Watch industry braces for life without Hayek

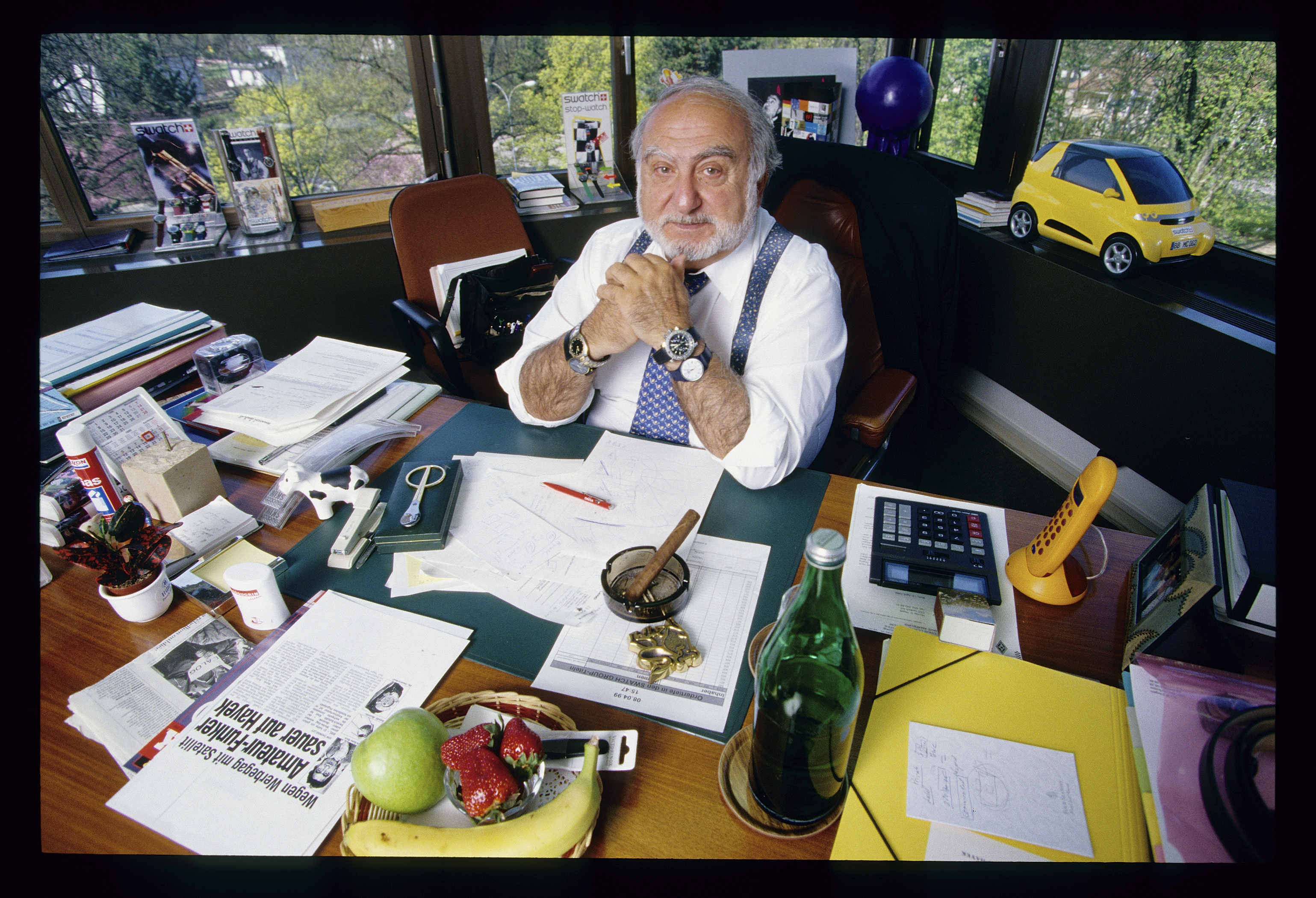

Ever since Nicolas G. Hayek revitalised the Swiss watch industry in the 1980s he has been an iconic figure, but how will watchmakers now fare after his death?

The consensus is that Hayek’s rescue work was complete, putting the industry on a safe footing and his own company, Swatch Group, in a commanding position. But the charismatic innovator might be missed in the event of another crisis.

The Swiss watch industry as a whole appears to have weathered the latest economic crisis with revenues increasing 15.8 per cent in the first five months of this year after a poor 2009. The volume of watches produced is also up 19.8 per cent, representing a healthy growth driven by Asia.

The Swatch Group, Switzerland’s leading brand, also appears to be in fine shape, and the company has stated it expects a record year of financial results in 2010. Profits may have tumbled 8.9 per cent last year to SFr763 million ($703 million), but this was far better than the watch industry as a whole.

Economic journalist Jürg Wegelin, who wrote a biography about Hayek that will hit the shelves in English this summer, believes Swatch will weather the loss of its talismanic founder.

Still in the family

Swatch will largely remain in family hands with 41 per cent of shares being owned by the clan. Hayek’s son, Nick Hayek, took over as chief executive of the group seven years ago while “Mr Swatch’s” daughter, Nayla, is on the board and her son, Marc, also has a senior role at the group.

“[Nicolas] Hayek was so personally connected to the development of the Swatch brand that had he left the company ten years ago it would have been a big problem,” Wegelin told swissinfo.ch. “But now the company has consolidated and I think his son will do a very good job. He took over seven years ago and he now has a lot of experience.”

Swatch shares took a dive to the tune of nearly four per cent on the news of Hayek senior’s death, but both he and his son have always dismissed short term stock market sentiment.

Ironically, financial analysts, another regular source of Hayek’s ire when he was alive, are predicting a rosy future for the company despite the loss of its leader and founder. Bank Vontobel, for example, has maintained its buy rating of Swatch shares because it can see no changes in the successful strategy in future with the company still being run by the family.

Swatch has become so dominant in the Swiss watchmaking sector that many other brands rely on the company’s supply of manufactured parts. According to Wegelin, many rivals also follow on the coat tails of Swatch’s strategic success.

Breaking dependency

But Jean-Daniel Pasche, president of the Swiss Watch Industry Federation, believes the various companies in the sector have long since shrugged off former problems and are quite able to provide for their own table.

“Of course we have lost a great personality and entrepreneur of our industry , but we will be able to continue our development and improve our position in global markets,” he told swissinfo.ch. “I remain quite confident in the future because Hayek’s enthusiasm will remain.”

Hayek himself appeared determined to break the dependency of other brands on Swatch-produced mechanical parts. Last year he announced that Swatch would soon stop providing such a service as the business did not generate enough income.

It is not yet known when this supply line will shut down, but the announcement certainly caused some discomfort for other brands, some of them Swiss. At present, there are not enough alternative suppliers to fill the gap, and Pasche was unable to predict what sort of impact this could have.

Head for a crisis

“A lot of brands already produce their own mechanical parts, but others will have to find other suppliers,” he told swissinfo.ch. “It is important in the future that there are more sources of these parts.”

It is also important that the Swiss watchmaking industry does not slip into sitting back to enjoy its current position of stability, according to Wegelin. Nicolas G. Hayek may have completed his work of saving the Swiss watch industry some years ago, but now it must face new challenges on its own.

“At the moment it is easy to follow the same strategy because it appears to be working,” he told swissinfo.ch. “But nobody knows if in a new situation or crisis there will be anyone else who could be as able as Hayek to find a solution.”

“The Swatch Group has a strategy, but it is vital that other brands do not just follow the flagship without any ideas of their own.”

Matthew Allen, swissinfo.ch

For the Swiss watch industry as a whole, 2009 results declined 22.3% on 2008. But the last two months of 2009, with only a single digit slump, were the first signals of a recovery.

In January, exports increased by 2.7% to SFr976 million ($903 million). In February they rose by 14.2% compared with February 2009 to SFr1.2 billion.

Wristwatches costing less than SFr500 at export price made up the large majority of exports and recorded a rise of 31.6% on February 2009. Exports of watches of more than SFr3,000 only grew by 3.9%. The US market has finally returned to growth, with Hong Kong and China also doing well, but Europe is still lagging behind.

The value of exports in May grew 13% to SFr1.2 billion ($1.1 billion). In the first five months of 2010, revenues had grown 15.8% on last year with the production of timepieces up 19.8%.

Swatch Group suffered an 8.8% decrease in profits last year to SFr763 million, but this was far better than the industry average and exceeded expectations.

Sales picked up in December and this year the company recorded its second best sales of watches for the month of January.

Swatch is expected to record gross sales of more than SFr6 billion this year from SFr5.42 billion in 2009.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.