White-collar crime flourishes as economy dips

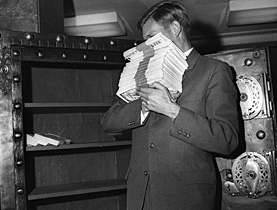

Swiss workers were caught swindling more than SFr1 billion ($860 million) through corporate criminal scams last year, according to court records.

Experts believe the total value of fraud and other economic crimes could add up to five times that amount as the growing global economic crisis places workers under greater pressure.

Audit specialists KPMG compiled their “fraud barometer 2008” by looking at publicised cases of corporate crime that ended up in the courts of Switzerland, Britain, Germany and Spain.

In Switzerland, this included the conviction of a bank director who stole SFr10 million and hid most of it in Tupperware boxes in a forest.

Anne van Heerden, head of forensics at KPMG Switzerland, told swissinfo that approximately 80 per cent of such cases do not make it to court as companies seek to avoid negative publicity. “The results from our court study could be just the tip of the iceberg,” he said.

Last year was the first time the barometer was conducted, so it was not possible to tell if the number of cases had increased. However, separate research has shown a rise in the amount of detected corporate crime.

“I do not believe that the number of cases is growing, but rather the detection rate is increasing,” van Heerden told swissinfo. “There has been a number of big cases in recent years which have forced companies to make more effort with their internal controls.”

Managers more guilty

For example the 2001 Enron scandal resulted in stringent new accounting laws to be enforced in the United States. More recently, the financial sector has been scandalised by the alleged $50 billion (SFr58 billion) investment fraud operated by Bernard Madoff.

Van Heerden added that more sophisticated electronic systems had made it easier for workers to hide money or falsify accounts than 20 years ago. Better methods of monitoring accounts detected a large number of crimes, but some perpetrators gave themselves away by simple mistakes such as using their personal bank accounts to salt away cash.

The deepening economic recession could lead to greater levels of economic fraud, according to van Heerden.

“We could see many more people who are unhappy with their working conditions and greater pressure on others to reach their targets,” he said. “For example, it may become more tempting for a country manager to show better figures than exist in reality.”

Most corporate crime is committed by white-collar workers, according to the barometer – a fact that has been confirmed by previous studies. The KPMG study revealed that managers were responsible for committing SFr606 million of crime last year, more than half the total.

Wild parties

The most common crimes were falsifying accounts or defrauding investors by siphoning money out of funds. People working for financial sector firms and investment advisors committed the majority of offences.

The court records showed that the ill-gotten gains were put to a variety of uses, including gambling, luxury holidays, throwing wild parties and filling the house with expensive appliances and fast cars.

More staid criminals filled their life insurance policies with stolen cash or bestowed endowments on family and friends.

swissinfo, Matthew Allen in Zurich

KPMG found 74 cases of corporate crime appearing in Swiss courts in 2008 – totalling SFr1 billion.

This compares with 98 cases in Germany (€500 million, SFr746 million)), 82 in Spain (€2.8 billion, including one case involving €2 billion) and 240 cases in Britain (€1.4 billion).

More than half of the victims in Switzerland were individual investors (SFr535 million) followed by societies (SFr217 million) and financial establishments (SFr214 million).

Fraud – falsifying accounts and siphoning off money – accounted for SFr630 million of the criminal cases brought to courts.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.