Recession fails to dent Swiss innovation drive

Companies continued to pour money into research and development (R&D) in Switzerland despite a global downturn that hit exporters particularly hard.

Official figures showed spending in Switzerland reached SFr12 billion ($11.24 billion) in 2008, up 24 per cent on the boom year of 2004. Swiss firms also spent SFr15.8 billion abroad, up 64 per cent in the same period.

Measured as a percentage of total economic output, or gross domestic product, Switzerland stands sixth in the international R&D league table with expenditure reaching 2.2 per cent of GDP.

Using this comparison, Swiss-based firms invest more of their profits into developing new products and services than the United States, Germany, France and a host of other larger economies.

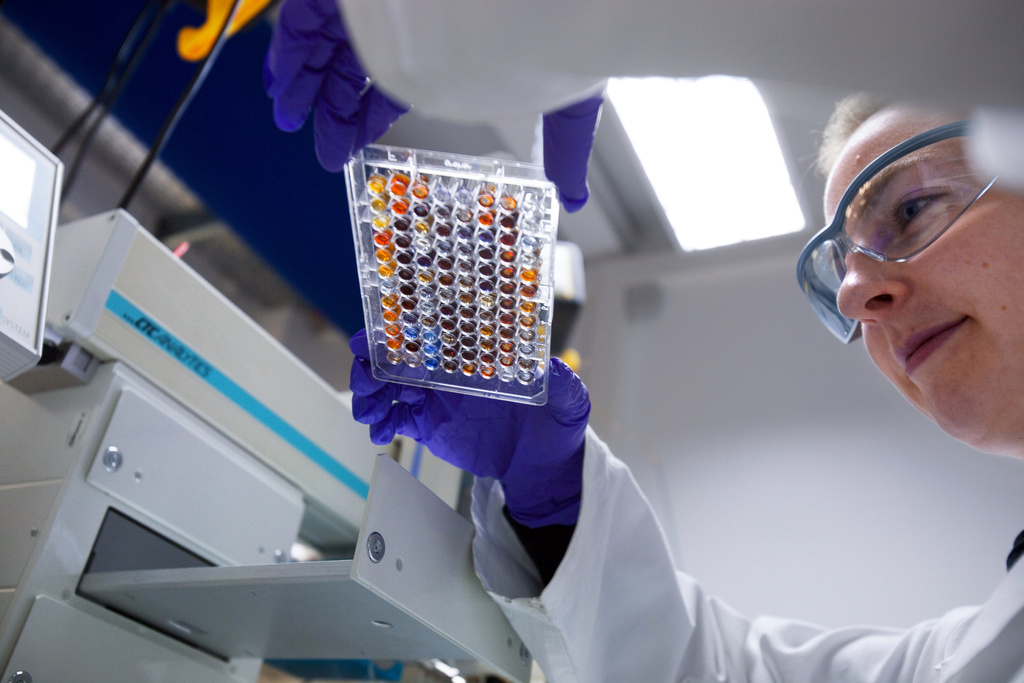

The phenomenon is not new in Switzerland and has traditionally been led by its large pharmaceutical industry. Pharmaceuticals, most notably Roche and Novartis, made up more than a third of all private sector R&D spending with an outlay of SFr4.6 billion in 2008.

However, investment in innovation is ingrained into the Swiss entrepreneurial landscape with many small and medium sized enterprises (SMEs) also putting cash into this activity. Switzerland currently stands top of the World Economic Forum global competitiveness report thanks in part to this commitment.

Far sighted strategies

“Switzerland has not been so badly hit by the economic crisis than other countries and most firms are financially sound and pursue long-term strategies,” Silvio Borner, professor of economics at Basel University, told swissinfo.ch.

“Many companies have cut back costs and asked employees to work shorter hours, but they have not cut back on research budgets.”

Switzerland’s status as a prime location for foreign companies has also undoubtedly helped to boost the figures. Global giants such as Google and Kraft have recently set up or expanded Swiss operations, lured by low tax rates, access to skilled labour and high living standards.

Borner hoped that the recent spat between Switzerland and other countries over tax evasion would accelerate that trend by highlighting the liberal attitude of the Swiss tax authorities.

“Corporate tax rates are lower in Switzerland than many other countries, but it is equally important that the Swiss tax authorities are much more reasonable and treat companies like partners,” he said.

The Federal Statistics Office figures show Swiss companies increasing their investments in R&D projects abroad. The 64 per cent increase in foreign R&D facilities since 2004 could be reflected in the growing number of overseas acquisitions in recent years.

For example, Roche last year completed the takeover of San Francisco-based biotech company Genentech.

International squeeze

Rudolph Minsch, economist at the Swiss Business Federation economisuisse, believes intensified competition from developing economies, particularly in Asia, has forced the hand of global Swiss players.

“The investments abroad have not cannibalized the expenditure in Switzerland, but effectively show a trend towards globalization in the research sector,” he said at the unveiling of the statistics.

“International competition has been notably strengthened also in this sector in the past few years, putting pressure on the Swiss economic centre. Several European countries and some Asians ones, in particular China and Singapore, have put a strategic accent on research and have improved their framework conditions for attracting foreign companies.”

Minsch urged Switzerland to match this competition by increasing spending on education and relaxing rules on setting up limited companies and hiring non-European staff.

“The bilateral accords with the EU on the free movement of people have been fundamental in guaranteeing an influx of qualified workers. But the Swiss economy needs more and more specialists coming from other continents to guarantee the future of research in some sectors,” he said.

Matthew Allen, swissinfo.ch (With input from Armando Mombelli)

Companies in Switzerland spent SFr12 billion on research and development in 2008, a rise of 24% – or SFr2.3 billion – from the boom year of 2004.

In the year 2000, R&D spending in Switzerland was a comparatively miserly SFr7.8 billion.

In 2008, pharmaceutical companies invested SFr4.6 billion in R&D projects in Switzerland. Those firms involved in communications technology spent SFr2.3 billion, machinery SFr1.4 billion and chemicals SFr643 million.

As a proportion of GDP, Swiss R&D investments totaled 2.2% (2.1% in 2004).

This places Switzerland sixth in a comparative international league table.

Israel leads the way with 3.7%, followed by Japan (2.7%), Sweden (2.6%), South Korea (2.6%) and Finland (2.5%).

The EU average is 1.1%, the US weighs in with 1.9%, Germany 1.7% and France 1.3%.

The number of people employed in R&D in Switzerland rose 20% from 2004 to 39,832 employees by 2008.

Swiss companies increased R&D spending abroad by 64% in the same period to SFr15.8 billion.

Such expenditure weighed in at SFr9.6 billion in 2004 and SFr9.7 billion in 2000.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.