Government raises bar for pension funds

The government has decided to raise the minimum rate of return on mandatory occupational pensions to 2.5 per cent from next January.

The 0.25 per cent rise has been met with mixed reactions from trade unions and the Centre-Left, as well as the insurance industry.

Announcing the increase on Wednesday, the interior ministry said the government had noted the recovery in the financial markets over the past 12 months and new profitable investment opportunities.

The cabinet also took into account the tight financial situation of many occupational pension funds.

A recent report said some Swiss pension funds, especially in the public sector, were still struggling to provide full financial coverage for occupational pensions.

But the number of funds suffering from a lack of cash fell from 45 per cent in 2002 to 25 per cent last year.

Mixed reactions

All the four main political parties welcomed the rise in the minimum rate.

However, the centre-left Social Democrats and the trade unions expressed disappointment that the rate was not set higher at 2.75 per cent.

They said the 0.25 per cent rise was not going to make much of a difference to those paying into company pension funds.

“Der Bund” newspaper suggested that it would amount to no more than an extra SFr4 a month for the average 40-year-old wage-earner – the price of a cup of coffee.

The centre-right Radical Party and the Christian Democrats, as well as the rightwing Swiss People’s Party, called for a change in the system, saying the rate should not be determined by politicians but by the markets.

The Swiss Insurance Association criticised the rate increase as a step too far. It said only a minimum rate of 2.1 per cent would allow for full cover of current pension claims.

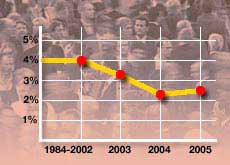

From 4.0 to 2.25%

In 2002 the government cut the minimum rate to 3.25 per cent from 4.0 per cent, amid protests by trade unions and employees.

Last year the cabinet reduced the rate by a further 1.0 per cent in a bid to ease the load on the country’s beleaguered insurance companies.

The occupational pension system is part of a three-tier system for pensioners in Switzerland.

The first pillar is the state old-age pension scheme, while the third pillar is made up of private pensions.

Company pensions are mandatory for every employee in Switzerland. They are funded jointly by contributions from employers and workers.

swissinfo with agencies

The minimum rate of return on company pension funds is to increase to 2.25% next January.

The government decision has prompted mixed reactions.

The mandatory occupational pension scheme is part of a three-tier system to protect the current standard of living for retirees.

The minimum rate of return stood at 4% for 18 years.

In 2003 the rate was reduced to 3.25%.

In January 2004 it was cut to 2.25%.

The rate will be raised to 2.75% from January 2005.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.