Central bank acts again as recession looms

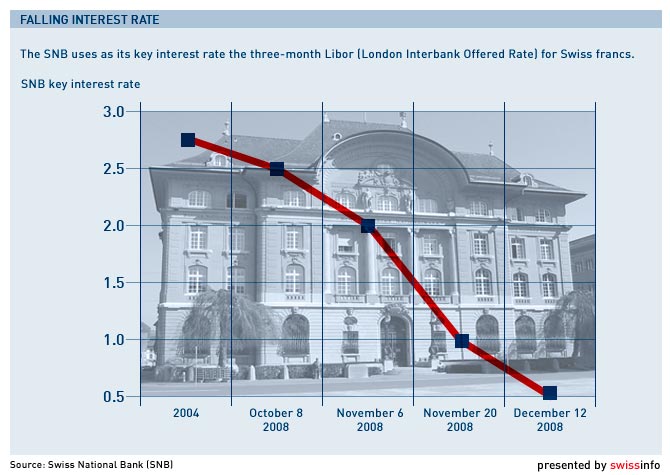

The Swiss National Bank (SNB) has lowered its key interest rate for a third time in as many months as it predicted negative economic growth next year.

The rate was lowered by 50 basis points as the bank insisted it would take further economic stimulus measures and said monetary policy was under control.

The new three-month Libor (London Interbank Offered Rate) target range was set at 0-1 per cent with a target of 0.5 per cent.

The SNB once again kept pace with other European central banks with its decision to reduce interest rates to their lowest level since 2000.

Its president, Jean-Pierre Roth told a conference in Zurich on Thursday that global economic conditions have deteriorated in the past three months. At the same time raw material and energy prices have fallen, reducing the risk of inflation.

The Bank predicted gross domestic product (GDP) growth would sink in 2009 to between –0.5 and –1 per cent. It also warned of further potential losses for banks, reduced consumption and falling exports, particularly for the metals, machinery and electronics industry.

“Whether one can call this a recession or not depends on the definition used, and is now merely a question of semantics,” Roth said.

Ammunition left

SNB executive member Thomas Jordan told the meeting that, contrary to reports, the Bank had not lost control of monetary policy despite inter-bank lending rates breaking through the three-month Libor range in October.

He blamed the temporary situation on the increasingly turbulent financial markets and a sudden lack of liquidity.

Jordan also stressed that the SNB had not used up all its ammunition in the fight to keep the economy afloat by reducing interest rates to practically their lowest level. It has also reduced the cost to businesses of using a special financing facility if they run short of cash.

Jordan hinted that the Bank would now concentrate on keeping the franc from strengthening too much as this would further damage Switzerland’s export industry. The franc has gained substantially against most major currencies this year.

Bank Sarasin senior economist Alessandro Bee told swissinfo that the SNB was now turning to plan B in its efforts to control the economic downturn.

Bankers warned

“In terms of traditional monetary policy instruments [adjusting interest rates] they have nearly run out of ammunition. They are now turning to unconventional instruments, but unlike interest rates that have historical benchmarks, no-one really knows how effective they will be,” he said.

“The Bank will not tolerate the franc appreciating too much. It can announce its preferred exchange rate target or intervene in the foreign exchange market by buying other currencies with Swiss francs.”

Bee added that narrowing the range of the three-month Libor, as in 2000, would increase the risk of interest rates rising above the target range, thus damaging the reputation of the SNB.

SNB vice-chairman Philipp Hildebrand added a stinging rebuke to bankers whose risk-taking strategies first sparked the financial and economic crisis.

“We believe that the crisis should prompt the big banks to consider where the core competencies of bankers lie, and that it should not be left to the authorities alone to think about the lessons to be drawn from the turmoil,” he said.

The SNB was forced to bail out Switzerland’s largest bank, UBS, to the tune of $60 billion in October.

swissinfo, Matthew Allen in Zurich

SNB: -0.5 to –1%

Economiesuisse 0%

BAK Basel Economics: 0.7%

KOF Business Institute: 0.3%

Credit Suisse: 1%

UBS: 0.2%

Central banks have a number of methods at their disposal to influence national economies. Stimulating the economy is known as an expansionist monetary policy while taking measures to cool growth is contractionary.

The most powerful and effective means is by controlling interest rates. Increasing the cost of borrowing cools an expanding economy and controls inflation by restricting the amount of credit consumers and companies can obtain, thus reducing spending power.

Reducing interest rates should have the opposite effect of stimulating the supply of credit in terms of economic difficulty.

Central banks can also control the amount of money available. A typical way of flooding cash into the financial marketplace is through repurchase or repo auctions – a form of short-term loan. Central banks buy securities from financial institutions and sell them back at a later date for a fee.

The SNB recently increased the supply of money to Eastern European countries that often issue credit in the form of safe Swiss francs. The SNB issued francs to the European Central Bank that passed it on to other countries at cheaper rates than those offered by Swiss banks.

Central banks can also influence the value of currencies by announcing preferred exchange rates and by buying up or selling large amounts of other currencies.

On many occasions central bank use their authority to influence the economy merely by issuing statements to which markets react. The most famous recent case was the stock market fall that followed former US Federal Reserve chairman Alan Greenspan’s “irrational exuberance” remark in 1996.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.