A reinvention that puts a premium on services

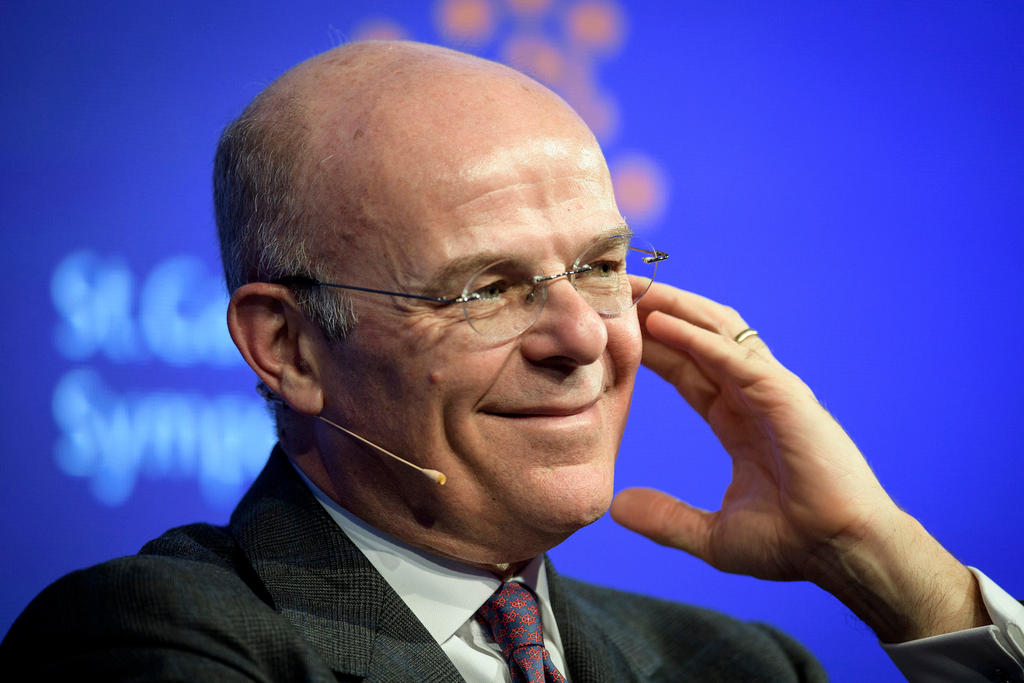

After a challenging few years, Zurich Insurance is redefining its identity. Oliver Ralph and Ralph Atkins meet the new boss.

Zurich Insurance’s lakeside headquarters is just a façade. Behind the original frontage completed in 1901, nothing exists. The company is rebuilding it from the ground up.

Mario Greco, who took over as the Swiss group’s chief executive last year, believes the global insurance business is about to go through a similar refit.

“The industry is on the verge of a profound change,” says the 58-year-old Italian. “I pretty much bet on the fact that it won’t look the same at all, definitely in 10 years, but most likely in five.”

In the past, he says, insurance was the ultimate “push” product – people only bought it if someone sold it to them. In the future, he believes insurers will have to build a closer relationship with their customers to survive.

Interviewed at the company’s temporary headquarters in a back office across town, Mr Greco says he wants to turn Zurich into a company that can build that sort of connection with his customers. In short, he wants to give the company “a new identity”.

Mr Greco studied economics in Rome and started his career at McKinsey in Milan. But he is a Zurich veteran. He spent five years at the company before 2012, leading both its life insurance and general insurance businesses. He left to lead a turnaround at Italian insurer Assicurazioni Generali by selling unwanted businesses and cutting debt, but he returned to Zurich last year after his contract in Italy was not renewed. Mr Greco is reluctant to go into the reasons why, saying only that he respects the shareholders’ right to make decisions about management.

More

Financial Times

External linkWhile he was away, Zurich – Europe’s fourth-largest insurer by market capitalisation – went through a rough patch. Underwriting problems in its US division in 2015 and general insurance losses elsewhere forced it to drop a putative £5.6 billion (CHF7.3 billion) bid for UK insurer RSA, and the share price fell sharply. Zurich’s then chief executive, Martin Senn, departed in December, and took his own life six months later. In a statement, the company said he was “not only a highly valued former CEO and colleague but also a close friend”.

Mr Greco returned to Zurich in March 2016, to an organisation where the business problems faced in 2015 had dented morale. “People think highly of the company,” he says. “2015 was a bad year but people wanted to strike back and show they are strong.”

Mr Greco says Zurich made a “very relevant mistake” in 2013, when it committed to a growth strategy that undermined its reputation for strong underwriting and caused costs to balloon.

But Mr Greco insists – several times – that he does not see Zurich as a turnaround. Wearing a tie on a swelteringly hot day, he affects modesty. “I’m just bringing back the consistency between the strategy of the company, the priorities of the company and the skills and the way we act. We’re not going for growth now, we’re going for profits, which is what a company such as Zurich should always do.”

It might not be a turnaround, but Mr Greco has had to take remedial action, for example getting rid of the complex “triple matrix” structure under which the company was organised along geographic, product and functional lines, leaving staff uncertain as to who exactly was in charge.

“We’re simple people, all of us. Geographies are the things that we all understand. They have different languages, they have different regulations…You can’t abolish that.” Zurich is now organised only by geography, he says.

He has overhauled the management and is planning to cut $1.5 billion (CHF1.5 billion), or 15 per cent, off the company’s cost base between 2017 and 2019, under a strategy unveiled last November. The company has not said how many more jobs will go as part of the process.

More fundamentally, though, he wants to rebuild the way that Zurich deals with its customers. “The identity I’m trying to give the company is to be the first [insurer] known to the customers for services,” he says.

“Not every customer will go after us. Zurich…will never be a trading company that wants you for one year and then you can go. We want to develop long-term relationships.”

In practical terms, that means fixing problems as they arise, rather than simply collecting premiums once a year and writing out cheques when necessary.

“We would rather be the company that will try to fix your bumper, to give you a courtesy car, and to give a guarantee for the work,” he says. “If you just want somebody to pay you cash, you might find some other companies doing better than us.”

Cover-More, acquired for $500 million this year, is a move in this direction. The Australia-based travel insurer offers extra services – for example, customers who fall ill while away can consult a doctor in their home country before seeking local treatment. “Cover-More is not an insurance company,” says Mr Greco. “It is a services company.”

There could be similar acquisitions as Mr Greco seeks to add more fee-earning services to Zurich’s portfolio. But he is cautious about M&A: “You often don’t need anything in another insurance company because what you get is another set of undifferentiated services and a bunch of clients who don’t know exactly why they purchased the services of that company.”

RSA, he says, would not be a good asset to buy now, although diplomatically he adds that his predecessors might have had a different logic.

It is clear that Mr Greco is happy to be back in Switzerland. Last year, Zurich’s operating profits rose 55 per cent to $4.5 billion. He wants to move fast: “This is a gigantic time of change for the industry and there will be winners and losers. This is not going to be neutral.”

Zurich’s new office (an “interplay of old and new”, according to the company’s blurb) is expected to be finished by 2020. When it is completed, Mr Greco says, “I don’t think that building will find the same industry.”

Second opinion: the analyst

Andrew Ritchie, an analyst at Autonomous Research, says Mario Greco is well respected for his work at Generali and brought “the company into line with its peers in terms of performance management”, he says.

Investors welcomed his return to Zurich. “He’s regarded as very focused but I wouldn’t say investors describe him as warm and cuddly. He’s no-nonsense,” says Mr Ritchie, adding: “The jury is still out on how much improvement he can drive at Zurich.”

Copyright The Financial Times Limited 2017

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.