Swiss media debate merits of interim UBS boss

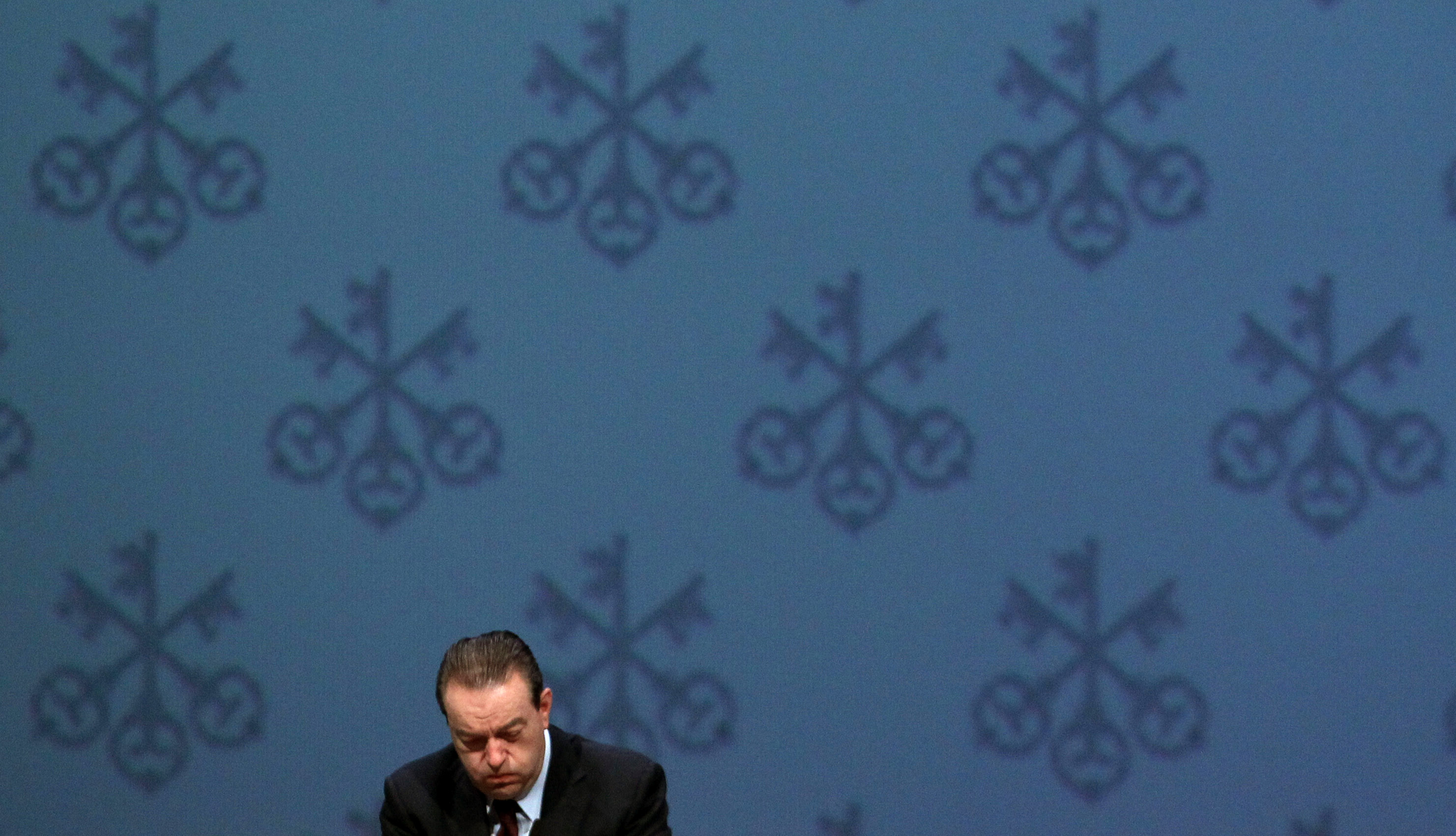

This past weekend’s selection of Sergio Ermotti as the interim CEO of Swiss bank UBS has sparked debate in both the domestic and international media.

Ermotti, who previously served as the bank’s head of the European business, was named to replace Oswald Grübel, who resigned on Saturday morning. The question is whether he can get the troubled bank back on track.

Grübel resigned after a rogue trader in London cost the bank $2.3 billion (SFr2.09 billion) in losses, the latest in a series of blows to the bank’s image.

Le Temps thinks that Grübel’s resignation and the appointment ad interim of Ermotti does not really represent a change of direction. The problems remain.

The Geneva-based paper writes that the first statements by Ermotti do not indicate true willingness to pursue a change of direction – in particular regarding the purpose of the bank’s investment sector, which has been responsible for most of UBS’s woes since the financial crisis.

In addition, “the decision to appoint a new boss ‘ad interim’ implies a lack of preparation, considering the fact that Grübel’s mandate was already expected to end within the next couple of years,” notes the paper.

The paper sees the interim appointment by the UBS board as failing to give Ermotti the necessary credibility at a sensitive moment.

On Sunday, various Swiss papers criticised the board chairman, Kaspar Villiger, for his flawed leadership and complained that Grübel’s departure was not enough to turn the bank around.

Alarm bells

The Monday edition of the Tages-Anzeiger also criticises Villiger for granting Ermotti mere temporary status as CEO.

“Why just an interim solution? Why don’t they give Ermotti a definite chance? His job is already hard enough,” writes the Tages-Anzeiger – referring to how he needs to shut down the investment bank, cut jobs and come up with a new strategy.

The Zurich-based newspaper also notes that Ermotti will have to change the culture within the bank. It cites a recent story in the New York Times that described the whole bank as fraudulent – not just the rogue trader.

“If that is what the most important newspaper in the US writes, then alarm bells should be going off,” finds the Tages-Anzeiger.

Of all people

“An investment banker, of all people” reads the headline on Monday’s German-language Berner Zeitung. The Bern-based newspaper asks how Ermotti can revamp the bank’s investment branch in such a way that it will not generate so much loss and risk.

In its commentary, the paper says Villiger was the problem – not Grübel – meaning that Grübel’s departure is not going to help matters.

As for Lugano-born Ermotti, the Berner Zeitung expresses hope that his posting will indeed be temporary – describing him as “an American-style investment banker”, having made a name for himself at Merrill Lynch.

“But at the head of a Swiss ‘too big to fail’ bank, one would want a Swiss-style banker who would focus on asset management,” concludes the newspaper.

The German-language Blick described 51-year-old Ermotti as the “Anti-Grübel” on page one of its Monday edition.

To illustrate the contrast between him and his 67-year-old predecessor, the tabloid showed Ermotti out for a jog near his home in Montagnola.

It quoted a number of Ermotti’s colleagues and friends – all of whom had positive things to say about him.

“He’s the right age for the position as head of UBS and he has more than enough energy,” it quoted Banca Svizzera Italiana CEO Alfredo Gysi as saying. He continued, “Regarding the investment branch of UBS, he is perfectly capable of estimating what makes sense and what does not.”

Predictions

Fribourg based La Liberté says that Grübel’s resignation will not bring any fundamental change in the strategy developed by UBS since the financial crisis of 2008. The current trend among the banks is to control risks, which will oblige banks to reduce the size of the investment banking sector.

According to La Liberté, the next strong man at UBS will not be Ermotti, who has only been working there for five months. This is not enough to know the bank in depth, it says.

La Liberté predicts that the next real boss will be German Axel Weber, due to succeed Villiger as chairman in 2013; the paper believes he may already begin working for the bank as an advisor within the next few months.

His job will not be easy: UBS still has to regain a normal inflow of new capital. The bank also has to win back the trust of its big Singapore shareholder, which has lost SFr9 billion ($9.9 billion) so far.

Switzerland’s biggest bank was flying high in 2007, announcing record quarterly profits of SFr5.6 billion in the second quarter of that year.

This figure was achieved despite the collapse of its Dillon Read Capital Management hedge fund. However the figures hid problems that only started to come to light after the sudden departure of chief executive Peter Wuffli in July of that year.

The profits turned into a SFr726 million loss in the third quarter as the bank started writing down subprime mortgage and debt security trades. The bank eventually lost some SFr50 billion in the financial crisis.

In 2008, the situation had become so bad that the Swiss National Bank was forced to bail out UBS with a SFr6 billion loan and by taking over bad debt.

UBS also admitted to aiding and abetting US tax evaders and was forced to pay a $780 million fine in 2008. It later had to release the names of 4,450 clients to the US authorities, denting its own reputation and Swiss banking secrecy laws.

Share prices fell from a high of SFr70 in 2006 to under SFr10 in 2009.

Former Credit Suisse boss Oswald Grübel took over as CEO in 2009 with a mandate to turn UBS around. The bank was back into the black for the full year in 2010 to the tune of SFr7.2 billion.

Ermotti, 51, comes from the Italian-speaking canton of Ticino.

His experience covers both investment banking and wealth management.

He joined UBS in April 2011 from the Italian bank UniCredit, where he was deputy CEO, responsible for corporate and investment banking, as well as private banking.

He had been with UniCredit since 2005, joining as head of the markets and investment banking division.

He moved to UBS after failing to secure the top job in a management reshuffle in 2010.

He started his career with an apprenticeship, before taking an advanced management programme at Oxford university.

He worked at Merrill Lynch for 18 years, where between 2001 and 2003 he held the post of head of global equity markets.

(With input from Federico Bragagnini)

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.