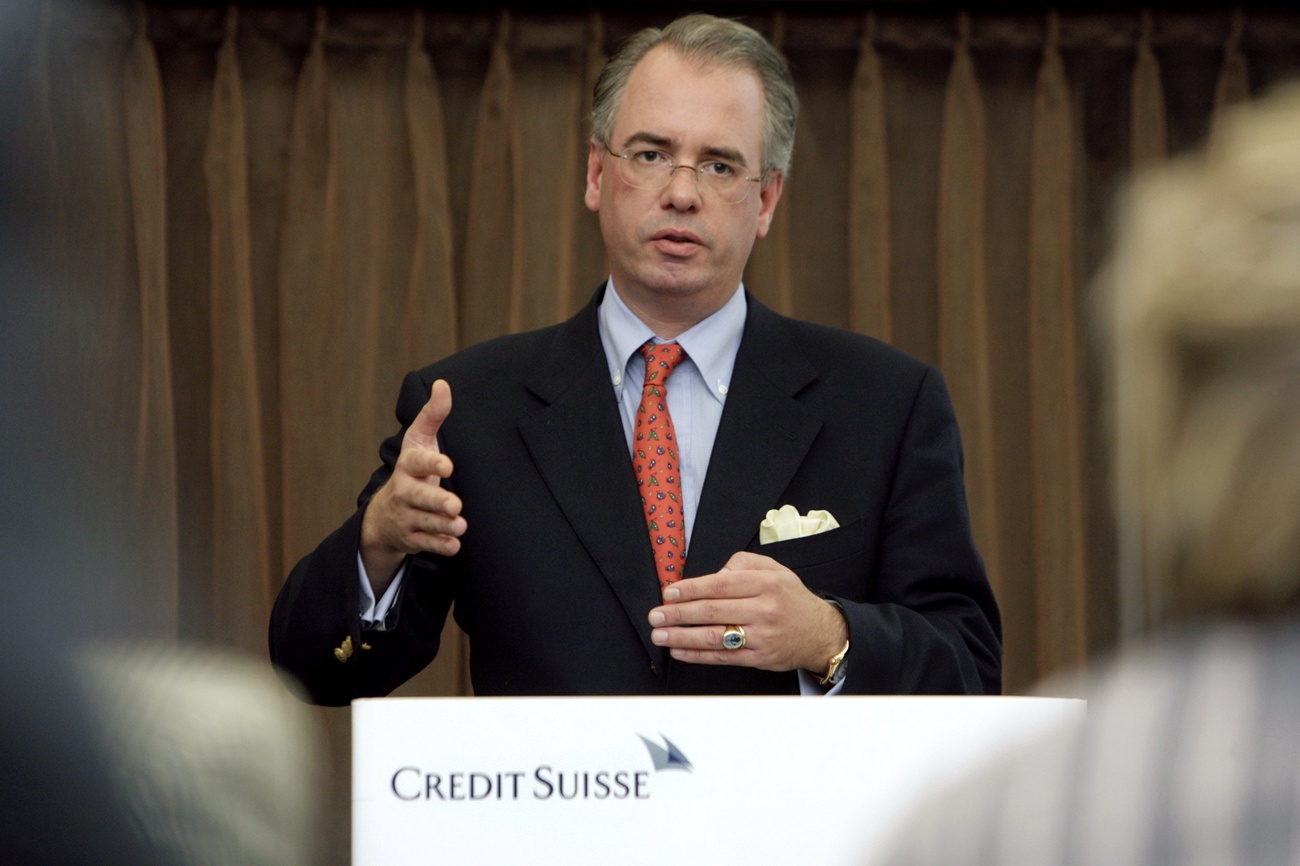

Last Credit Suisse chief executive, Ulrich Körner, to leave UBS

The final chief executive of Credit Suisse, Ulrich Körner, is set to leave UBS in the coming weeks, as the Swiss bank prepares to complete a crucial step in the integration of its former rival.

UBS executives are working to complete the merger of the bank’s legal entities with those of Credit Suisse by the end of May, according to people with knowledge of the plans, just over a year after the Swiss state engineered the shotgun marriage between its two biggest lenders.

Körner, who was appointed Credit Suisse chief executive during its dying days in 2022 and stayed on in the role after UBS rescued the bank, had hoped to leave the business earlier but has been persuaded to stay until after the legal merger, according to people briefed on the discussions.

The combination of the two banks’ holding companies will mean the Credit Suisse management board will become obsolete, including the role of chief executive.

More

How the Swiss ‘trinity’ forced UBS to save Credit Suisse

The departure of Körner and dissolution of Credit Suisse’s holding company marks the final chapter in the 168-year-old bank’s history, which played a crucial role in financing the industrialisation of Switzerland and its railways.

Under the integration plan outlined by UBS chief executive Sergio Ermotti in February, the Swiss entities are due to be merged in the second half of the year, while Credit Suisse clients will continue to be migrated to UBS into next year.

The final part of the integration, merging IT systems, will run into 2026.

Once the legal merger is complete, UBS plans to ramp up its job cuts programme, as the bank aims to have a total workforce of 85,000 by the end of the integration process, according to people with knowledge of the plans.

Based on the combined group’s headcount of 120,000 last year, the total number of job cuts would be 35,000. UBS executives have said not all of these would come from redundancies, as some would also go through natural attrition.

When asked about job losses last year, Ermotti said: “We are committed to minimising the impact on employees by treating them fairly, providing them with financial support, outplacement services and retraining opportunities.”

Surprise choice

UBS declined to comment on Körner’s position or its job cut plans. Körner also declined to comment.

Körner, who started his career at Price Waterhouse and McKinsey, joined Credit Suisse in 1998, rising to become head of Switzerland.

In 2009 he switched to UBS, where two years later he was on the cusp of being named temporary chief executive after Oswald Grübel was forced to resign following a $2.3 billion (CHF2.1 billion) rogue-trading scandal.

More

Rogue trade scandal brings down UBS chief

But Ermotti took the job instead and Körner returned to Credit Suisse in 2021 as head of its asset management business in the wake of its damaging Greensill debacle. Just over a year later he was the surprise choice to replace Thomas Gottstein as chief executive as the bank stumbled towards its eventual collapse nine months later.

Körner is one of the last Credit Suisse executives still at UBS, having seen chief financial officer Dixit Joshi, wealth management head Francesco de Ferrari and chief operating officer Francesca McDonagh all leave in the past year.

UBS is due to publish its first-quarter results on Tuesday.

Copyright The Financial Times Limited 2024

More

Credit Suisse appoints Ulrich Körner as new CEO

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.