will come to a nationwide vote on November 29.

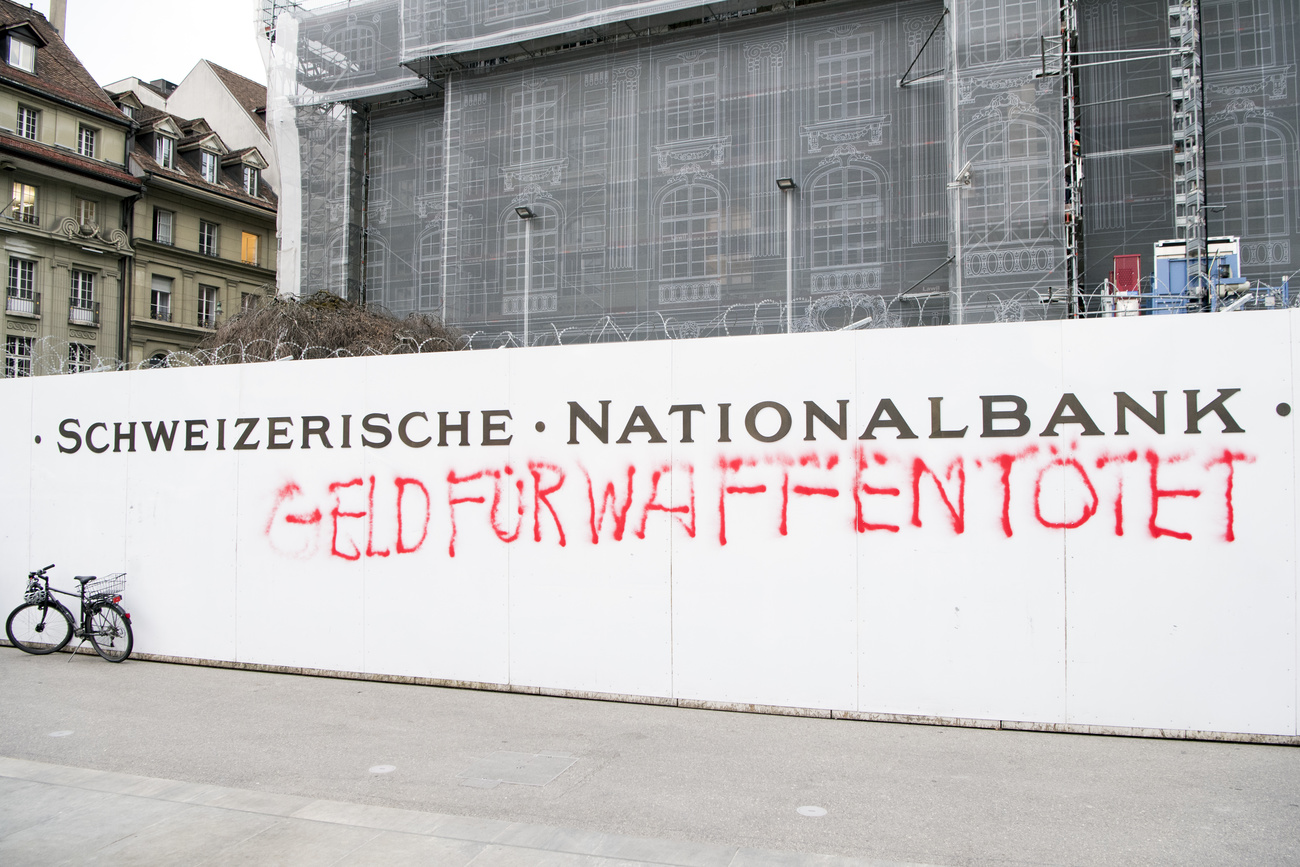

The proposal targets the financing of the global arms industry. It seeks to prohibit the Swiss National Bank (SNB), Swiss foundations and pension funds from investing in producers of war materiel.

Thomas Bruchez is co-secretary of the pacifist Switzerland without an Army group, which launched the initiative. He explains why he advocates more sustainable investments.

swissinfo.ch: Switzerland already has a law outlawing the financing of war materiel. Why do you want to introduce new constraints?

Thomas Bruchez: The current situation is highly unsatisfactory. There is a ban on direct financing, but it only covers the financing of internationally prohibited weapons, that is, nuclear, biological and chemical weapons, cluster munitions and anti-personnel mines.

Indirect funding is excluded only if it is intended to circumvent direct funding, which is impossible to prove.

There is currently no provision preventing the financing of conventional weapons, because there is a reasoning that seeks to distinguish between ‘good’ and ‘bad’ weapons. This is very dangerous, because most human rights violations are committed with small arms. But all weapons are problematic, which is why we need a legal framework to prohibit their financing.

swissinfo.ch: Do you have two examples of Swiss institutions that have invested in manufacturers of war materiel?

T.B.: The Swiss National Bank invests heavily in producers of war materiel. According to figures from the NGO Pax, it is invested $1.3 billion (CHF1.2 billion) in nuclear weapons in 2018. It is also investing more than $2 billion in the US arms industry.

It is even more difficult to obtain figures for pension funds, because there is no transparency. But one can make assessments based on investments in international equities, funds that include arms producers. Our estimate is that between $3.8 and 4.3 billion is invested by Swiss pension funds in war material producers.

swissinfo.ch: Are Swiss institutions’ investments in the arms industry significant on a global scale?

T.B.: The Swiss financial centre is one of the largest and most influential in the world, managing around 25% of the world’s private assets.

A financing ban by Switzerland would therefore have a double impact: given the importance of its financial centre, it would mean a lot less investment in arms producers, and thanks to its influence, a ban would send a signal to the other major financial centres of the world to do the same.

swissinfo.ch: Foundations and pension funds in other countries are allowed to invest in conventional war materiel. Why should Switzerland stand out?

T.B.: It is true that no country has a more restrictive law. But in practice, Switzerland is not the most advanced state when it comes to sustainable investment. There are many large financial institutions that already exclude producers of war materiel.

We need pioneers, and Switzerland is a good candidate because it is neutral, has a humanitarian tradition and seeks a strong international peace policy. By allowing financial institutions to invest in producers of war materiel, Switzerland is undermining its own efforts.

More

Opponents say anti-arms investment plan would hit small firms

swissinfo.ch: Isn’t there a danger that Swiss financial institutions will lose out on returns if they are not free to choose their investments?

T.B.: Absolutely not. Numerous studies show that sustainable investments yield returns that are as good as or even better than conventional investments.

This can be seen by comparing the classic MSCI World index, which includes the world’s leading companies with strong performance, with the ‘socially responsible’ MSCI SRI, which excludes, among others, arms producers.

The sustainable fund has a better performance than its conventional counterpart as well as a better resistance to risks, because during the coronavirus crisis the index for the MSCI SRI lost less than the MSCI World.

swissinfo.ch: Isn’t there a considerable risk that an investment ban will put Swiss producers of war materiel and small and medium-sized companies (SMEs) in difficulties?

T.B.: Swiss law and regulations provide a very clear definition of war materiel: Dual-use goods, both civilian and military, are not listed as war materiel. Spare parts are only considered war materiel if they cannot be used for civilian purposes. This means that the vast majority of Swiss SMEs would not be affected.

The initiative defines war materiel producers as companies that generate more than 5% of their annual turnover from the production of weapons. Even if a company has a product or a large order that is considered war materiel, it is unlikely to account for more than 5% of its turnover.

And in practical terms, even the major Swiss arms producers would not be affected, as they do not receive funding from the National Bank or pension funds.

The impact in Switzerland would be totally negligible, because the text was constructed to affect the international arms industry and the world’s largest producers of war materiel.

More

Proposed investment ban targets armament industry

Adapted from French/urs

Adapted from French/urs

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

Join the conversation!