US tax deal could prove deadly for small banks

Valiant, Berner Kantonalbank and Vontobel are the first Swiss banks to have agreed to sign up to a United States tax declaration programme. Experts warn the associated legal costs of complying with the treaty could “kill” some of the smaller banks.

Big banks, which sparked the US crackdown by knowingly or recklessly harbouring untaxed assets, have the financial clout to absorb costs and fines. But regional institutions, making up one in four of all Swiss banks, may face a harsher ultimate penalty, despite shouldering a far lesser burden of guilt than larger rivals.

In August, Switzerland agreed to US demands that force banks to come clean about their US clients. Under the terms of the deal, any bank found to have a single tax evader on their books is automatically catapulted into the same liability category as larger rivals.

The Swiss financial regulator has requested banks to come forward by December 9 if they intend to sign on to the US tax deal. By the end of the year they need to have informed the US authorities.

While eventual fines may be lower than more culpable peers, the administrative and legal costs of dealing with the US authorities could run into millions of francs.

“Some banks will have to take part in the programme based on a single US client relationship that they were not even aware of when the account was opened, perhaps because they had dual citizenship that the bank did not know about,” Christian Fischer, managing partner at the CFM Partners law firm, told swissinfo.ch.

“This is a costly exercise which could kill some small banks which feel they have not done anything wrong. Many banks are struggling, even loss-making at the moment, and this is a huge additional cost that they will not be able to bear.”

Under the terms of the Swiss-US tax deal, signed in August, the 300-plus banks in Switzerland will be arranged into four categories by the DoJ.

Group 1: The 14 banks already under active investigation for suspected tax evasion offences. These include UBS, Credit Suisse, Julius Bär, Pictet and the Zurich and Basel cantonal banks.

Some Swiss subsidiaries of foreign banks are also included in this list, such HSBC and Israeli bank Leumi. Switzerland’s oldest private bank, Rahn & Bodmer was the last institution to be added to the category 1 list in September.

Group 2: Those banks that know or suspect that they have committed tax evasion offences in the US. By coming clean before the end of the year, these banks would avoid criminal prosecution but would be subject to big fines (see other box).

Group 3: Banks that have US customers but believe that they, and their clients, have complied fully with US tax regulations.

Group 4: Banks with very limited exposure to foreign clients – no more than 2% of total client base are non-local.

Expensive rotten apples

The stark reality is that all banks, no matter their size, have an unpalatable choice to make before the end-of-year deadline to participate in the treaty expires: incur crippling legal bills to sign or risk annihilation at the hands of the US criminal courts.

The penalty for getting such decisions wrong is plain for all to see: banks Wegelin and Frey have already gone out of business after incurring the wrath of the US Department of Justice. The DoJ has made it clear that it would continue to throw any bank that attempts to wriggle out of its obligations to the criminal courts.

But the alternative to criminal proceedings will also cost banks dear. Signing up to the non-prosecution treaty could rack up legal fees to the tune of millions of francs and attract US civil penalties of up to 50% of untaxed assets held by banks.

“The programme is barely tolerable both economically and legally,” Swiss Bankers Association (SBA) chairman Patrick Odier recently told reporters.

Small banks have been horrified to learn that dual Swiss-US citizens are also being targeted by the US treaty. In addition, the US agreement holds banks to blame for merely failing to notice their clients hiding assets from the US tax authorities, as opposed to actively encouraging evasion.

“Some banks cannot say for certain if they count US citizens among their clients who have failed to tax their assets or make voluntary disclosures in the US,” Rolf Zaugg, chief executive of the Zurich Regional Bank and chairman of the Clientis regional group, told the Tages-Anzeiger newspaper.

To find out could easily cost at least CHF100,000 ($112,000) and then upwards of CHF1 million in legal fees to join the US non-prosecution programme if any rotten apples were uncovered by the search, he added.

“I am particularly annoyed at some of the big banks that have left us with this mess,” Zaugg told the newspaper.

Swiss banks that are not already under active DoJ investigation could avoid criminal prosecution by applying for a so-called “non-target” letter by the end of the year under the terms of the Swiss-US deal.

But they could still be liable for huge civil penalties depending on when they opened accounts for US clients containing non-declared assets.

Accounts already in existence before August 1, 2008, would attract a fine of 20% of accumulated assets.

A 30% fine would apply to accounts opened between August 1, 2008, and February 28, 2009.

This levy would increase to 50% of accumulated assets of any undeclared account opened after February 28, 2009.

Categorising guilt

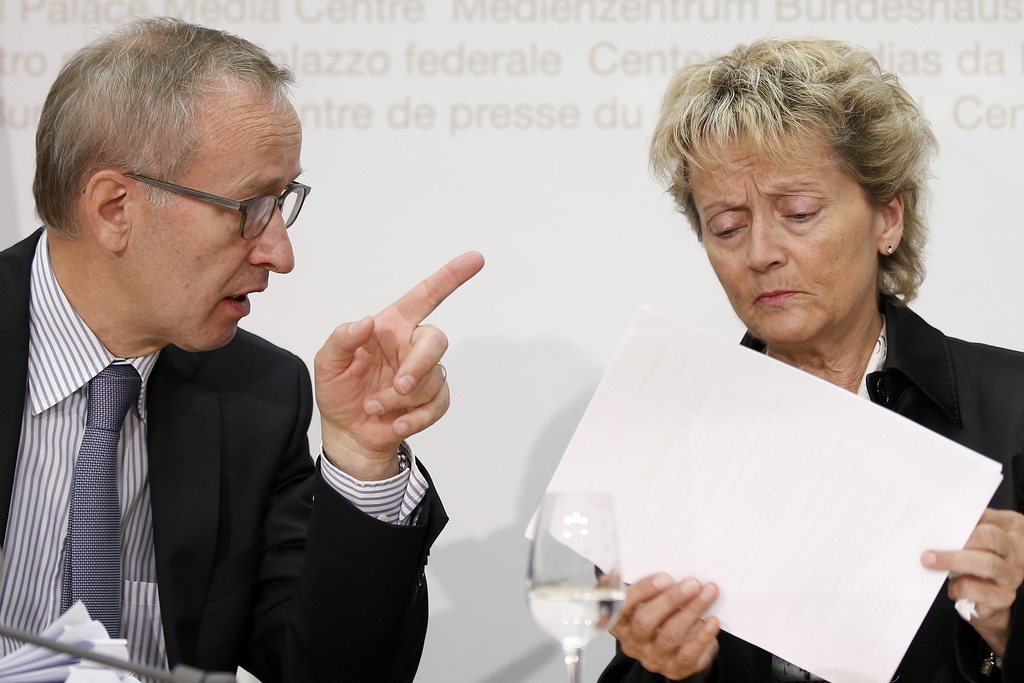

Swiss Finance Minister Eveline Widmer-Schlumpf has been lambasted for signing an agreement that leaves so much to the mercy of interpretation. And the DoJ has made it crystal clear that it has the monopoly on interpreting the details.

This includes defining the grade of wrongdoing for individual banks, set out in four different categories (see box). Group one banks are already known and under criminal investigation, while the remaining three clusters define a range of guilt from serious (group two) to none (group four).

The DoJ has warned against banks trying to downplay their liability or hoodwink the US authorities.

“There are banks who say: ‘We have only done a little bit wrong therefore we belong in group three’,” Kathryn Keneally, assistant attorney-general at the DoJ’s tax division told the SonntagsZeitung newspaper last month. “But these banks would be well advised to choose group two.”

The underlying message is clear: unless a bank knows that it is 100% squeaky clean it should count itself as criminal. But by joining the Swiss-US deal it can reduce its criminal liability to a civil offence and pay a financial penalty.

“Exposure to tax evasion issues in the US can be counted as a risk to the institution,” Tobias Lux, spokesman for the Swiss Financial Markets Supervisory Authority (FINMA), told swissinfo.ch. “We want to know whether they have an adequate risk programme to deal with this risk.”

Given the level of uncertainty, several banks have chosen to ignore FINMA’s December 9 deadline, including Switzerland’s third-largest banking group, Raiffeisen, which wants more time to make up its mind.

Small banks comply

The Swiss regional bank Valiant Holding AG said on Monday it would participate in the scheme brokered by the two countries’ governments because it could not say definitively that all its US clients paid their taxes.

“The costs of the US programme will not jeopardise the financial stability of Valiant in any way. This decision does not endanger the distribution of an unchanged dividend,” Valiant said in a statement.

Valiant said an internal review showed it had never actively sought US clients or visited Americans to drum up business. The bank said less than 0.1% of its clients were American.

Meanwhile, Zurich-based bank Vontobel Holding said it would participate in the US programme, but declare itself free of hidden US client funds.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.