Swiss firms more innovative than ever

Swiss companies have been ranked the most innovative in Europe in surveys, dispelling the myth that the country's ideas often fail to find commercial success at home.

Switzerland climbed one place to top the European Innovation Scoreboard issued by the European Union this week. And research by the KOF Swiss Economic Institute reveals that innovation really does translate into cash.

The EU’s annual comparison of innovation in the continent showed Switzerland outperforming 32 other countries after displaying strong growth in ideas and application during 2009.

The report praised Switzerland for not losing steam during the economic recession, unlike many neighbouring countries. Switzerland’s traditional strength in patents remained unchecked and also scored high marks for the quality of its work force.

The accolade mirrored Switzerland’s elevation to top spot on the World Economic Forum’s global competitiveness report last year. A high capacity for innovation was also recorded as a Swiss strong point.

Switzerland has been known for a long time as a country of innovation, but it has also been frequently criticised for failing to cash in on the full commercial potential of its ideas. The long-standing argument is that the Swiss are not pragmatic or entrepreneurial enough to successfully sell their ideas, in contrast to peers in the United States for example.

Japanese steal a march

However, recent research by KOF has turned that idea on its head by showing that Swiss firms generate a higher percentage of their sales through innovative products and services than any other European country.

The theory was fuelled further in the 1960s and 1970s when Japanese firms cashed in on Swiss research into quartz watches.

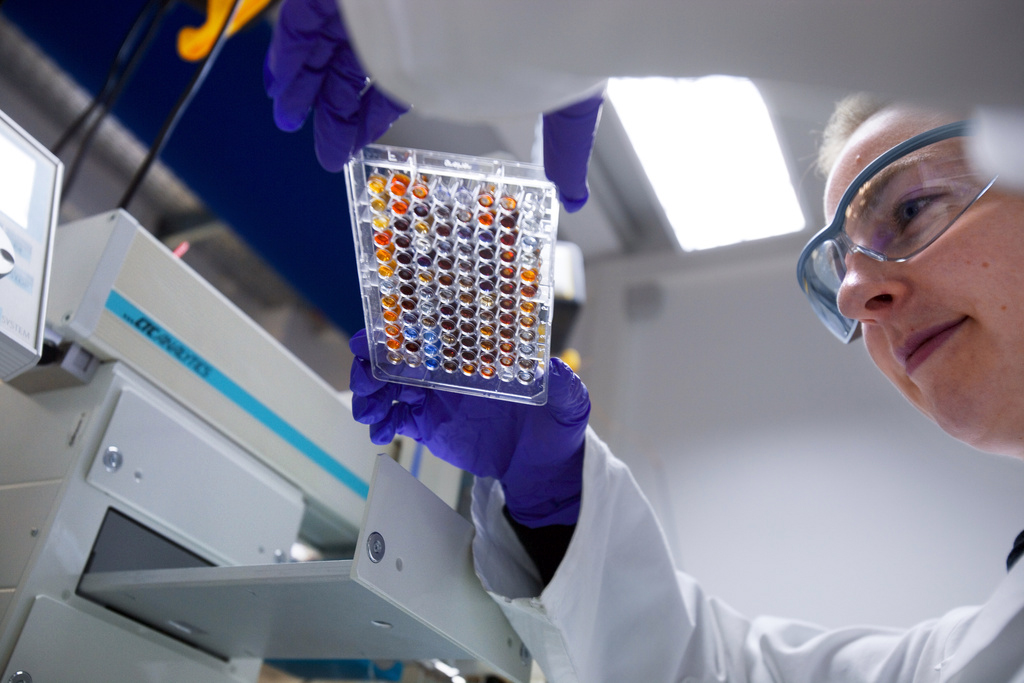

KOF innovation specialist Spyros Arvanitis pointed out that many Swiss firms in such fields as pharmaceuticals, machinery, chemicals and finance are internationally recognised for their original products and services.

The perpetuating myth that ideas do not make it onto the market in Switzerland now largely revolves around higher education research, he said.

“The argument that many good ideas do not get commercialised is more a point for universities,” he told swissinfo.ch. “Companies are not known for coming up with inventions that do not find a commercial application.”

Innovation before foreign arrivals

Swiss universities are also tackling this problem. Zurich’s Federal Institute of Technology ETH produced 25 spin-off start up firms last year compared to 10 in 2003.

Another commonly held perception is that the recent arrival of foreign firms to sample Switzerland’s low corporate tax rates has raised the bar of innovation. But US internet giant Google has long protested that it was more interested in the high quality of universities and the workforce than tax breaks when it set up its research centre in Zurich.

Claudia Magri of the Greater Zurich Area business promotion agency also argued that existing innovation capacities helped attract firms rather those newcomers creating innovation when they settled in Switzerland.

“The arrival of well-known brands helps in raising awareness and attracting more companies of a particular industry, but these companies ultimately came here because the Greater Zurich Area offers a high degree of innovation in their field,” she told swissinfo.ch.

“They find the right environment for advancing their core business, for example through collaboration with research institutes, academia and highly skilled professionals.”

Recession brakes innovation

However, Switzerland suffers from the same negative innovation cycle as other countries during hard times. Economic theory dictates that firms should devote more time to research and development during recessions than at any other time to help them out of the trough.

Government statistics show that companies spent a record SFr12 billion ($11.35 billion) on R&D in 2008. But researchers did not expect this increase to be sustained when the problems of the financial crisis hit the real economy.

A European Union survey conducted in April 2009 found that 23 per cent of firms had already cut R&D spending as a result of the recession while 29 per cent expected to do so in the near future.

Switzerland is expected to follow suit, according to Arvanitis. “The capital resources of companies shrink during a recession and it is precisely these resources that fund innovation,” he told swissinfo.

Matthew Allen, swissinfo.ch

The KOF Swiss Economic Institute surveyed 6,000 companies in a number of countries to gauge the innovation capacity of Swiss firms.

One of the questions they were asked was what percentage of their sales turnover was generated by innovative products or services.

In manufacturing, Swiss firms said products that were new to the company accounted for 17.9% of sales, while innovations new to the market generated 16.6%

This compares to 13.3% and 12% in Britain, 7.7% and 11.2% in the Netherlands, 6.2% and 17.6% in Finland and 15.4% and 14.1% in Germany.

Innovative Swiss services new to the company accounted for 14.3% of overall sales while those that were new to the market were responsible the same sales volume.

In Britain the figures were 14.1% and 9.4%, in Italy 7.5% and 7%, Austria 8.9% and 6.2% and 7.3% and 6.4% in Germany.

The conclusion drawn by KOF was that Swiss firms were better able to commercialise innovation than a range of European competitors.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.