Swiss industry has learned to live with strong franc

The recent appreciation of the Swiss franc has sent shockwaves through Swiss firms, resulting in job losses and lower research budgets. But viewed long-term, Switzerland’s export-driven economy has adapted remarkably well to a strong currency.

This is the overall conclusion of five studies, commissioned by the State Secretariat for Economic Affairs (Seco), released on Tuesday. They examined the aftermath of the so-called Swiss franc shock, which was triggered when the Swiss National Bank (SNB) ended its longstanding ceiling of CHF1.20 to the euro almost three years ago. That move suddenly made Swiss exports 10% more expensive and cut Swiss economic growth to 0.6% in 2015 from 1.8% a year earlier.

The studies presented on Tuesday however show that the short- and long-term effects of a stronger currency differ significantly. In the short run, the strong franc has been a shock to Switzerland’s export-driven industry, as two studies by the Economic Institute (KOF) at the Federal Institute of Technology in Zurich (ETHZ) show.

The removal of the CHF-euro ceiling in January 2015 led to a 4% reduction in the overall number of employees in an average-sized industrial firm two years after the currency shock. This is not only true for export-oriented firms but also for companies serving national markets, which reported similar falls in employee numbers.

The institute notes that export-oriented firms reacted to the strong franc by slashing R&D and investment budgets: on average, a 17% reduction for a 10% appreciation of the franc. Small and medium-sized firms simply dropped or postponed investment projects, while large global companies relocated investment activities abroad.

However, KOF says in the medium and long term these effects are not so clear-cut.

Got to grips

The other three studies presented on Tuesday suggest that Swiss industry has managed to get to grips with the strong franc. According to a study by three economists at the University of Basel, Switzerland’s economy withstood the crisis “surprisingly well” and the appreciation of the franc had only a small negative impact on exports between 1990 and 2015.

They added the 2015 currency shock, and an earlier one in 2011, had also made the Swiss exporters more resilient.

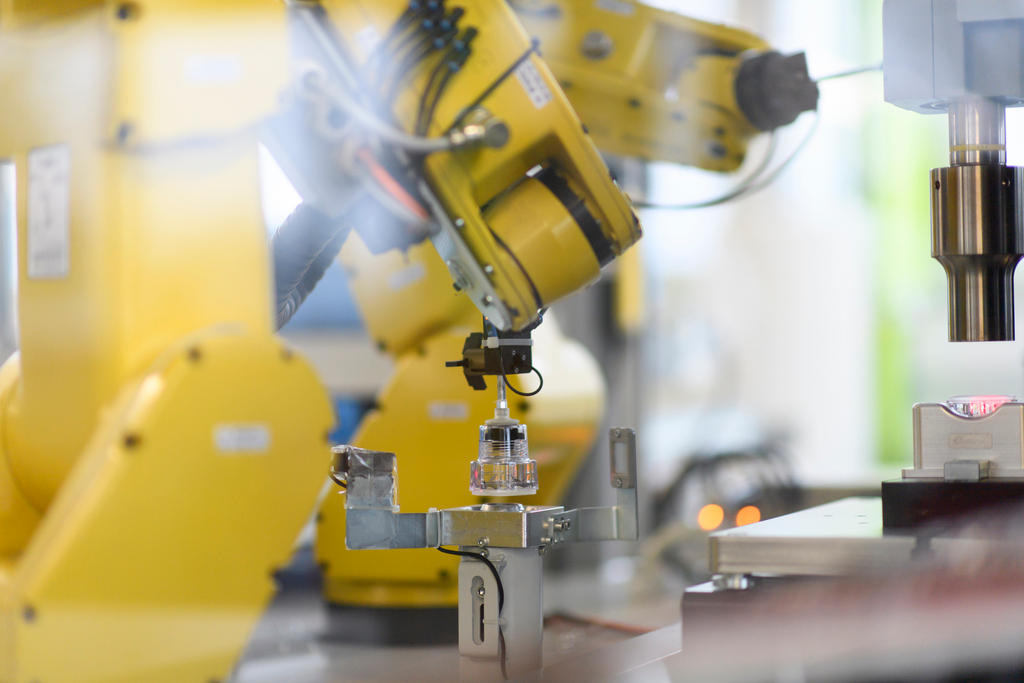

Industry has adapted to the changes and to remain competitive has, among other things, increased product quality, according to a study by the Zurich University of Applied Sciences. It claims that an appreciation of 10% by the franc led to an average improvement in product quality of 1-2%.

It found that sectors with high R&D spending, such as the machine and watch industries, saw significant improvements in quality. The pharmaceutical industry, Switzerland’s driving force, remains an exception; it hardly reacts to short-term foreign exchange movements.

A study by the BAK Economics research institute also suggests that Switzerland’s export industry is highly adaptable.

“The goods exporters in Switzerland are more resilient than in other countries,” they wrote. “But on the other hand, the resilience of the service industry to currency effects is lower.”

Swiss unemployment, which is traditionally low and stable, rose slightly after the franc shock to an average rate of 3.2% in 2015 and 3.3% in 2016, it has since dropped back to 3.0% in September this year.

The SNB predicts growth of just under 1% this year in Switzerland. SECO has downgraded its growth forecast for 2017 to 0.9%. It says it expected GDP growth to accelerate to 2% next year.

New high

Also on Tuesday, the Swiss News Agency reported that the euro had hit a new high in value against the franc since the abandonment of the currency peg in 2015: as of Tuesday afternoon, one euro was worth CHF1.1652. The Swiss currency value has been declining steadily since the summer compared to the euro, which was worth between CHF1.08 and 1.09 in June. This trend somewhat reduces the pressure on the SNB, which nevertheless still considers the Swiss franc to be “significantly overvalued”.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.