Union rails against strong franc measures

The rapid rise in the franc’s value threatens to pit trade unions against companies and worsen industrial relations. The Swiss Trade Union Federation has spoken out against some firms’ plans to pay cross border workers in euros or extend working hours.

Earlier this week, dental implant specialist Straumann asked employees to take pay cuts and asked those who live outside of Switzerland to accept payment in euros. Technology firm Bühler said on Friday that it had reached an agreement with workers to extend working hours to 45 hours per week for the next seven months.

These are just two examples of measures Swiss firms are taking to reduce costs after the Swiss National Bank (SNB) decided to end its franc-euro exchange rate ceiling last month. Since January 15, the price of Swiss companies’ exports to the European Union has skyrocketed, along with the franc’s value against the euro.

The Trade Union Federation on Friday said it had heard of 40 Swiss companies planning to take similar measures that would adversely affect staff. “Altogether, they threaten staff with layoffs and outsourcing to pressure them into accepting wage cuts, payment in euros and longer working hours,” said the federation’s vice-president Venia Alleva.

“Individual firms going it alone at the expense of employees will bring them nothing,” she added.

Employee distrust poison

The federation was particularly concerned about plans by several companies to force cross-border workers to accept euro payments, a measure that breaks Swiss law according to unions. It also condemned retailers asking the government to extend shop opening times to counter the effects of cross-border shopping.

Employment specialist George Sheldon, a professor at the University of Basel, told swissinfo.ch of his surprise at the “panicky” reaction of some firms to the SNB’s surprise decision last month.

“This only happened three weeks ago and we still do not know exactly where the franc will go against the euro,” he said. “It dropped to parity with the euro but has since been hovering at around the CHF1.05 mark. It’s way too early for companies to get excited. I am surprised that some have reacted like this so soon.”

Sheldon questioned the wisdom of companies leaning on employees too hard to help them cut costs.

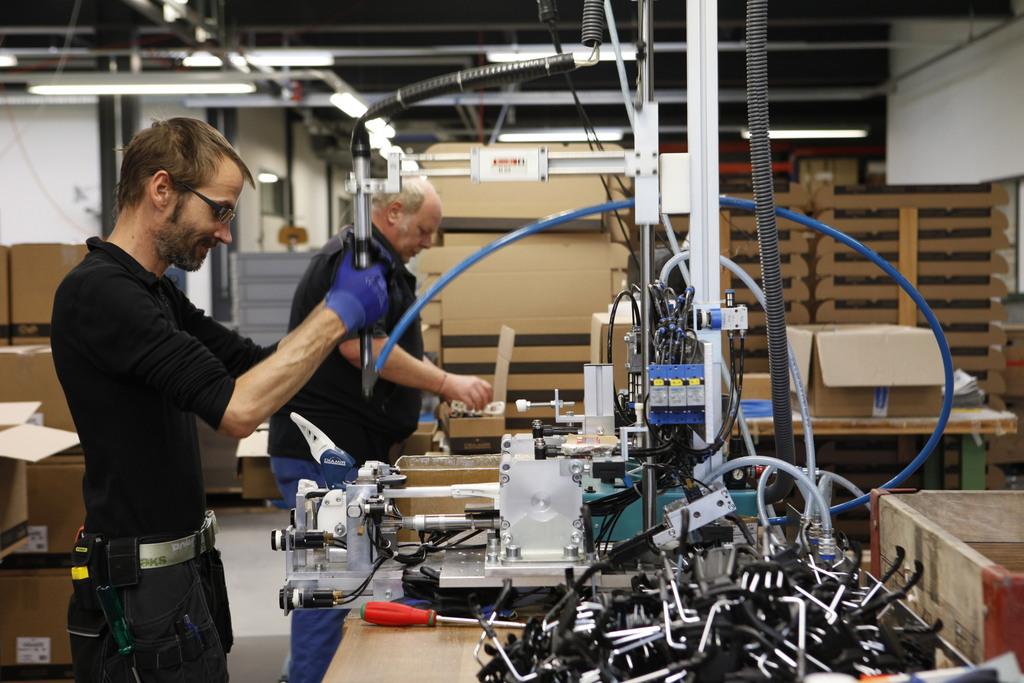

“Switzerland does not do mass production, it manufactures high-end specialist products that require great expertise to produce,” he told swissinfo.ch. “Companies are dependent on a highly skilled workforce and they do not want to create a feeling of distrust with their employees. It could be very counter-productive in the long-term.”

SNB’s unofficial rate target?

The Bühler group defended its decision to have employees work extra hours for free over the next seven months. The agreement was made amicably with staff, said chief executive Calvin Grieder. “I am proud of the way our staff agreed so quickly to ensure our competitiveness,” he stated.

In exchange for staff cooperation, the company has agreed to lift a moratorium on pay increases and promised employees profit-sharing bonuses if certain targets are met.

The Trade Union Federation called on companies to join forces to put pressure on the SNB to restore its defence of the franc.

There is some evidence that the SNB continues to buy up foreign currencies to keep the franc from appreciating too highly. The central bank’s hoard of foreign currency derivatives swelled by more than CHF3 billion ($3.2 billion) in January to CHF498.4 billion, according to International Monetary Fund statistics.

This is compared to an increase of CHF32.4 billion spent by the SNB in December. Last month, SNB board member Fritz Zurbruegg told the Blick newspaper that the central bank would probably have had to splash out CHF100 billion in January to defend the CHF1.20 franc-euro exchange rate ceiling any longer than it did.

The SNB would not comment on media reports that it is still intervening in the forex markets to unofficially keep the franc-euro exchange rate between CHF1.05 and CHF1.10.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.