Private bankers face up to regulatory pressure

Switzerland's private banks have survived the financial crisis relatively unscathed, but must now stand up to a regulatory backlash, the industry has warned.

Banks are facing pressure on two fronts. On the one hand, from Swiss regulators who are hoping to avoid another financial collapse. On the other, some European countries and the United States want to tighten rules to prevent tax evasion.

The Swiss Private Bankers Association (SPBA) said the damage from the financial crisis had been largely confined to the two big banks, UBS and Credit Suisse. The value of assets under management has shrunk, but has been made up in part by new business defecting from larger banks.

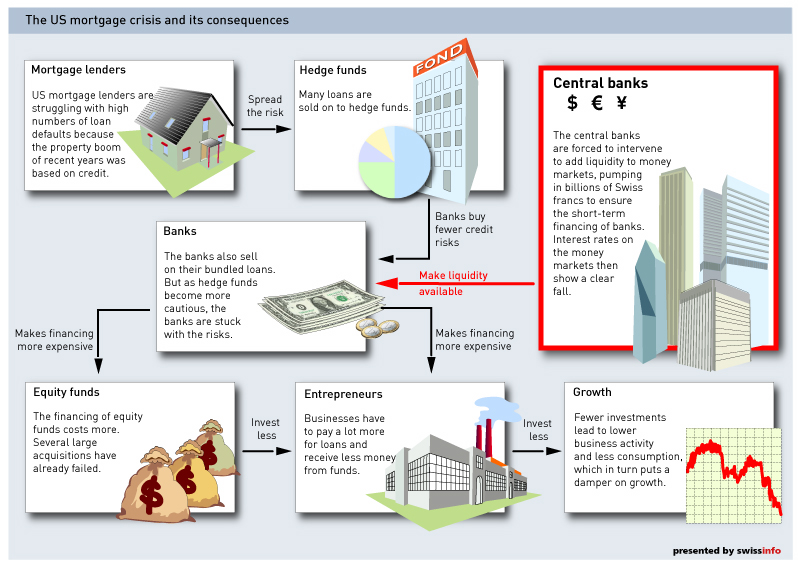

SBA chairman Konrad Hummler cautioned that business could be further hit in the wake of the recent Madoff fraud in the US that has cost many wealthy people and hedge funds billions of dollars. Hedge fund business is a profitable line for many private banks.

“The number of hedge funds will probably diminish by 50 per cent and they were always instruments with high margins. If there are much fewer hedge funds then this business will be slower and this will cause job losses,” Hummler told swissinfo.

Tax evasion

Speaking at the SPBA annual meeting in Bern on Thursday, Hummler was also nervous about regulators imposing a raft of new rules to rein back the excesses of the financial industry. He warned that there is no simple solution to the industry’s problems and insisted that regulations should become more focussed rather than more abundant.

“Our system was already over-regulated before the crisis. This is not just a crisis of the banking system but one of the regulators,” he said. “We have to think of more effective regulation that is concentrated on the real risks and problems.”

Swiss banking privacy also come under renewed attack from European neighbours and the US last year. German and French government officials called on Switzerland to be blacklisted as an uncooperative tax haven in October, accusing Swiss banks of helping their citizens evade taxes.

The US tax authorities have demanded confidential client information from UBS as they investigate the bank for aiding tax cheats.

US pressures

SPBA secretary general Michel Dérobert said the sector was braced for a tightening of the US qualified intermediary (QI) rules that require banks to withhold tax from the accounts of clients who are US citizens. This could greatly add to the administrative burden, he warned.

“These rules are going to get tougher following the situation last year. The question is: how tough will these rules be and will they be too costly to follow for smaller banks? It is possible that some of the smaller players will be squeezed out of the US market,” he told swissinfo.

“It is also in the interests of the US to have banks who are willing to invest there. They will have to strike a balance of having stricter rules without harming themselves.”

Konrad Hummler added that Switzerland was unlikely to buckle in the face of demands to scrap banking secrecy.

“This is a decision that the Swiss citizens will have to make themselves. There is a lot of nervousness, we have to take it seriously, but we don’t have to feel threatened because we are decent people,” he said.

swissinfo, Matthew Allen in Bern

The Swiss Private Bankers Association (SPBA) was founded in 1934 and now represents the interests of all 14 private banks in Switzerland. They employ some 6,000 people throughout the world.

Under Swiss law a private bank must have a legal status of sole ownership, registered partnership, limited partnership or limited partnership with shares.

Other banks carry out the activity of private banking – the professional management of assets belonging to private wealthy people.

Switzerland’s biggest bank, UBS, is the world’s largest wealth manager, looking after some $2 trillion in assets.

People wishing to dodge paying taxes on their assets can do so by three means: avoidance, evasion and fraud.

Avoidance is the legitimate means of structuring finances so they don’t fall under the scope of taxable assets. This can be done, for example, by setting up a trust fund or by changing country residence or nationality.

Evasion is the deliberate concealing the true state of assets from the tax authorities – in other words, lying about the extent of your assets.

This is a civil offence in Switzerland and some other countries, such as Austria and Liechtenstein, but criminal in most states.

The main distinction between evasion and fraud is that the perpetrator tells lies on official documentation. This is sometimes known as “aggravated” tax evasion.

Unless tax fraud can be proved, Swiss banks are not obliged to hand over details of accounts and client assets to investigators.

In some cases this information is needed before fraud can be established in the first place.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.