Novartis challenges India’s patent law

A court case brought by Swiss drugs giant Novartis in India could define how the industry distributes discount medicine to the developing world while maintaining profits.

Novartis went to court on Monday contesting that India’s patent law could leave millions without access to affordable drugs. Opponents accuse the Basel-based firm of squeezing the competition.

Two years ago, the Indian government introduced patent protection for drugs for the first time. But the law only protects completely new compounds that were invented after 1995, a deviation of the industry standard.

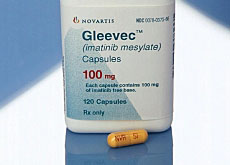

The Novartis leukaemia drug Gleevec (Glivec in some countries) falls foul of this ruling as it is deemed to be a new form of an existing treatment that was developed before the cut-off date.

This has opened the door for generic pharmaceutical companies to copy the treatment, which is currently distributed free to thousands of patients in India, at a fraction of the cost.

“We are deeply convinced that patents save lives. If the patent law is undermined the way it is happening in India, there will be no more investment into the discovery of lifesaving drugs,” said Novartis head of corporate research Paul Herrling.

The company has insisted it will continue to offer Gleevec free to patients in India who cannot afford it.

Watchdog groups such as Médicins sans Frontières, however, say generic competition has dramatically reduced the cost of Aids drugs. They have launched a petition against Novartis while hundreds of activists protested in the streets of the Indian capital, New Delhi.

Lot at stake

The Geneva-based International Federation of Pharmaceutical Manufacturers and Associations (IFPMA) is “very concerned” about the Indian patent law.

“It’s very positive news that India has put into place a patent law, but it needs to be tweaked. There is an important principle here,” spokesman Guy Willis told swissinfo.

“Companies need to have assurances that they can obtain adequate patent protection that gives a fixed period of legal monopoly in which they can recoup what they have invested in research so that they can continue their research.

“Otherwise we don’t have a sustainable industry and that will preclude our ability to improve treatments.”

But the Swiss branch of Médicins sans Frontières argued that blocking cheaper generic copies would keep the cost of treatments such as Gleevec artificially high.

“This court ruling will not just have consequences for Gleevec: the whole market is at stake,” spokesman Pere Pons told swissinfo.

“The consequence of a ruling in favour of Novartis would be fewer and fewer drugs on the market. In the long term it would kill the competition from generic drugs.”

However, Pons admitted that the Indian generic drug companies, although capable of producing Gleevec at a tenth of the $2,600 (SFr3,259) charged by Novartis for a monthly dose, are also looking to make a profit.

“We are not saying that Novartis are the bad guys of the movie and that the generic companies are the good guys, but we do not want to see Novartis trying to reduce the principle that drugs should be affordable both now and in the future,” he said.

swissinfo, Matthew Allen

India introduced its drug patent law on January 1, 2005 to comply with World Trade Organization rules.

The Indian authorities have denied Novartis patent protection for the beta crystal, the active ingredient of Gleevec, ruling that it was an adaptation of an existing compound. The crystal has been granted protection in 36 other countries.

Novartis says 99% of Gleevec users in India get the drug free. Médicins sans Frontières says other generic companies in India supply their versions at discounted rates.

Gleevec was first registered in the United States in 2001. Last year it was Novartis’s second most successful drug in terms of sales, generating $2.5 billion (SFr3.13 billion).

Novartis announced a net profit of $7.20 billion (SFr9 billion) for 2006 – up 17 per cent on 2005. Full-year sales were $37.02 billion, up 15 per cent on the previous year, while operating income was up 18 per cent.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.