Stock Bulls Back in Charge as Jobs Fuel Fed Bets: Markets Wrap

(Bloomberg) — Stocks notched their biggest advance since February as a slowdown in US jobs sent bond yields tumbling, with traders reviving bets on Federal Reserve rate cuts this year.

A softer-than-estimated payrolls number — that did not signal the labor market is rolling over — and a cooldown in wages appeased investors worrying about “stagflation” or a recession. Instead, the latest employment print gave fodder to the believers in an economy that is gradually slowing and would allow a data-dependent Fed to start easing policy as early as September.

“The payroll miss hands the baton to the bulls,” said Jose Torres at Interactive Brokers. “Markets are rallying aggressively as incoming data point to a shorter journey across the monetary-policy bridge.”

The S&P 500 rose 1.3%, with equities also buoyed by Apple Inc.’s post-earnings surge. The tech-heavy Nasdaq 100 climbed 2%. Wall Street’s “fear gauge” — the VIX — sank to an over one-month low.

Treasury two-year yields, which are more sensitive to imminent Fed moves, dropped seven basis points to 4.81%. Swap traders are now projecting around 50 basis points of policy easing this year — which would equate to two rate cuts. The dollar saw its worst week since March.

A litany of weaker-than-estimated data points — from jobs to services and manufacturing — sent the US version of Citigroup’s Economic Surprise Index to the lowest since February 2023. The gauge measures the difference between actual releases and analyst expectations. Nonfarm payrolls advanced 175,000 in April, the smallest gain in six months. Unemployment ticked up to 3.9% and wage gains slowed.

Rather than worrying about a bigger slowdown that could weigh on Corporate America, investors focused on prospects that the latest data will help ease some of the pressure around the higher-for-longer policy narrative.

“The softer-than-expected payroll report suggests there is no heat in the economy that should keep inflation persistently high, which increases odds for rate cuts this year,” said Sonu Varghese at Carson Group.

Fed Bank of Chicago President Austan Goolsbee told Bloomberg Television that additional jobs reports like Friday’s would give him comfort the economy is not overheating. Speaking separately, Governor Michelle Bowman said inflation will likely remain elevated for “some time,” but added she still anticipates price gains will eventually cool with rates held at current levels.

Following Wednesday’s Fed decision, Chair Jerome Powell noted it’s unlikely the next move would be to raise rates.

Being weaker across the board, the April employment report vindicates Powell’s decision not to lurch hawkish at the May meeting and “is good news for the Fed and the market,” according to Krishna Guha at Evercore.

“We feel somewhat more confident in our base case that the Fed will start cutting by September,” Guha added.

To Seema Shah at Principal Asset Management, the latest jobs report indeed brings the rate-cutting dialogue back into the market and perhaps explains why Powell was able to lean more dovish on Wednesday.

“This is the jobs report the Fed would have scripted,” Shah noted. “Of course, today’s weaker numbers need to mark the start of a new slower trend for multiple rate cuts to seriously be back on the agenda – but, by then, the new fear could be a slowing economy.”

Separate data Friday showed the US services sector unexpectedly contracted in April for the first time since 2022 as a gauge of business activity slumped to a four-year low and a measure of input costs rose.

“Today’s jobs report is the definition of Goldilocks: job growth that is gradually moving back to around trend amid a normalization of wage growth,” said Gennadiy Goldberg at TD Securities “This is certainly the type of employment report that Fed officials will welcome. We remain optimistic that the Fed will first ease rates at its September FOMC meeting.”

Overall, market observers say signs of a cooling economy could nudge the Fed to lower interest rates over time — but that inflation data would be vital.

“Worried that the US economy is overheating? The April employment report throws a bit of cold water on that idea,” said Mark Hamrick at Bankrate. “The data will need to align for the Fed to gain confidence that inflation is getting closer to its 2% target before pulling a rate-cut trigger. It remains on high alert for unacceptably high inflation.”

A rally in US stocks faltered last month as the Fed signaled it would hold interest rates higher for longer amid elevated inflation. A sharp slowdown in economic growth in the first quarter has also raised “stagflation” chatter — though many market observers have downplayed that possibility.

To Alexandra Wilson-Elizondo at Goldman Sachs Asset Management, the latest jobs report should be perceived by markets as a “welcome breath of fresh air as it will hush the hawkish undertone in the market and any recent ‘stagflation’ fears.”

While Fed officials will likely be relieved that the labor market is cooling, this report is not soft enough to change the Fed outlook, according to Tiffany Wilding at Pacific Investment Management Co.

“Hiring was strong, unemployment remains low, and wages are likely to tick up again next month,” she noted.

Wilding bets the Fed will try to get at least one cut in this year, but she still expects the central bank to take one or two cuts out of its rate-path projections when it releases new Summary of Economic Projections in June. Back in March, Fed officials maintained their outlook for three interest-rate cuts in 2024.

“If inflation does not breakout and jobs data stays moderate, a first rate cut could be due in September, but we expect the Fed to remain very dependent on incoming data, meeting by meeting,” said Larry Tentarelli at Blue Chip Daily Trend Report.

Chris Zaccarelli at Independent Advisor Alliance says that as long as the Fed maintains rates where they are — or cuts once or twice — the market can keep moving higher.

More Comments on Jobs:

- Andrew Brenner at NatAlliance Securities:

Weaker number, increased unemployment rate, and lower wage growth. Looks like a Goldilocks report.

- Mohamed El-Erian president of Queens’ College, Cambridge and a Bloomberg Opinion columnist:

A Goldilocks report that will please the Fed and please the markets.

- Jeffrey Roach at LPL Financial:

Slower payroll growth and fewer hours worked imply the economy is slowing at a measured pace. This jobs report is consistent with the soft landing narrative.

- Bret Kenwell at eToro:

The April jobs report doesn’t create an urgent concern for the labor market or the economy, and it found a way to thread the needle between being soft enough, but not too weak. The bond market is back to pricing in two rate cuts for the year, which is a relief to stock and crypto bulls.

- Michael Kantrowitz at Piper Sandler & Co.:

Soft macroeconomic data is needed to bring rates down and stocks up. Bullish all day.

- David Donabedian at CIBC Private Wealth US:

Following the April jobs report, there is rising optimism that the Fed may be more supportive of the markets now pricing in two possible rate cuts this year.

- Glen Smith at GDS Wealth Management:

Friday’s weaker-than-expected jobs report is unlikely to change the Federal Reserve’s hesitancy to cut interest rates in the near-term, as there have still been several months of strong jobs and inflation data and it’s clear that inflation is still too far above the Fed’s 2% target to justify a rate cut.

- Ronald Temple at Lazard:

Today’s payroll report combined with the job opening and quit data all point to easing of labor market tightness, which should translate to lower wage and inflation pressure, opening the door for rate cuts as early as the September meeting.

- George Mateyo at Key Wealth:

Rate cuts will come back into focus, and investors should remain vigilant for larger slowdowns in the month ahead. But today, this small amount of bad news relative to expectations will be viewed as good news, and suggest the economy is moderating but remains on solid ground.

- Chris Low at FHN Financial:

Today’s report was a far cry from the kind of labor market weakness that would prompt a Fed rate cut. Nevertheless, more abundant labor and slower job and wage growth should help contain inflation, and that is the key to rate cuts. Hence, odds of a September rate cut have climbed.

- Chris Larkin at E*Trade from Morgan Stanley:

Following a steady stream of sticky inflation data in recent months, today’s much-weaker-than-expected jobs report had to bring smiles to the faces of the Fed board. It may not put a June rate cut back on the table, but unless it turns out to be an anomaly, it will increase the odds that the Fed will be able to get in at least one cut this year.

- Richard Flynn at Charles Schwab UK:

Investors will interpret today’s weak jobs report as a sign that demand is slowing in the labor market. A dive in the labor market may be what it takes to push the Fed from a stroll to a sprint.

- Matt Peron at Janus Henderson Investors:

In terms of markets, this should be a big boost given the negativity around sticky inflation of late, and if confirmed, can bring the prospect of rate cuts back into the picture for 2024.

- Florian Ielpo at Lombard Odier Asset Management:

This report is generally good news for the markets, especially for bondholders. It could herald a period of at least stable interest rates, accompanied by a gradual weakening of the US dollar.

Corporate Highlights:

- Apple Inc. posted stronger-than-expected sales last quarter and predicted a return to growth in the current period, sparking optimism that a slowdown is easing. Profit also topped Wall Street projections in the period, and Apple announced the biggest stock buyback in US history.

- Amgen Inc.’s shares soared after its chief executive officer said he was “very encouraged” by early results from a study of the company’s experimental obesity drug, MariTide.

- Societe Generale SA equities traders outshone their bond-trading counterparts for a fourth straight quarter, with revenue from the unit helping the French bank beat estimates for profit in the three months through March.

- Booking Holdings Inc., owner of travel brands Kayak and Priceline, said it expects room-night reservations to slow in the current quarter as tensions in the Middle East curb regional tourism.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1.3% as of 4 p.m. New York time

- The Nasdaq 100 rose 2%

- The Dow Jones Industrial Average rose 1.2%

- The MSCI World index rose 1.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro rose 0.4% to $1.0764

- The British pound rose 0.1% to $1.2549

- The Japanese yen rose 0.5% to 152.89 per dollar

Cryptocurrencies

- Bitcoin rose 5.7% to $62,103.17

- Ether rose 2.9% to $3,074.41

Bonds

- The yield on 10-year Treasuries declined eight basis points to 4.50%

- Germany’s 10-year yield declined five basis points to 2.49%

- Britain’s 10-year yield declined six basis points to 4.22%

Commodities

- West Texas Intermediate crude fell 1% to $78.14 a barrel

- Spot gold fell 0.1% to $2,301.47 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Alexandra Semenova.

©2024 Bloomberg L.P.

BNP Weighing Up to 150 Job Cuts in Geneva to Slash Costs

(Bloomberg) — BNP Paribas SA is considering eliminating as many as 150 jobs in Geneva in a bid to cut costs and streamline its operations, according to people familiar with the matter.

The French lender is consulting with staff representatives on the move and the process will last for weeks, said one of the people, who asked not to be identified discussing personnel. It is too early to say what roles might be effected but it may include back-office and IT positions.

The bank has more than 1,000 employees in Switzerland across Geneva, Zurich and Lugano, according to its website. It’s possible the number of jobs cut could be smaller and some people could be relocated within the business, the person said.

In an email, the lender confirmed it has initiated consultations with its staff commission in Geneva “as part of the continuous adaptation of its organization,” but declined to share details.

The reductions are part of Chief Executive Officer Jean-Laurent Bonnafe’s efforts to seek an additional €400 million ($431 million) in cost savings to offset revenue headwinds. The Paris-based firm leaned on lower expenses to boost its first-quarter profit that beat analyst expectations.

BNP Paribas is among a raft of global lenders that are slashing their workforce with the broader aim of cutting costs. This week, Bloomberg News reported that Barclays Plc started culling employees in global markets, investment banking and research as the British bank embarks on a £2 billion ($2.5 billion) savings drive envisaged by CEO C.S. Venkatakrishnan. HSBC Holdings Plc began a new round of reductions in investment banking in Asia last month.

BNP Paribas is also eyeing opportunities in Switzerland following the takeover of Credit Suisse by UBS Group AG, and is planning to develop its corporate and institutional banking and wealth management in the country.

The bank’s “ambition in Switzerland is unchanged: we continue to implement our strategic plan 2025, pursuing our growth at the service of Swiss clients and the Swiss economy,” BNP Paribas said in the email.

–With assistance from Alexandre Rajbhandari.

(Updates with more company comment in final paragraph.)

©2024 Bloomberg L.P.

Switzerland Today

Greetings from Zurich!

World Press Freedom Day isn’t just a catchy slogan. Denying fair and open scrutiny of the facts is a disservice to society. And as SWI swissinfo.ch’s own journalists can attest, repression of the media can prove far more sinister. Read on to find out more.

In the meantime, we bring you a round-up of today’s main news.

In the news: two Red Cross workers shot are shot dead in Sudan, the shape of discrimination in Switzerland and how medieval squirrels spread leprosy.

- Two drivers for the International Committee of the Red Cross (ICRC) have been shot dead in Sudan, an attack that left three others injured.

- Swiss pilots reported an increase in the number of laser and GPS spoofing attacks last year.

- Basel hospital has found breath tests to be just as effective as taking blood when monitoring certain ailments, such as diabetes, in patients.

- Researchers believe squirrels may have helped spread leprosy in the Middle Ages, a conclusion they drew after studying the bones of the animals.

- A large-scale solar energy plant has been granted planning permission in the Bernese Oberland.

- Almost one in three people felt they had been the victim of discrimination between 2016 and 202, according to a report on racism.

Defending freedom of the press

Switzerland is one of the safest places to ply your trade as a journalist. But depending on where else you live in the world reporters can have a rougher time.

SWI swissinfo.ch covers events all over the world and our own journalists have also suffered at the hands of less savoury administrations.

To mark World Press Freedom Day, we’ve brought you first-hand accounts of how difficult it can be to inform readers of events.

For example, SWI swissinfo.ch journalist Elena Servettaz recounts how she has lost her job and been threatened both personally and through her family for daring to criticise Russian president Vladimir Putin.

Other journalists have encountered press restrictions in China, Tunisia and Mexico – but also in Switzerland. Here, intimidation is financial rather than physically threatening. Powerful actors sometimes try to use the law courts to bury stories under legal costs and potential fines.

This is one of the reasons that the NGO Reporters Without Borders (RSF) today reported that press freedom is declining in Switzerland.

Ironically, Switzerland climbs three places into the top 10 best behaving countries in this year’s RSF comparison study. But that has got more to do with other countries losing ground than Switzerland gaining in credibility.

June 9 vote indications

Voters have indicated support for three out of the four big popular initiative votes this summer. Proposed reforms of healthcare costs and energy infrastructure have so far grabbed the public’s imagination.

The same cannot be said for the “stop compulsory vaccination” initiative, which is struggling to gather support, according to a poll of voting intentions from our parent company SRG.

The people reading this newsletter – Swiss citizens living abroad – appear in most cases even more definite in your views.

Some two-thirds of Swiss Abroad say they will vote for a Social Democrat-backed initiative to cap health costs at 10% of incomes. That’s a far higher proportion than your voting compatriots living in Switzerland.

A second healthcare cost control initiative, supported by the Centre Party, has majority approval at this stage, according to the poll, but with slightly less enthusiasm.

Some 75% of all voters say they are in favour of a proposal to generate more renewable energy – as are 70% of Swiss Abroad poll respondents.

But an initiative demanding protection against compulsory vaccination orders has some work to persuade the public by June 9.

You can read more information on the June 9 votes by clicking on this link.

Swiss chocolate giant Lindt’s expansion plans face a cocoa price roadblock

The Lindt & Sprüngli group has just inaugurated a CHF100 million expansion of its cocoa mass production factory in Olten, Switzerland. High cocoa prices could leave the brand-new machines underutilised.

Olten, a Swiss rail network hub near the capital Bern, is where cocoa beans are delivered by cargo train to the Lindt factory to be transformed. They are cleaned, roasted and crushed to form a viscous cocoa mass that is the starter material for the production of chocolate. And Lindt wants more of it.

On Friday, the company inaugurated a CHF100 million (about $110 million) expansion of the cocoa mass factory. Work began in 2021 and the completed expansion boasts new production lines, a new loading bay for cocoa mass and a state-of-the-art laboratory.

The company’s doubling of its cocoa mass production capacity comes at an awkward time when cocoa prices are at record highs on the global market. SWI swissinfo.ch spoke to Marco Peter, CEO of Lindt & Sprüngli Switzerland, to find out how the company plans to ride out the crisis.

SWI: How important is this expansion strategically for the Lindt & Sprüngli group?

Marco Peter: For us it is very important. We need to anticipate the volume needs of the near- and mid-term future to support the continuous growth that we’ve been having.

SWI: In terms of timing, you now have cocoa prices going up quite a lot and even crossing the $10,000 per tonne mark recently. Isn’t it problematic to have all this extra capacity at this time when prices are so high?

M.P: You can’t always get the optimal timing. When we decided to start this project four years ago it was a different situation on the cocoa market. Yes, the extra capacity may not be needed in the very short term but nobody knows what the future will bring.

This production line will be active for 20 to 40 years depending on how much retrofitting we can do. In the long-term we think we made the right decision. Don’t forget we are historic company that is almost 180 years old. We need to set up the whole group and production network in order to be successful for the next 180 years hopefully.

SWI: Lindt & Sprüngli announced that chocolate prices are increasing this year and also in 2025. What does this strategic expansion mean for consumers who are now grappling with inflation and the higher cost of some of your products?

M.P: By investing in new machinery we have modern technology with higher efficiency and food safety. However, purely from a capacity increase point of view there isn’t a direct correlation to the end consumer.

More

How much more are you willing to pay for Swiss chocolate?

SWI: How do you see this expansion as a commitment to Switzerland as a hub and headquarters of your business?

M.P: Our roots are in Switzerland and we hold true to them. This investment is in a hub for our other European production factories in Germany and Italy. It has added strategic relevance because we can produce cocoa mass made in Switzerland also for chocolate made outside Switzerland.

SWI: As of now Europe still remains your biggest market but there are a lot of regulations unfurling there like the ones addressing deforestation and human rights. How difficult is this going to make it to source cocoa beans for your factory?

M.P: With our Cocoa Farming ProgramExternal link since 2008, sustainability is something close to our heart for quite some time. We have the traceability into these cocoa origins.

We think we are well set up for the new regulations although there is some uncertainty with how the EUDR (European Union Deforestation RegulationExternal link) especially will be implemented across the entire industry, not just in Switzerland or within Europe but also third countries.

Whether it has a disruptive effect on where we source cocoa remains to be seen. I think the most pressing issue at the moment is the price of cocoa.

SWI: The CFO of American confectionery heavyweight Mondelez Luca Zaramellahas said that he expects a price correction in September or October as the data for the new crop becomes available. Do you see the price of cocoa stabilising soon?

M.P: The yield of that harvest will be an important factor. It remains to be seen if demand will go down but I guess with price increases the demand will self-correct.

What we still have though is a deficit. There was less yield than what was used to produce chocolate for about two years now. Then you still have weather and disease to consider. I don’t have a crystal ball.

We know the last time we had disruptive cocoa prices was in the 1970s. It was a long journey of about five years until we had a return to normal.

SWI: Chocolates have more brand loyalty among consumers than other products. Do you think this is going to be tested in the next few years looking at how prices are going up?

M.P: Definitely. That’s where we see opportunity with our strong brands and our premium positioning. People are already willing to pay more for the excellent quality that we deliver.

How high chocolate prices can go depends on the cost of raw material. Compared to our competitors we are in a good position.

Edited by Mark Livingston

President of Patek Philippe: ‘I am, by far, the watchmaker who knows his customers best’

Thierry Stern is both the owner and director of Patek Philippe, one of Switzerland’s four leading independent watch brands. In an interview he explains why the prestigious Geneva-based company produces almost all its timepieces in-house, while delegating sales to outside partners.

While it may not rival Rolex – the other major Geneva brand – in terms of sales, many in the know regard Patek Philippe as the best watch manufacturer, and the most exclusive. Its most emblematic models, such as the Nautilus, are snapped up for a fortune on the secondary market.

Together with Rolex, Audemars Piguet and Richard Mille, Patek Philippe is one of the “Big Four” watchmakers, the four independent brands that generate around half the profits of the Swiss watchmaking industry.

Founded in 1839 and owned by the Stern family since 1932, Patek Philippe employs around 3,000 people worldwide, including 2,050 at its Geneva headquarters. It is run today by Thierry Stern, who joined the family business in 1990 and took over as its president in 2009.

Unlike the directors of Rolex, a watchmaking company that has based its success on the cult of secrecy, Stern regularly speaks out in the Swiss and international press. SWI swissinfo.ch met him at the recent Watches and Wonders trade fair in Geneva.

SWI swissinfo.ch: How has Patek Philippe evolved over the past ten years and what changes can we expect in the future?

Thierry Stern: In terms of design, we’ve moved with the times while remaining true to our DNA. For instance, we’ve incorporated more innovative colours – such as watch straps in jeans-inspired colours – while maintaining a classic style. In other words, we’ve been able to combine my father’s very classic culture with my younger ideas – although I’m already 53. In short, we’ve managed to win over the hearts of fathers, mothers, sons and daughters.

As for the future, I don’t have a crystal ball, but I find myself in the same position as my father years ago. I’m trying to teach my young colleagues the importance of innovation while staying faithful to the codes of Patek Philippe. Ultimately, it’s crucial to combine innovation with tradition in order to continue surprising and pleasing our customers.

SWI: How about the evolution of watch movements?

T.S.: The movement is the heart of the timepiece, so you can’t play around with this component, which must always be perfect, fine and precise. We’ve reached such a level of quality and requirements that changes to the movements are rarer and less daring. Nonetheless, we strive to launch two innovations a year, taking care to make them practical and not just gimmicks.

Regarding design, we’re currently preparing products for marketing in 2027. The development cycles for watch movements are much longer: we’re now working on innovations that will be launched in 2038. As a watchmaking leader, I have to propel myself far ahead and take risks, for there is no guarantee that the new advances in watch movements will appeal. It’s always a gamble, but that’s also the beauty of watchmaking.

SWI: You often highlight the “verticalisation” of your production. This is quite the opposite of Porsche, for instance, which outsources 80% of its added value but meticulously controls its suppliers. Why not follow this model?

T.S.: We have a complete manufacturing facility and 95% to 98% of our added value is produced in-house. Of course, we purchase screws and straps from external suppliers and, for safety reasons, we duplicate certain production lines – dials, for example – with outside companies.

But I don’t see the point in outsourcing more, because the best way to control quality from A to Z is to do everything in-house, even if it is more expensive. We go so far in terms of craftsmanship, development and research that we really can’t contract these tasks out.

Concerning Porsche, I think their strategy is dictated by cost-cutting. In any case, a Porsche isn’t really comparable to a Patek Philippe; they’re not at all in the same sector.

SWI: How do you explain the success of the main independent watch brands compared with the big groups?

T.S.: I can’t speak for other brands, but at Patek Philippe our success is due to our passion for our products and for watchmaking in general. We only employ people who share this passion and take pride in developing and representing the best watches in the world, in line with the founders’ vision.

Another pillar of our success lies in the credibility of our brand. Since our founding in 1839, we have consistently produced watches and maintained an unchanged strategy: making Swiss watches entirely in-house. Our customers and retailers, who have known us for several generations, bear witness to this constancy.

Finally, the leaders of Patek Philippe are deeply passionate about their craft and are involved in designing new watches. I know I’m patting myself on the back here a bit, but that’s how it is.

SWI: Yet big groups such as Swatch, LVMH and Richemont benefit from greater financial clout and internal synergies.

T.S.: Since we’re independent, we have to compensate by being smarter in steering our small boat. One advantage is that we can alter course very quickly, as I can change my mind without having to battle against other shareholders or a board of directors. This means I can modify a product line or budget line in one minute. We also have excellent control over our costs because it’s our own money.

We furthermore have highly competent managers who have often cut their teeth in the big watchmaking groups and are very happy to work for Patek Philippe, precisely because the decision-making chain is so short. And finally, we don’t have any political battles within our company, as everyone knows that I’m the boss and no one is going to take my place.

SWI: A small boat? According to reports by the bank Morgan Stanley, you sell 70,000 watches a year and have an annual sales revenue of CHF2 billion ($2.2 billion).

T.S.: As an independent family group we don’t disclose any figures, so I wonder how these estimates were reached. In any case, I don’t read these reports. The figure of two billion is flattering, but I can tell you we’re really not at that level.

SWI: The leaders of several successful watch brands are convinced of the importance of direct sales. Your strategy is diametrically opposed.

T.S.: Let’s not delude ourselves. Those who emphasise the importance of direct sales are not seeking to get closer to their customers, but to earn more money by obtaining the highest profit margins. I’ve worked for Patek Philippe for 35 years and am, by far, the watchmaker who knows his customers best. I challenge any other watchmaking boss – or market manager for that matter – to contradict me.

Patek Philippe does sell through retailers, but this doesn’t mean we don’t go and see our customers. On the contrary, we’re constantly out and about, for example at events organised by our retailers or during visits to our manufacture facilities. Not only do I go and see our retailers and customers in big cities such as New York and Paris, but I also travel to the depths of Texas, and I’m the only watch company CEO to do so.

SWI: Since you have a lot of contact with your customers, why don’t you set up your own boutiques in addition to your salons in Geneva, Paris and London?

T.S.: Because we don’t have the time for that and we prefer to put all our energy into producing beautiful watches. Rather than running shops, I prefer to spend more time with our customer base. This is really important for us, as a family business. Lastly, our retailers have been our partners for two to three generations and we know each other inside out.

More

Swiss watchmaking: where things stand

SWI: Patek Philippe is a family company and independence is one of your core values. How are you preparing the next generation?

T.S.: I don’t think there’s just one method, but rather 36,000. It depends very much on the family and the mentality of each child. The main thing is not to worry unduly. In our case, my children’s mother and I didn’t do anything special, but our two sons grew up hearing a lot about the company.

When my children turned 16, I told them they should start thinking about whether they wanted to take over the family business, as this would impact their choice of studies. But above all, their mother and I told them that if they wanted to do something different, we had no problem with that at all, because we didn’t have children so that they could take over Patek Philippe but out of love.

Once I’d taken this load off their shoulders, their school marks soared! In the end, both our boys have chosen to work with me, and I’m very happy about that.

SWI: If neither of your sons were to succeed you, would you be tempted to sell the business?

T.S.: Not at all. I would appoint a non-owner managing director to skip a generation. We have highly capable managers in our company, so I have nothing to worry about here.

Adapted from French by Julia Bassam/ts

More

Newsletters

Lindt & Sprüngli expands cocoa processing plant

Chocolate manufacturer Lindt & Sprüngli has expanded its cocoa mass production plant in Olten, canton Solothurn, at a cost of CHF100 million ($111 million).

After a construction period of around three years, the expansion of the Lindt Cocoa Centre was opened on Friday.

In addition to new production lines, the expansion also includes a modernised loading hall for cocoa mass, a laboratory and the redesign of the plant administration, the company announced. The expansion will lead to a doubling of production capacity. Twelve additional jobs have been created.

Cocoa paste for the Lindt brand has been produced in Olten since 1991, initially exclusively for the production site in Kilchberg (canton Zurich). Since then, the Olten plant has steadily grown in importance for the entire Lindt & Sprüngli Group. It is the largest cocoa mass plant within the global production network.

Several of Lindt & Sprüngli’s European production sites are supplied with Swiss cocoa mass from Olten, according to the company’s statement. The cocoa mass is further processed and refined there in accordance with Swiss manufacturing standards.

The cocoa beans are delivered to Olten in railway wagons and stored in special silos until further processing. In a first step, the beans are cleaned while still in their shells and then broken open, Lindt & Sprüngli explained.

The cocoa nibs contained therein are roasted in a specially developed process in which the temperature and roasting time are harmonised.

In the next step, the nibs are crushed into cocoa mass in mills, whereby pressure and friction produce the viscous cocoa mass – the starting product for further processing into chocolate.

Adapted from German by DeepL/kc

This news story has been written and carefully fact-checked by an external editorial team. At SWI swissinfo.ch we select the most relevant news for an international audience and use automatic translation tools such as DeepL to translate it into English. Providing you with automatically translated news gives us the time to write more in-depth articles. If you want to know more about how we work, have a look here, and if you have feedback on this news story please write to english@swissinfo.ch.

Repeat offender Brian back in Swiss custody following brawl

Zurich city police arrested a notorious repeat offender, known as Brian, on Thursday evening after a brawl. The public prosecutor’s office has opened proceedings on suspicion of attempted grievous bodily harm.

The 28-year-old has been provisionally detained for the time being, the Zurich public prosecutor’s office announced on Friday. It remains to be seen whether Keller will remain in custody for longer. The public prosecutor’s office has not yet decided whether it will apply to the compulsory measures court for pre-trial detention. It must make this decision within 48 hours.

+ UN torture rapporteur wades into ‘Carlos’ case

The public prosecutor’s office did not provide any further details due to the ongoing proceedings. However, it referred to the presumption of innocence, which applies until the legal conclusion of proceedings.

Brian allegedly attacked a man with punches in Zurich on Wednesday evening. Images from a surveillance camera show the well-known ex-convict running towards his opponent and knocking him down. The victim was Tiktoker “Skorp808”, with whom Brian has been feuding for some time.

On Thursday, both had published videos in which they commented on the latest incident. “Skorp808” said that he had suffered a triple fracture to his cheekbone in the attack. Brian stated that his opponent had recently insulted his mother and girlfriend and attacked a colleague.

+ Brian released from prison in November 2023

Videos of the two men had already surfaced in March. Brian insulted his opponent and demanded his head while posing with a knife. He claimed that this was an advert for a fight and “trash talk”, as is common in boxing. He was subsequently questioned by the public prosecutor’s office.

In November 2023, Brian, who became known under the pseudonym “Carlos” in a documentary film about a youth lawyer in 2013, was released after years in various prisons. At the age of 28, he was finally able to live his own life, he said at the time. He wished to become a professional boxer and simply be a decent citizen.

Adapted from German by DeepL/kc

This news story has been written and carefully fact-checked by an external editorial team. At SWI swissinfo.ch we select the most relevant news for an international audience and use automatic translation tools such as DeepL to translate it into English. Providing you with automatically translated news gives us the time to write more in-depth articles. If you want to know more about how we work, have a look here, and if you have feedback on this news story please write to english@swissinfo.ch.

One in three Swiss residents victims of discrimination

Almost one in three people felt they had been the victim of discrimination between 2016 and 2022. Discrimination occurred most often in the form of verbal and psychological violence.

These are the findings of a new survey by the Swiss Federal Statistical Office (FSO). It showed that last year, most victims of discrimination in Switzerland were disadvantaged because of their nationality, language, gender or origin.

According to the “Discrimination and Racism in Switzerland 2023” survey, discrimination was mainly in the form of psychological and verbal violence. Over 40% of those discriminated against suffered from marginalisation, disregard or ridicule. Around a third stated that they had experienced verbal violence, insults and threats or bullying and insinuations.

More

Racism in Switzerland: are we taking it seriously enough?

According to the survey, almost half of the victims felt that they belonged less to society as a result of this discrimination. In addition, 40% experienced a deterioration in their relationship and a third avoided places or situations as a result. One-fifth of the victims reported a deterioration in their health.

Translated from German by DeepL/kc

This news story has been written and carefully fact-checked by an external editorial team. At SWI swissinfo.ch we select the most relevant news for an international audience and use automatic translation tools such as DeepL to translate it into English. Providing you with automatically translated news gives us the time to write more in-depth articles. If you want to know more about how we work, have a look here, and if you have feedback on this news story please write to english@swissinfo.ch.

First large-scale alpine solar plant approved in Switzerland

The go-ahead has been given to build Switzerland’s first large-scale solar project in the Bernese Oberland. The project must now forge ahead before winter arrives.

Planning permission for the solar plant on Alp Morgeten in the Simmental was given by the Frutigen-Niedersimmental District Governor’s Office. In future, the plant will produce electricity for 3,000 households.

For project initiator Christian Haueter, the authorisation means one thing above all: a lot of work. However: “It is also satisfying that the project was approved after a thorough examination.”

Haueter attributes the approval to the fact that the project has broad local support. In addition, the solar plant generates local added value.

Four environmental protection organisations had campaigned against the planning application in advance. However, their objections were rejected by the regional governor’s office.

The electrical connection lines required for the solar installation must be authorised in a separate federal procedure. The client may only begin construction on Morgeten once the federal government has approved the connection lines.

The pressure is on. Because from 2025, Alpine solar plants will have to supply a minimum amount of electricity. This is the only way they can benefit from an accelerated authorisation procedure. “That’s why we need to get started as quickly as possible,” says Haueter, adding: “At an altitude of 2,000 metres, the construction time is very limited and hardly anything will be possible in the winter months.”

He therefore hopes that no further objections will be taken to the administrative court and delay the project.

Adapted from German by DeepL/kc

This news story has been written and carefully fact-checked by an external editorial team. At SWI swissinfo.ch we select the most relevant news for an international audience and use automatic translation tools such as DeepL to translate it into English. Providing you with automatically translated news gives us the time to write more in-depth articles. If you want to know more about how we work, have a look here, and if you have feedback on this news story please write to english@swissinfo.ch.

Swiss climate verdict: why carbon budgets mattered to the judges

The European Court of Human Rights (ECHR) recently ruled that Switzerland had failed to meet its own climate targets and to set a national carbon budget. What’s behind this budget, and why does it matter?

On April 9, Europe’s top human rights court ruledExternal link in favour of a group of elderly Swiss women, the KlimaSeniorinnenExternal link, who said the government’s inadequate efforts to combat climate change put them at risk of dying during heatwaves.

+ Landmark ruling: Switzerland’s climate policy violates human rights

Summing up, the ECHR saidExternal link the Swiss government had failed to comply with its own targets for cutting emissions and had “failed to quantify, through a carbon budget or otherwise, national greenhouse gas emissions limitations”.

This is welcome news for Georg Klingler, a climate specialist with Greenpeace Switzerland, which initiated and funded the lawsuit. “Now the court says you need to stick to the laws and commitments you made, and you need to actually prove they can work,” he tells SWI swissinfo.ch.

What is a carbon budget?

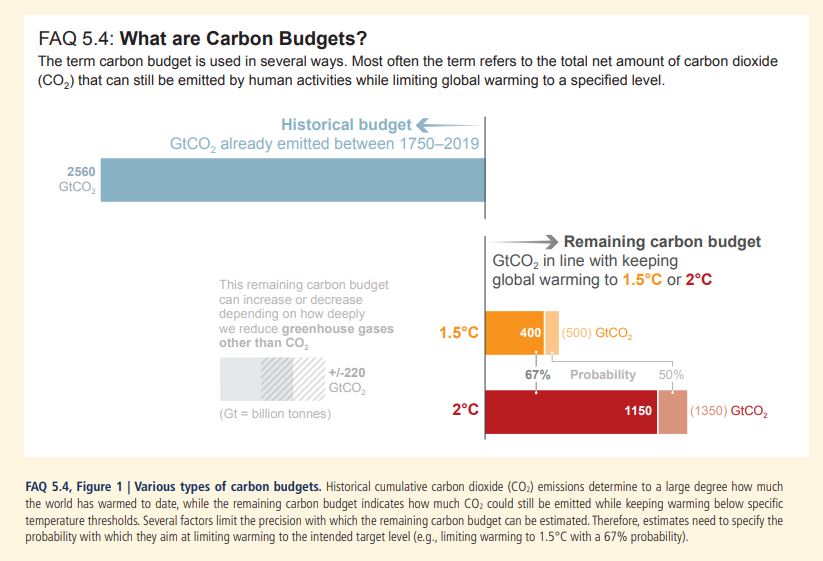

A carbon budget is a tool used by climate researchers and policymakers to help determine the framework and direction of climate policy. It often refers to the total amount of CO2 that can still be emitted by human activities while limiting global warming to a specified level (e.g., 1.5°C or 2°C above pre-industrial levels). The total is then divided among countries according to “fair shares” and other criteria (see below).

A number of countries have set interim targets using carbon budgets. The UK was among the first in 2008; it has set legally binding emission caps over successive five-year periods. France, Germany, Ireland, Nigeria and New Zealand are also using carbon budgets in their planning.

But calculating a carbon budget and determining a country’s “fair share” is not straightforward or easy to enforce.

How is a carbon budget calculated?

To keep warming below the ambitious the 1.5°C mark agreed under the Paris climate accord, the United Nations Intergovernmental Panel on Climate Change estimatesExternal link that humans can only emit about 500 billion more tonnes of CO2 into the atmosphere starting in 2020.

Some scientists have since loweredExternal link this estimate to 250 billion tonnes. We’re currently burning about 40 billion tonnes of CO2 globally per year.

The IPCC calculation of a remaining carbon budget is based on what are essentially subjective choices: the global warming level that is chosen as a limit; the probability with which we want to ensure that warming is held below that limit and how successful we are in limiting emissions of other greenhouse gases, such as methane or nitrous oxide.

And when dividing up the remaining carbon budget by country, value judgements must consider issues such as equity, fairness and differences such a population size, level of industrialisation, historic emissions and mitigation capabilities, the UN body says.

Rather than taking a top-down carbon budget allocation approach, the 2015 Paris Agreement went for a bottom-up approach based on individual country-level commitments. When setting their climate promises – known in UN jargon as “Nationally Determined Contributions” or NDCs – the Swiss are obliged to consider the principle of fairness under Article 4(3) of the climate treatyExternal link. But it is up to them to decide what that fair share is.

Why doesn’t Switzerland have a carbon budget?

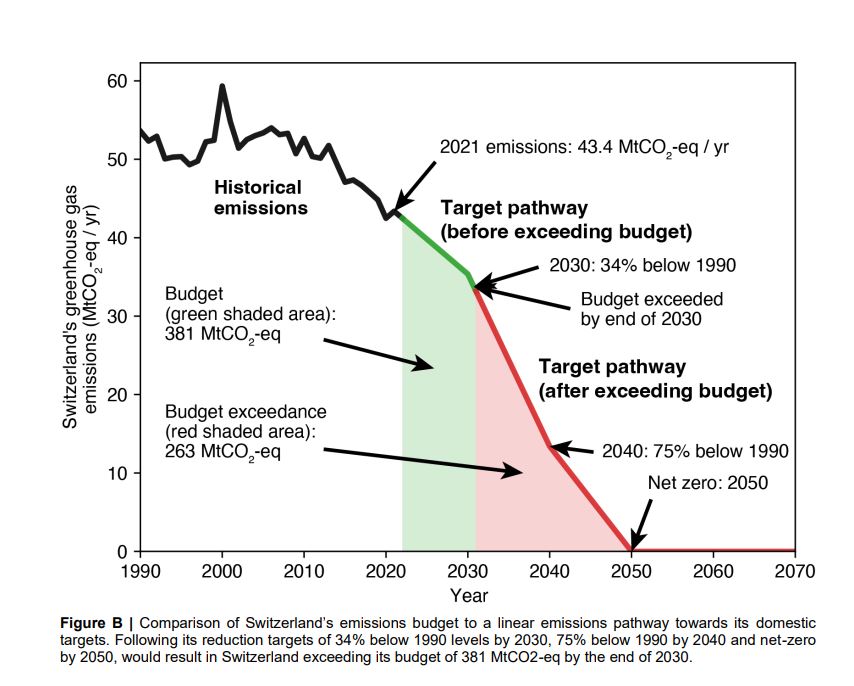

Switzerland has committed to halve CO2 emissions by 2030 External linkand ultimately eliminate emissions by 2050External link. The Alpine nation has argued that there are no uniform, internationally-recognised guidelines for country-specific carbon budgets. It was therefore not possible to clearly determine Switzerland’s share of the overall budget. And the government saysExternal link the existing 2030 and 2050 goals support scientific consensus on the overall reductions needed.

But the government has previously presented a rough figure: nearly one billion tonnes of CO2 equivalents that would be achieved through cumulative emission reductions between 2021 and 2050.

In support of the lawsuit before the ECHR, scientists have calculatedExternal link that Switzerland’s remaining budget, based on population size and historic emissions, is actually much lower: 381 million tonnes of CO2 from January 2022 onwards. And to stay within this budget, Switzerland would need to reach net-zero by 2040, not 2050 as is currently planned, they say.

Switzerland’s Federal Justice Office is now analysing the full Strasbourg judgement and the measures to take.

Why did the ECHR ruling focus so heavily on the carbon budget aspect?

For Nikki ReischExternal link, director of the Climate and Energy Programme at the Centre for International Environmental Law (CIEL), the court’s focus on a carbon budget is important, because “it makes clear that Switzerland needs to set a hard limit on its future emissions and stay within it”.

Chris Hilson, a professor of law at the University of Reading, on the other hand, calls it the “most ambiguous and potentially contentious part” of the climate ruling.

“It is clear that member states must now adopt carbon budgets. But is how these budgets are determined a matter for the courts?” he asks in a recent blog postExternal link published by Colombia Law School.

While in general the climate judgement had been “admirably clear”, uncertainty around carbon budgets seems likely to be pursued in national courts and may come up again at the ECHR, the law expert wrote.

More

Newsletters

Edited by Sabrina Weiss/Veronica De Vore