Ailing disability insurance hopes for tax boost

The campaign over a proposed tax increase to prop up the state-run disability insurance scheme is slowly gathering pace ahead of a nationwide vote.

Most political parties, the government as well as various organisations and pressure groups have come out in favour of a 0.4 per cent hike in value added tax (VAT). The rightwing Swiss People’s Party is up against an overwhelming alliance on September 27.

Over the past two weeks several small political parties, the farmers’ association and organisations for the disabled all issued statements recommending voters approve the proposal.

On Friday a group of mainly retired politicians of the People’s Party became the latest committee to outline its reasons against the increase.

In line with their party they slammed the planned temporary fiscal charge as a “false and dangerous compromise” which jeopardised the financial future of the state old age pension scheme – another tenet of the Swiss social security system.

The reason being that the proposal includes an injection worth several billion francs from the pension scheme into the disability insurance.

The rightwing party earlier warned that raising taxes would slow private consumption and put a financial strain on families.

“An increase is poison for the purchasing power of consumers,” parliamentarian and businessmen Peter Spuhler argued at a news conference in June when his People’s Party launched its campaign.

VAT is currently 7.6 per cent, with reduced rates for the hotel industry and for essential consumer goods.

Opponents also claim money could be saved by cracking down on fraudsters, notably beneficiaries of Turkish and East European origin, who allegedly cheat the Swiss authorities by faking mental illness.

Solidarity

However, supporters of the tax increase, limited to seven years, stressed the importance of disability insurance both for individuals and for the country’s social security system.

“It is a question of solidarity and of reason,” said Silvia Schenker from a health umbrella group and member of the centre-left Social Democratic Party.

The centre-right Christian Democratic Party and the Radicals said rejection of the tax increase could endanger a political solution.

“We are no longer able to help those in need if the disability insurance is in trouble,” said Christophe Darbellay, president of the Christian Democrats.

Consequences

For its part, the government warned of serious consequences for social security if the proposed plan was voted down.

“It means only an extra four francs in taxes on every thousand francs,” said Interior Minister Pascal Couchepin.

“It is a crucial vote for our social security system. I’m confident that we can win it because we have convincing reasons. I count on parties, organisations and voters to act rationally.”

The disability insurance scheme makes annual deficits of SFr1.4 billion ($1.3 billion) and has run up SFr13 billion in debts.

Delays

Initially the government set the vote for May but decided to postpone it amid concerns by the business community that the global economic downturn risked undermining the chances of approval.

Later the government and parliament also put off the date for the implementation of the planned tax increase. It will take effect in 2011 – instead of 2010 – if approved by voters.

Small and medium-sized enterprises (SMEs) had argued there was not enough time to adapt to the changes by the beginning of next year.

Three weeks ahead of the nationwide vote the campaign has picked up with billboard posters in the streets and advertisements in newspapers.

But even so, experts expect voter turnout to be below average on September 27, with the public more interested in the election of a new cabinet minister by parliament on September 16.

Urs Geiser, swissinfo.ch

On September 27 voters will also decide on the scrapping of the so-called general people’s initiative.

The special voting right was introduced only six years ago, but has never been applied since, apparently because it is incompatible with the Swiss parliamentary system.

Ballots also take place on a local and cantonal level on a number of issues.

Voters will have the final say on a proposed 0.4% increase on VAT for seven years to shore up the ailing disability insurance scheme.

The state-run insurance was set up in 1960 and is aimed at integrating disabled people into society.

It is one of the tenets of the social security system, including the old age pension scheme, the unemployment insurance and welfare payments.

The disability insurance has undergone five reforms since its creation and further changes are already under discussion in parliament.

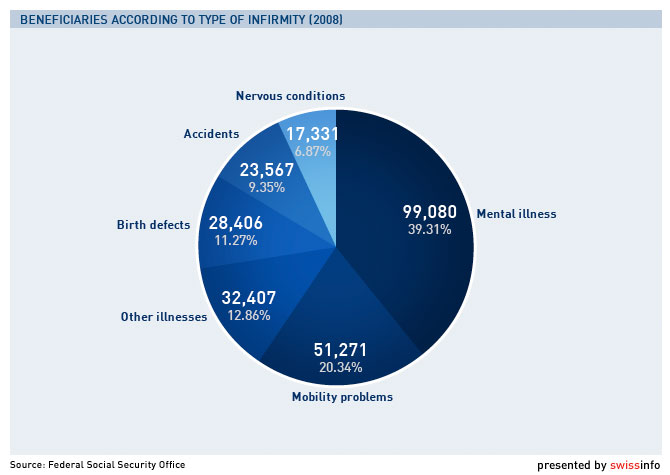

About 300,000 people receive payments from the disability insurance scheme, including 40,000 who live abroad, mostly in European Union countries. Some 4,000 beneficiaries live in Turkey and countries of the former Yugoslavia and have been targeted by critics as potential insurance fraudsters.

VAT in Switzerland is currently 7.6% with reduced rates for the hotel industry and essential consumer goods.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.