Media take UBS to task over company situation

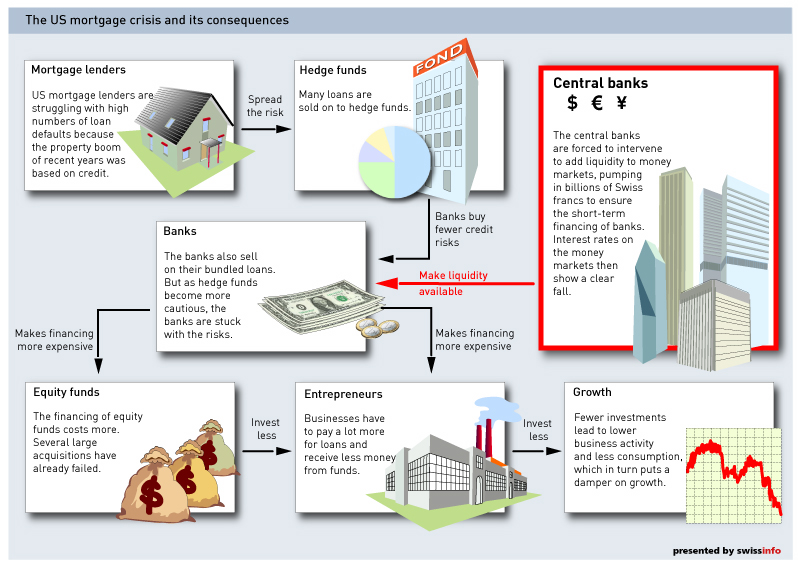

The decision by Switzerland's largest bank, UBS, to write off a further $10 billion (SFr11.3 billion) because of the subprime mortgage crisis has been heavily criticised.

The Swiss and international media questioned chairman Marcel Ospel’s role in the debacle – stopping short though of asking him outright to resign – and the decision to seek help from foreign investors.

In a statement, Europe’s largest bank by assets announced on Monday it had revised its “assumptions and inputs” used to value US subprime mortgage related positions.

This was in response to “continued deterioration in the US subprime mortgage securities market… but mainly fuelled by worsening market expectations of future developments”.

Chairman Ospel came in for some choice words from the media on Tuesday. For the French-language business paper L’Agefi, management at the bank was “smug” and “out of touch with the market”.

The Tribune de Genève and 24 Heures added that the bank was losing the confidence of its smaller account holders. Zurich’s Tages Anzeiger talks of a “loss of trust”.

“Would you trust a bank at which the top 13 managers were paid SFr250 million in good times (in 2006), but won’t lose anything if the weather turns bad?” it added.

The Neue Zürcher Zeitung wondered if the loss of customer confidence would not eventually do more damage to the bank than the losses it has racked up. And asked why it failed to see the US subprime crisis coming.

While the Wall Street Journal called the latest losses a setback, the Financial Times had its axe out for chairman Ospel. It said that if he truly believed in American management values, he should consider falling on his own sword.

“The only way UBS can win back the confidence of the market is to clean its house,” wrote Paul Betts. “The problem is that the man who created this house is still there and in charge.”

Ospel told German-language Swiss radio that his resignation had not been an issue at board meetings, and he wanted to be a part of the solution to the current problem.

He will, however, not receive a bonus this year. Last year, Ospel received a total salary of SFr26.6 million.

Foreign investors

UBS also announced it was raising SFr13 billion in new capital by selling stakes to the Government of Singapore Investment Corporation (SFr11 billion)investors in Singapore and and an undisclosed strategic investor in the Middle East (SFr2 billion).

UBS commented that it wanted to maintain a very strong capital based “under all circumstances”.

Geneva’s Le Temps and Zurich tabloid Blick hinted that UBS might now mean United Bank of Singapore. But while Le Temps seemed unconcerned about the bank becoming more Asian, Blick said it was worried it might end up in foreign hands.

The announcement sent the share price down by almost three per cent at the opening of trading on Monday but by late morning it had bounced back to an increase of around three per cent. It finished the day up 1.4 per cent.

Commenting on the moves, Ospel said the losses in the US mortgage securities market were “substantial” but could have been absorbed by the bank’s earnings and capital base.

“Nevertheless, it is important to always maintain a notably strong capital position to support the continued growth of our wealth management position, which is the largest generator of value to UBS shareholders,” he said.

Transparency

Rohner said the bank wanted as much transparency on the issue as possible.

“In the last several months, continued speculation about the ultimate value of our subprime holdings – which remains unknowable – has been distracting.

Rohner added that losses in the US subprime market were “disappointing” but came at a time when most of UBS businesses were generating close to record levels of profit.

“I am confident that after these writedowns and with a strong balance sheet we are well positioned for growth and profitability.

Last month, UBS announced a management reorganisation after announcing a third-quarter loss of up to SFr800 million. It said it would write down SFr4 billion in losses in its fixed-income portfolio following the closure of its Dillon Read Capital Management subsidiary

The world’s largest wealth manager swept out senior managers and announced it would cut 1,500 jobs in its investment bank as it became one of the biggest casualties so far of turmoil in global credit markets.

swissinfo with agencies

The Singapore investment of SFr11 billion gives the island-state a nine per cent stake in UBS.

Both strategic investors are subscribing to a total issue of SFr13 billion of mandatory convertible notes.

The notes will pay a coupon of nine per cent until conversion into ordinary shares, which must take place on or before a date about two years after issuance.

UBS says the accords with strategic investors are subject to the approval of its shareholders at an extraordinary general meeting that will take place in mid-February.

The Government of Singapore Investment Corporation (GIC) is a global investment management company established in 1981 to manage Singapore’s foreign reserves.

It has a network of eight offices in key financial capitals around the world.

GIC has grown from managing a few billion dollars, to well above $100 billion today.

With a portfolio of this size, it is now amongst the world’s largest fund management companies.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.