Landlocked Switzerland dives into alt-seafood market

As a diver, Brittany Chibe knows climate change and overfishing take a heavy toll on the ocean. Seeing the bleached corals of Australia’s Great Barrier Reef on her first scuba dive seven years ago was a devastating experience. “It’s something that weighed on my heart for a really long time,” says Chibe, a 35-year-old food-tech entrepreneur. “And I didn't know how I could, as one individual, make some change.”

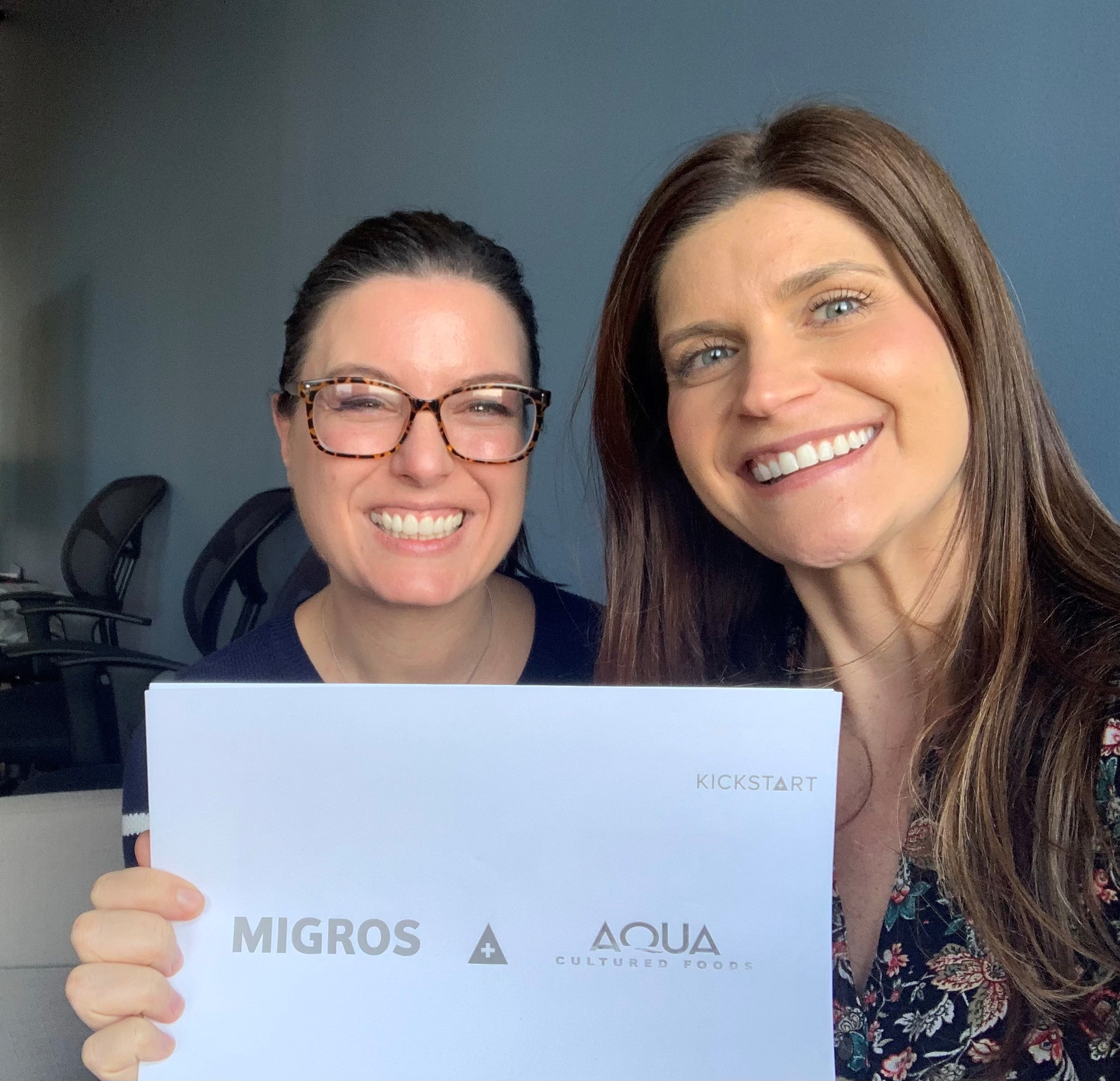

So when Anne Palermo, whom she had met at a networking event in Chicago years earlier, showed her photos of the spongy, seafood-like fungi that she had grown in her home kitchen in the summer of 2020, she recognized the potential and jumped at the chance to make a difference. Chibe partnered up with Palermo. Both women already had their own companies, but Chibe did not hesitate to sell hers to focus together on Aqua Cultured Foods. They incorporated the company in the United States in December 2020.

Their experiments in Chicago quickly gained attention in Switzerland. The company took part in a five-month accelerator programme at Big Ideas Venture in the United States in early 2021, which paved the way for $2.3 million in pre-seed funding; investors included Gonzalo Ramirez Martiarena, CEO of the Geneva-based Swiss Pampa. The company was then approached by Zurich’s Kickstart Innovation programme and that culminated in a partnership with Migros, Switzerland’s largest retailer.

“The Swiss have an interest in these alternative proteins,” says Chibe. As a next step she plans to assess consumer acceptance of her company’s plant-based seafood alternatives in Switzerland. “It’s a nice market to go test on a smaller scale, get feedback from consumers, and tweak the product as needed before launching throughout the rest of Europe.”

When it comes to food, Switzerland has a solid sense of adventure. Tradition made the country synonymous with cheese and chocolate, but it was also Europe’s first to approve insect-derived products and punches above its weight on food science and technology innovation. Plant-based dairy and meat alternatives are already a hit with Swiss consumers. Food industry giant Nestlé and Migros are among many Swiss companies betting on animal-free food products that can credibly substitute seafood and fish. Overall, Switzerland is as an ideal testing ground for consumer interest and sales. Novel food market regulations are looser than in the European Union and the population is increasingly aware of the environmental impact of its consumption habits.

More

Demand for plant-based products shoots up in Switzerland

Environmental imperative

Preventing overfishing and the degradation of marine environments is one of the reasons Swiss multinationals and startups worldwide say the alt-seafood space has caught their attention. Overfishing – catching marine creatures faster than they can reproduce – is a global problem driven by skyrocketing demand and one that consumers increasingly care about.

Landlocked but lake-rich Switzerland consumes about 75,000 tonnes of fish every year, approx. 7.5-8 kilogrammes per year per capita.External link Almost all fish and seafood available to consumers in Switzerland is imported (less than 3% was produced domestically in 2019, according to FAO statisticsExternal link).

“Swiss consumers are becoming more and more conscious about their consumption of animal protein,” says Nestlé spokeswoman Inge Gratzer. “The fish alternative segment has a great potential and is the fastest growing sub-segment in the plant-based meal solution market.”

Nestlé took an early interest in this space. After nailing down vegan bacon, cheese and burgers, the company began its quest for viable fish and seafood alternatives. The eureka moment for experts at its research centre in Lausanne came in the winter of 2019, when scientists developed VUNA, a vegan alternative to tuna. They deemed it “convincing enough” in taste and texture to be deployed in salads, sandwiches and even pizzas. The Vevey-based multinational rolled out VUNA in Switzerland first, then placed it on supermarket shelves in the Netherlands, Italy, Germany and Austria.

The key is speed

The next breakthrough was VRIMP, a shrimp-mimicking addition to its vegan product line, Garden Gourmet. That product launched in October 2021. “Speed is key when it comes to innovation,” adds Gratzer. “We went from concept to shop test in nine months for the VUNA, and around 12 months for the VRIMP.”

The alternative seafood market is still relatively new and small. But experts say it is developing rapidly with both big companies and smaller start-ups making seafood equivalents from plants, microbes through fermentation, and animal cells. The number of companies globally in this space jumped from 29 in 2017 to 87 by June 2021, according to the non-profit The Good Food Institute.

Product development is shrouded in the usual secrecy but Switzerland’s interest in alternative proteins is growing. “Migros… is interested in developments in food and consumption and in this sense invests in promising companies,” Migros spokesman Tristan Cerf said in response to questions about the company’s partnership with Aqua Cultured Foods and broader efforts in the vegan space. The company declined to provide specific information or figures on its alternative seafood and fish product development efforts, market research and investments.

“These areas are still in the research stage, no cultured meat or fish is available on the market,” said Cerf. “It will take several years before production can ensure an accessible availability to the market.”

Last year, Migros, along with food technology company Bühler and flavours and aromas company Givaudan launched an innovation hub for cultured meat near Zurich. The Swiss firms found common cause in supporting efforts to produce cultured meat, fish and shellfish. The Swiss Protein Association, a lobbying group including alt protein companies – Migros, the Kundig Group and Planted – took shape in 2021 “to raise awareness among politicians, industry leaders, and consumers of the potential benefits of alternative sources for a climate friendly and sustainable diet.”

“Switzerland as a country is very well placed to take a more leading role in this space as it has such significant kinds of expertise, very commercially advanced, so I think there’s so much opportunity there,” says Carlotte Lucas, corporate engagement manager for the Belgium-based Good Food Institute Europe.

Market potential

And there is money to be made. The Smart Protein Project, which is funded by the EU, put out the first retail sales data of plant-based foods in Europe last year. For plant-based seafood in Germany, sales in 2020 were about €1.9 million, representing a 190% increase relative to 2019. Globally, the $2.15 billion invested in 2020 in plant-based protein marked a 222% growth relative to the previous year and represented 48% of all-time investment ($4.43 billion between 1980 and 2020), according to the Good Food Institute.

The Good Food Institute believes the sustainable seafood market could be worth $221 billion. That’s based on the assumption that it gets 1.4% market share of the total global seafood market. That benchmark is based on the performance of the plant-based meat market, which today has 1.4% of the global meat market. “We know sustainable seafood is a couple of years behind,” says Lucas.

Location, location, location? Not an issue

A key advantage of alternative seafood production is that there are no geographic constraints, which makes for simpler and shorter supply chains. Manufacturing facilities can be built where consumer demand is concentrated rather than near environmentally sensitive and expensive coastal aeras. “The great thing about sustainable plant-based seafood is that it can be produced anywhere,” says Lucas. “It doesn’t need to be produced near a coastline, which makes it possible for more products to be brought to market in Switzerland, which may be a little bit hard due to logistics, for example.”

But there are also challenges. Plant-based meat and seafood products tend to be more expensive and that can be a problem when it comes to winning over and retaining consumers. Nestle’s tuna alternative, VUNA, costs CHF3.71 per 100 grammes, while the cheapest can of pink tuna in water sold by Swiss retailer Coop costs CHF1.35 for the same amount. Vegan burgers typically have a higher price point than beef burgers.

“One big challenge that the broader sustainable proteins sector faces is… reaching price parity of plant based products compared to their conventional counterparts,” says Chibe. “But I also think that Switzerland is potentially a better market because there is a higher standard of living and maybe consumers are used to spending more on all these products.”

And, because conventional seafood is more expensive than conventional meat, the gap to reach price parity with plant-based seafood is smaller. “So that could play well,” she adds.

The goal is to attract not only vegans but also a much broader consumer base. Consumer interest studies carried out in the United States suggests that these products appeal to flexitarians and pescatarians, not just vegetarians and vegans who have sworn off all kinds of animal-based proteins. The flexitarian diet aims to reduce an individual’s carbon footprint and improve health by reducing meat consumption and privileging alternative protein sources instead. Pescatarians reject red meats but eat fish or seafood.

In the United States, about 40% of the population considers themselves flexitarians or actively looking to reduce their meet and seafood consumption, even it is just once a week. According to Coop’s Plant-Based Food Report 2021, about 40% of the Swiss population of 8.5 million would like to eat plant-based alternatives more often in the next five years.

“Those are really the consumers that we’re hoping to attract,” says Chibe. “People who are curious about alternative proteins and are looking to push down their meat consumption, whether it is for ethical or environmental reasons.”

Swiss retailers already offer hundreds of alternative protein products on their supermarket shelves. Migros claims to stock more than 1,000 certified vegan and vegetarian products, launching 130 new such products in 2021 alone, according to public company data. Coop says it offers more than 1200 such products on its shelf and recently launched its own vegan brand., Yolo.

The health halo

Another hurdle to overcome that fish and seafood, unlike meat or dairy products, benefit from a “health halo.” Matching its high nutritional value – not to mention taste, texture and appearance is no easy task, according to Nestlé and Aqua Cultured Foods. “We leveraged our technologies and expertise in plant sciences and proteins to get the right flavor, as well as the right texture for the VUNA and for the VRIMP,” says Gratzer.

Matching the flakiness, taste, texture and smell of fish – not too little, not too much – is especially hard, according to Lucas of the Good Food Institute. Taste, price and convenience are the holy grail when it comes to successfully positioning alternative protein products.

“Do these products taste the same as their traditional counterpart? Do they cost the same or less? And are they widely available?” she asks. “If and when this sector is able to meet all three of those, then there’s no reason that consumers wouldn’t use these products.”

Aqua Cultured Foods experimented with popcorn shrimp and calamari fries before moving on to ceviche-grade seafood and fish alternatives. “The early days were us just at her home kitchen, cutting up the fungi, playing around with the fungi, breading and frying it, and it was really delicious,” she recalls Chibe in a video interview. The company is now focused on pinning down flavor with the aim of launching its products in 2023.

“We are still in the R&D phase,” says Chibe. “We want to mimic the realistic taste, texture and appearance of traditional seafood. The hope is to convert traditional seafood eaters.”

More

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.