Initiative aims to impose ethical investment rules

Swiss voters will have the option to curb the financing of defence companies if they accept the anti-arms-investment initiative on November 29. Even though the trend towards ethical investment is growing worldwide, Switzerland would set a precedent with the proposed restrictions.

Selling arms is a lucrative business. The turnover in legal international arms trade is estimated to be at least $80-100 billion (CHF72-90 billion) per year. Those who invest in and promote the industry also make big bucks. This symbiotic relationship is at the crux of the anti-arms investment initiative that seeks to ban the financing of companies that produce war materials. Switzerland is one of the biggest and most important financial markets in the world and plays an important role in the arms industry.

However, the Swiss financial market is currently undergoing its own radical changes. Three years after the abolition of the banking secrecy, the government is taking yet another bold step: Switzerland is to become a leader in providing sustainable financial services for the environmental industry. This is, however, not entirely altruistic as climate-friendly investments have become very popular on the global market.

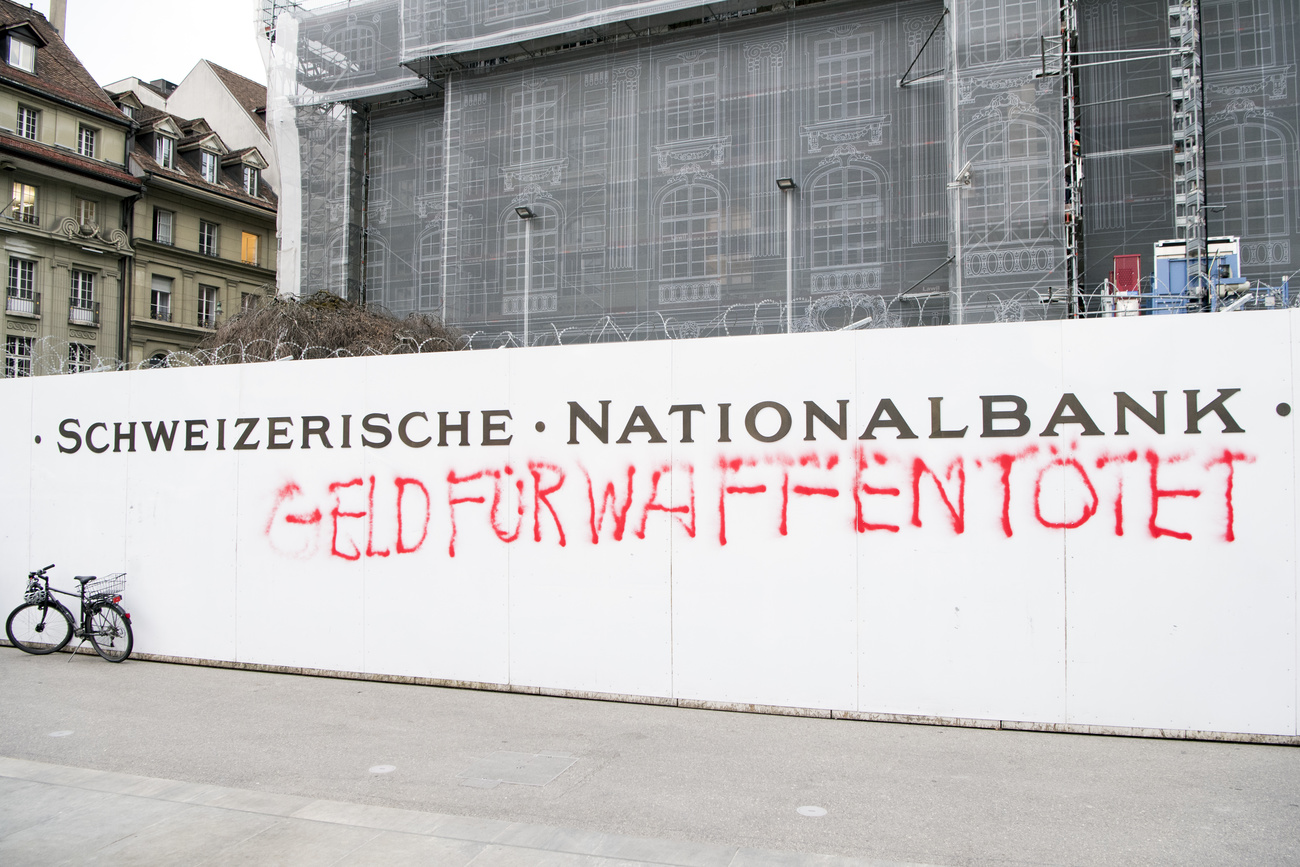

The anti-arms investment initiative also wants to encourage the financial market to be not only environmentally friendly, but also humane. Under the proposed regulations, the Swiss National Bank, foundations and pension schemes would be banned from investing in companies that manufacture war materiel. “If accepted, the initiative would be a further step along the path Switzerland has been following for a few years,” reads the supporters’ statement.

The Federal Act on War MaterialExternal link defines what is considered war materiel in Switzerland. It includes weapons, weapon systems, ammunition and military explosives as well as ‘dual use’ items which can be used for civilian as well as military purposes.

Prohibited war material includes nuclear, biological and chemical weapons as well as anti-personnel mines and cluster munitions. This means that it is prohibited to develop, produce or broker such weapons as well as directly or indirectly financing such weapons.

The initiative not only targets government and public institutions, but also the private sector. Banks and insurance companies would be required to adhere to the new way of doing business. If this came to pass, it would put Switzerland in a unique position across the globe as no other country has such an extensive ban on financing as the one proposed by the constitutional amendment. Countries seem to have more of a consensus on outlawed weapons listed in the Swiss law on war materiel.

Norway’s Government Pension Fund, also known as the Oil Fund, is the only other comparable example of what Switzerland is trying to do. The Oil Fund is the biggest government fund in the world and all decisions on how investments are made are scrutinised by a five-member ethical council. Over the past few years, the fund’s portfolio has adapted to increasingly strict criteria and has excluded companies involved in businesses such as tobacco, fossil fuels, or arms production.

Private sector ahead

The private sector is already one step ahead of everyone. The number of banks, pension schemes and foundations committed to ethical investment is on the rise. A good example is the Alternative Bank Switzerland which has focused on social and ecological banking for three decades.

There are numerous other financial institutions outside Switzerland with strict exclusion criteria for investments. The German Umweltbank, for example, excludes any investing that contributes to the endangerment of the quality of life of people, animals and nature. Weapons and military goods are specifically mentioned on their exclusion list.

Tight definition

The development in the private sector also inspired the naming of the initiative. “We looked at the international standards of sustainable financial products from major financial service providers such as Dow Jones or MSCI,” says Julia Küng, co-president of the Young Green Party of Switzerland and member of the initiative committee. The Socially Responsible Investing Index is one product, for example, that goes beyond other similar initiatives and spells out extensive exclusion criteria. This index excludes investing in alcohol, tobacco, any form of gambling, pornography and genetically modified organisms as well as any military materials.

The initiators have adopted one of the most controversial criteria for their initiative from this index. Under the proposal, only companies which generate more than 5% of their annual turnover from the production of war materiel are considered defence companies. Opponents of the initiative argue that the five-percent-threshold was arbitrary and too low because it would not only affect big armament manufacturers such as Ruag but also small Swiss companies that supply larger manufacturers.

The voter pamphlet explicitly states that Airbus and Boeing are conglomerates that produce war material, which makes them vulnerable to the initiative. This would follow the example of the Norwegian Government Fund which got rid of its shares in Airbus and Boeing many years ago.

Adapted from German by Billi Bierling

More

Proposed investment ban targets armament industry

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.