Government wants to create rules for foreign takeovers

The takeover of Swiss companies by foreign state-owned or state-linked funds is to be better regulated. The government has laid down the broad outlines of a foreign investment control system.

Concerned about the international trend of company takeovers, parliamentarians adopted a motion in March 2020 to protect the Swiss economy.

More

Swiss firms to be protected from foreign investors

However, the government believes that the cost-benefit ratio of an investment control is unfavourable and that the existing regulations are sufficient.

“The open policy towards investments from abroad is of central importance to Switzerland as a business location and thus also for the prosperity of the population in Switzerland,” the foreign ministry said in a statementExternal link on Wednesday. “This policy ensures a sufficient inflow of capital and knowledge for Swiss companies and thus contributes to value creation and the preservation and creation of jobs.”

Switzerland’s openness and attractiveness to foreign investors must therefore be maintained, it said.

Threats

The proposed measures are intended to control possible threats to order or security. Accordingly, all takeovers by foreign state-owned or state-linked investors will have to be declared and approved, regardless of the industry. The State Secretariat for Economic Affairs (SECO) will be responsible for implementing the controls.

The areas in which a mandatory notification and approval regime applies in the case of takeovers are still to be determined. One issue will be whether a Swiss subsidiary of a foreign group of companies is to be considered a domestic target company.

The new rules should also prevent major distortions of competition if state-owned or state-linked foreign investors acquire Swiss property, according to the foreign ministry.

The government’s concerns include the failure of a company that provides an essential service, the dependence of the Swiss army on suppliers of essential weaponry, the dependence of government departments on suppliers of IT security systems, or the leakage of particularly sensitive data.

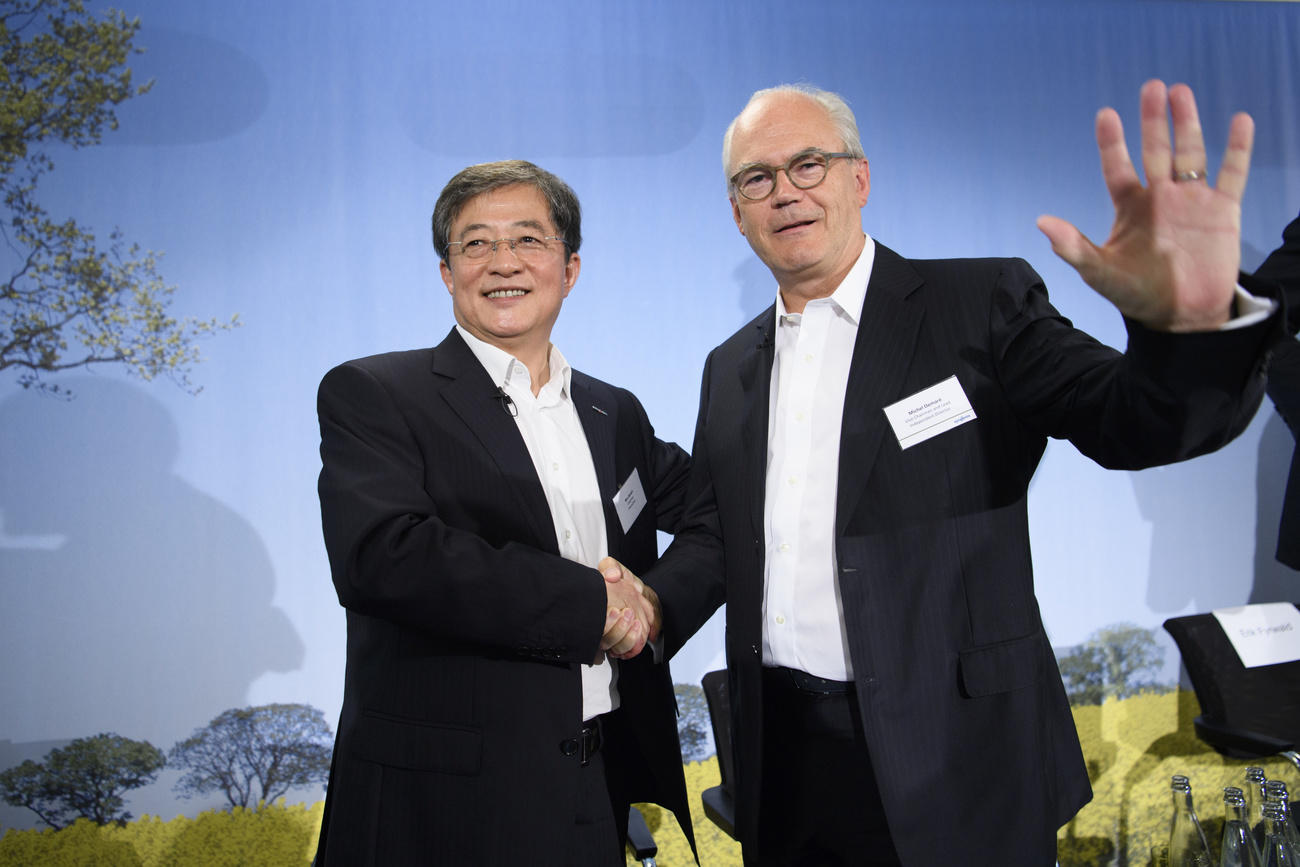

The motion was prompted by the takeover of the agrochemical firm Syngenta and airline catering business Gategroup by Chinese companies in 2016.

A draft of the government outlines of a foreign investment control system is expected to be put out to consultation at the end of March 2022.

More

ChemChina buys Syngenta in record Chinese deal

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.