One-off gains mask UBS trading losses

The financial markets have temporarily pulled a veil over UBS’s rogue trading losses, but investment banking operations are still dragging the group down.

For once, UBS profited from volatile markets in the last three months that reduced the size of its debts by SFr1.77 million ($2 billion) – at least on paper. But the lucky break has merely wallpapered over the cracks of a recent SFr1.85 billion rogue trading fiasco.

The widening of credit spreads allowed the group to post a pre-tax profit of SFr1 billion for the third quarter. This was still way below the SFr1.66 billion recorded this time last year, but a better result than predicted when the rogue trading losses were discovered in September.

Last month, UBS openly feared it would have to announce red ink. But the bank revised its forecast upwards a few weeks later, also based on the SFr700 million profit realised from the sale of bonds.

As the bank’s share price climbed modestly during Tuesday’s trading, analysts were divided on how to judge its performance bearing in the mind the one-off charges and gains.

Zero impact

“The news of third quarter profit is not as positive as it may appear at first glance because the gains UBS booked have nothing to do with normal business,” Kepler Capital Markets analyst Dirk Becker told Bloomberg news agency.

Andreas Venditti was also sceptical about the impact of the reduction in the bank’s debt. “The SFr1.77 billion gains are what the bank would theoretically make should it now buy back its liabilities at a lower cost,” he told swissinfo.ch. “But the long term impact will be zero by the time these liabilities mature.”

Bank Sarasin noted that the group’s investment banking business had reported a pre-tax SFr566 million loss, compared with a SFr406 million loss at the same period last year.

“The results once again confirmed the need for urgent action in UBS’s investment banking business especially given further regulatory and structural changes,” Sarasin said in a note.

Those structural changes are due to be announced at UBS’s eagerly awaited investors’ day on November 17. Before the rogue trading scandal, the bank had announced it would overhaul the poorly performing division as part of plans to cut costs by SFr2 billion by 2013.

High profile casualty

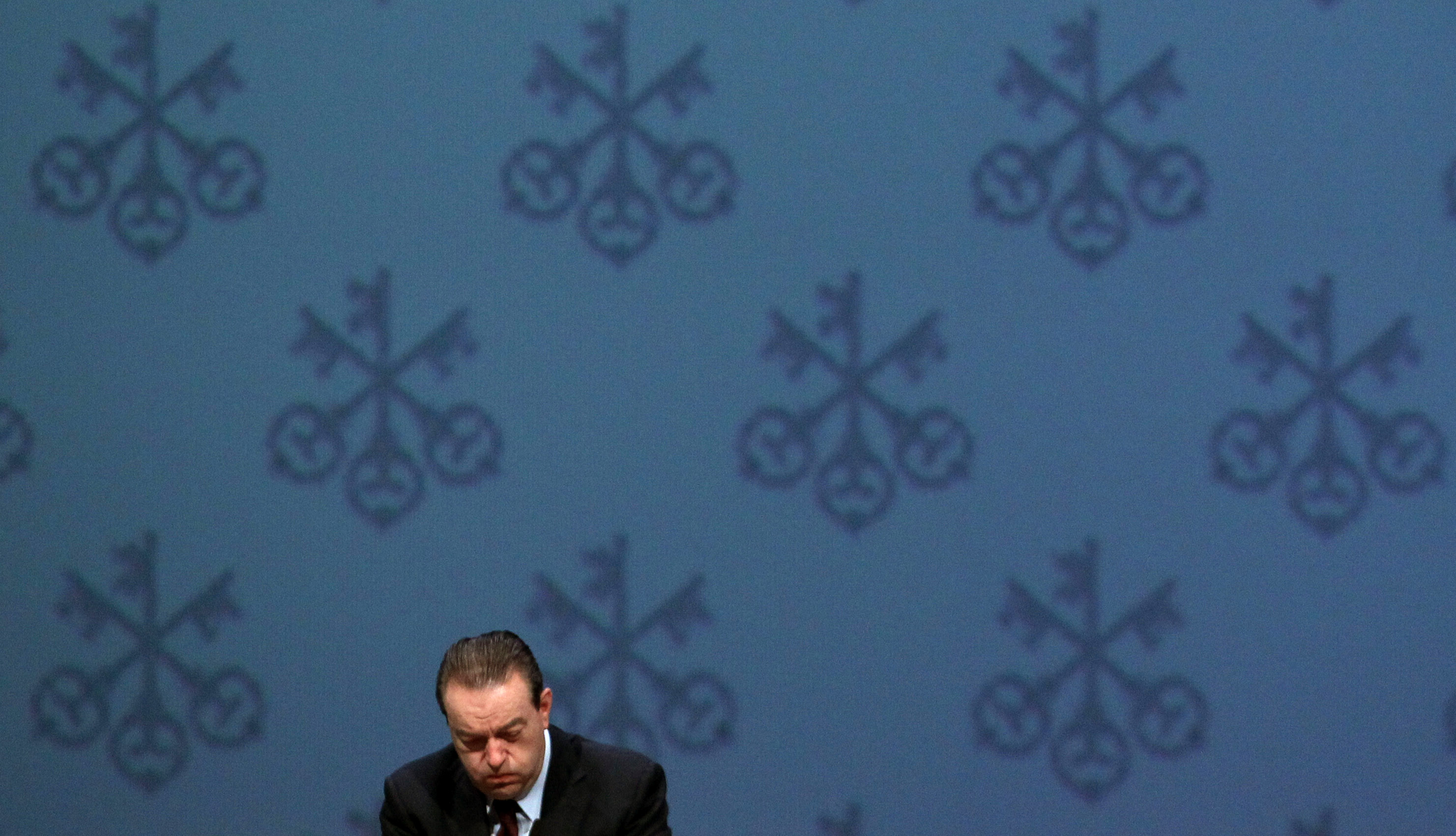

New UBS Chief Executive Sergio Ermotti remained tight-lipped on Tuesday about plans to restructure investment banking. “I am very confident about the future of our business,” he said at the bank’s results conference.

In the absence of concrete information, the Swiss media has been busy speculating that up to 1,700 job cuts from investment banking will be announced in next month’s review. The bank has confirmed that 3,500 positions will be lost throughout the group.

One of the casualties has been Oswald Grübel, who resigned as chief executive last month after taking responsibility for the rogue trading losses.

Ermotti said on Tuesday that further disciplinary action is still on the cards as the bank investigates the scandal. Swiss financial journal Bilan ran an article earlier this month suggesting that several UBS employees knew about the rogue trader’s unauthorised positions.

Ermotti reiterated that none of UBS’s divisions will be put up for sale, but the bank has to work out how best to size and position its businesses in the light of depressed markets and a distinct lack of risk appetite among investors.

Poor conditions

At present, the group is being propped up by its wealth management and retail operations. Wealth management recorded a third quarter net profit of SFr888 million – boosted in part by the sale of bonds.

Many observers are tracking the rate of inflows from wealthy clients as a sign of how the rogue trading scandal is affecting the bank’s reputation.

The bank’s core wealth management division saw SFr3.8 billion of net new money – down from the SFr5.8 billion booked in the last quarter. But Wealth Management Americas saw inflows of SFr4 billion compared to SFr2.6 billion in the previous three months.

The bank cautioned that “current market conditions and trading activity are unlikely to improve materially, potentially creating headwinds for growth in revenues and net new money”, unless solutions were found for the European and United States debt issues.

UBS posted a SFr1 billion ($1.14 billion) net profit attributable to shareholders despite the SFr1.8 billion losses inflicted by a rogue trader.

Underlying pre-tax profits clocked in at SFr980 million.

Results were boosted by a SFr1.76 billion reduction in the value of debts caused by market fluctuations in in the quarter. The sale of bonds also raised SFr700 million.

The bank paid just SFr40 million in tax for the quarter.

Investment banking operations – that were directly hit by the rogue trades – turned in SFr605 million pre-tax losses.

Net new money deposited at the bank’s two wealth management divisions amounted to SFr7.8 billion.

In the same period last year, UBS posted a SFr1.66 billion pre-tax profit attributable to shareholders, boosted by a tax credit of SFr825 million.

Underlying pre-tax profits in Q3, 2010, were SFr818 million.

Investment banking recorded a pre-tax loss of SFr403 million while wealth management net inflows reached SFr1.3 billion.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.