Shareholders pay for UBS fightback

Stricken bank UBS faces a struggle to restore confidence and protect its key wealth management business after writing off more than SFr15 billion ($13 billion).

Experts are warning that shareholders will pay the price for a “panic reaction” aimed at keeping wealthy clients happy. The loss also puts chairman Marcel Ospel under increasing pressure.

Switzerland’s largest bank had its fingers burned by the collapse of the American subprime mortgage business that lends to people with low credit ratings. It wrote off SFr4.2 billion in October followed by another SFr11.3 billion this week.

The bank said on Tuesday that it could have absorbed the losses, but chose to raise SFr13 billion in new capital from the Government of Singapore Investment Corporation and an undisclosed Middle East investor to prevent wealthy clients taking their money elsewhere.

But the sale of an 11 per cent stake in the bank on preferential terms, along with the issue of more shares and the payment of dividends in UBS stock rather than cash, has been questioned by one banking expert.

“The Singapore and Middle East investors are getting in at very good emergency conditions and existing shareholders will have to foot the bill,” Manuel Ammann, a professor at St Gallen University’s banking and finance institute, told swissinfo.

“And with the issue of new shares, not to existing shareholders, the profits will have to be shared out even further. It has the traits of a panic reaction”.

Ospel bashing

Despite this, the emergency measures were well received when they were announced on Monday, with shares making initial gains on the news. That suggests that the plan is working, according to Zurich Cantonal Bank analyst Andreas Venditti.

“It is a sign of confidence that UBS has been able to find big investors to give it capital. They took these drastic steps to bolster confidence in wealth management,” Venditti told swissinfo.

Wealth management is the cornerstone of the UBS business model and the bank was desperate that weakened confidence in its investment banking arm did not spill over to its most valuable sector.

The bank manages more than SFr3.1 trillion ($2.6 trillion) in assets and wealth, making it the world’s largest keeper of rich people’s fortunes. It has taken on SFr155 billion in this sector so far this year.

The media have been quick to turn on chairman Marcel Ospel, who wielded the axe on his chief executive, chief financial officer, head of investment banking and 1,500 jobs this year.

Where will it end?

But Ammann believes the initial rising share price signals that shareholders will give him another chance to turn things around with the emergency bailout and promises to tighten up risk management at the notoriously conservative bank.

“Ospel’s position has been weakened and he could get a rough ride at the next shareholders’ meeting. But the stock price reaction suggests that shareholders are looking forward and believe the worst is behind them,” he said.

But with UBS still holding some $29 billion (SFr33 billion) in subprime securities, the end might not quite be in sight.

“The positions are still there even though they have been written down quite substantially. It depends on how far the US mortgage market deteriorates. The expectations a few months ago seemed to be different from what they are today and who knows what is going to happen tomorrow,” said Venditti.

swissinfo, Matthew Allen in Zurich

UBS was created in 1998 from the merger of Union Bank of Switzerland and the Swiss Bank Corporation. Five years later it adopted the single UBS brand for all its major businesses.

The group’s first major acquisition in 2000 was PaineWebber, the fourth-largest securities broker in the United States. This filled a strategic and regional gap in UBS’s wealth management business.

However, the acquisition of hedge funds Long Term Capital Management and Dillon Read Capital Management ended in disaster as both collapsed with crippling debts.

In July of this year, two months after Dillon Read went bust, chief executive Peter Wuffli abruptly departed without clear reason. Following initial details of subprime losses in October, UBS announced 1,500 job cuts in its investment banking arm including senior managers.

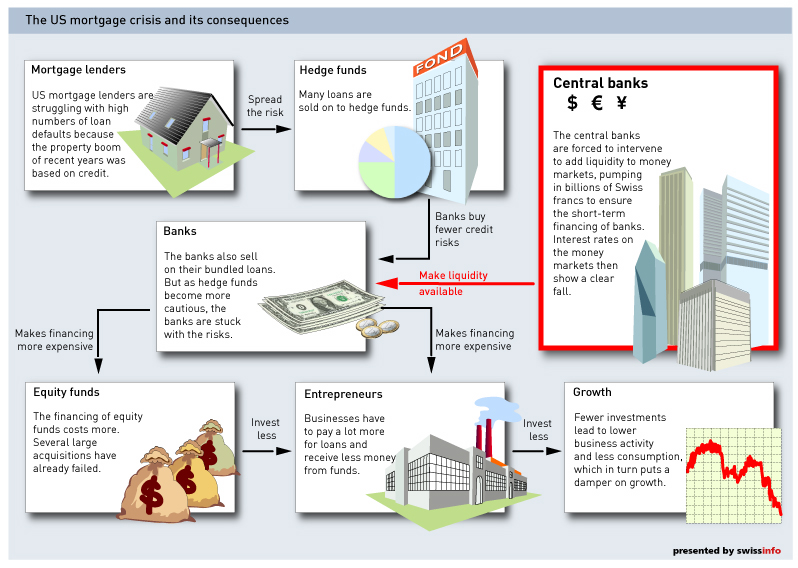

UBS is not the only financial institution to suffer losses as a result of the collapsed US subprime mortgage sector.

Subprime mortgages are housing loans that are sold to people with a little income and a poor credit rating. These mortgages are then packaged together and traded as mortgage-backed securities on the financial markets.

The industry started to show cracks last year when defaults rose and some mortgage lenders, most notably New Century Financial Corporation, went bust. As the problem worsened, it spread to banks that had bought the now worthless mortgage-backed securities.

The worst affected institutions were mainly US investment banks such as Citigroup and Merrill Lynch. But the problem has spread worldwide with an estimated $300 billion of losses expected.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.